Futures Rebound From Early Rout Despite Continued Surge In Most Shorted Stocks

Unlike previous days when the surge in most shorted stocks – as they are doing this morning – pushed the broader market lower, on Monday bullish sentiment is everywhere, and after sliding as much as 1.5% at the start of trading on Sunday, Emini futures rebounded rising 1% following last week’s sharp selloff as a shift in the retail trading frenzy to silver drove up mining stocks and investors awaited manufacturing data later in the day.

At 7am. ET, Dow E-minis were up 233 points, or 0.78% and S&P 500 E-minis were up 37.75 points, or 1.02%. Nasdaq 100 E-minis were up 135.75 points, or 1.05%. The VIX slipped about 2 points on Monday, last seen just above 31, after hitting its highest since October .

Shares of Exxon and Chevron jumped 2% each after the WSJ reported that the chief executives of the two largest U.S. oil producers held preliminary talks in early 2020 to explore a merger, and may resume talks in the future. The most shorted names also jumped, with GameStop and AMC rising on Monday on top of their gains of nearly 400% and 278% respectively last week, when meme stocks dominated news on Wall Street last week, even as Apple, Microsoft and other corporate heavyweights reported record quarterly results. Focus now turns towards quarterly earnings from Amazon.com Inc and Google-owner Alphabet Inc on Tuesday to wrap up results from the so-called FAANG group.

“Markets will concentrate again on the really important developments: ongoing vaccination and therefore brightening outlooks regarding re-openings with increasing activity, paving the way for pent-up demand driving the economic recovery,” said Robert Greil, chief strategist at Merck Finck Privatbankiers.

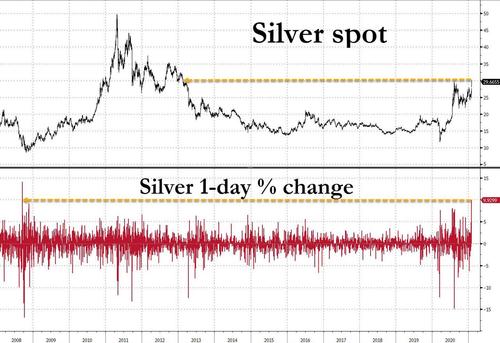

The big highlight, however, was them move in spot silver which extended Asia’s rally, gaining as much as 11.4% – the biggest one day move since the Monday after Lehman filed for bankruptcy – to trade at $30-handle, the highest price since 2013. The SLV ETF jumped 9% in premarket trading. Silver miners Hecla Mining, Coeur Mining and Wheaton Precious Metals surged between 12% and 21%.

Europe’s Stoxx 600 Index rallied 1%, with miners, tech and retail doing much of the heavy lifting. Oil & gas was the only sector in the red. European-listed silver miners soared, led by Fresnillo, which rises as much as 17%, most since March. KGHM, Poland’s sole producer of copper and silver, jumped as much as 7.1% in Warsaw, most since Jan. 7. The Stoxx 600 basic resources index rises as much as 2.8%, best-performing industry group of the Stoxx Europe 600. Diversified miners also bounced, with Anglo American +3.2%, Glencore +3%, BHP +2.4%, Rio Tinto +1.8%. The mining surge helped boost European sentiment despite a crash in German retail sales, which tumbled 9.6%, the biggest drop since April 1956, on expectations of just a -2.6% drop.

Earlier in the session, the MSCI Asia Pacific Index added 1.7%, the biggest gain in three weeks, following their longest losing streak since September, with equity benchmarks in India, South Korea and Indonesia posting the biggest gains. Indian markets rallied the most since May after the country’s government unveiled a budget that blows out the fiscal deficit wider than expected to revive growth. South Korea’s stock gauge snapped a four-day decline, boosted by Celltrion and Samsung Electronics. Philippines, Indonesia and Hong Kong were among the other major gainers. Information technology and consumer discretionary sectors were the biggest boosts to the MSCI Asia Pacific Index, which rebounded from its worst weekly loss since March. Myanmar’s stock exchange suspended trading, citing a network connection error, as the country’s military declared a state of emergency and seized power for a year. Malaysian markets were closed for a holiday

In rates, Treasuries beyond the 2-year remained under pressure, with long-end of the curve cheaper by ~1.5bp as U.S. stock futures advance after erasing an opening loss. Treasury 10-year yields around 1.08%, cheaper by 1.5bp vs Friday’s close, while 2-year at 0.107% hovers within 1bp of last year’s record low; 2s10s spread is wider by 1.6bp with front-end rates broadly anchored. Core fixed income in Europe trades a narrow range, with bunds bull flattening slightly. Peripheral spreads tighten to core, with Italy narrowing ~3bps to 112.5bps, outperforming peers.

In FX, the Bloomberg Spot Dollar Index rose a second day after data showed German retail volumes fell 9.6% in December; the pound held steady, outperforming peers as the U.K. makes progress on vaccinations and as money markets push back bets on a BOE rate cut ahead of its meeting Thursday. Commodity currencies swung back to losses in the European session after recovering from a China PMI-driven slide in Asian trading as sentiment improved. The yuan is poised for its biggest retreat since October after China on Sunday reported that manufacturing purchasing managers’ index fell to 51.3 in January, versus 51.9 a month earlier amid a recent resurgence of Covid-19 cases.

In commodities, naturally the highlight was silver which broke above $30 an ounce as the precious metal took center stage in the retail investor frenzy sweeping through markets. Elsewhere, crude futures drifted off best levels; WTI dips back below $52.50, Brent at $55.50. Base metals trade mixed, with LME nickel outperforming; copper underperforms in second straight day of declines

On the data front, investors awaited to a reading on ISM’s manufacturing index, which is expected to tick lower in January after accelerating to its highest level in nearly 2-1/2 years in December. Focus turns towards quarterly earnings from Amazon.com Inc and Alphabet on Tuesday to wrap up results from the so-called FAANG group.

Market Snapshot

- S&P 500 futures up 0.9% to 3,739.50

- MXAP up 1.7% to 207.23

- MXAPJ up 1.9% to 698.09

- Nikkei up 1.5% to 28,091.05

- Topix up 1.2% to 1,829.84

- Hang Seng Index up 2.2% to 28,892.86

- Shanghai Composite up 0.6% to 3,505.28

- Sensex up 5.0% to 48,602.93

- Australia S&P/ASX 200 up 0.8% to 6,662.96

- Kospi up 2.7% to 3,056.53

- Brent futures down 0.8% to $55.41/bbl

- Gold spot up 0.5% to $1,857.51

- U.S. Dollar Index up 0.2% to 90.81

- German 10Y yield rose 2.5 bps to 0.505%

- Italian 10Y yield rose 1.3 bps to 0.532%

- Spanish 10Y yield fell 2.0 bps to -0.096%

Top Overnight News from Bloomberg

- Five-year U.S. Treasuries, which have so far been immune to the bond-market sell-off, are now vulnerable, according to strategists who argue markets may be underpricing the Federal Reserve interest rate hike cycle

- The Bank of England is preparing to take a significant step into the debate on whether negative interest rates should be used to stimulate the coronavirus- stricken U.K. economy

- The U.K. will formally request to join an 11-member transpacific trading bloc Monday, with negotiations expected to start later this year

- German Chancellor Angela Merkel will hold crisis talks with pharmaceutical executives, regional leaders and European Commission officials Monday in a bid to speed up the continent’s stuttering vaccination push

- Japanese Prime Minister Yoshihide Suga looks set to extend a state of emergency for major metro areas that will inflict more pain on the economy, as he tries to stem the latest wave of Covid-19 cases and reverse a fall in public support

- Australia only recently started its quantitative-easing program, yet the key question already confronting the central bank is when and how to taper bond purchases given the strong economic recovery

- Sweden’s economy dodged a contraction last quarter, providing the first glimpse of how its no-lockdown strategy of 2020 affected businesses and consumers throughout the year. GDP grew 0.5% from the previous quarter

- Myanmar’s military detained Aung San Suu Kyi, declared a state of emergency for a year and voided her party’s landslide November election victory in a setback for the country’s nascent transition to democracy

Courtesy of Amplify markets, here is a 3-minutes snapshot of global markets:

A more detailed recap courtesy of Newsquawk

A positive tone was observed in the Asia-Pac region with most regional bourses in the green and US equity futures also recovered from the early stumble seen at the reopen where there was some residual pressure after Friday’s losses on Wall St which were due to month-end flows, recent overvaluation concerns, large hedge fund losses and fears of tighter regulation amid the main street trading frenzy. ASX 200 (+0.8%) initially underperformed amid fresh COVID-19 restrictions in Western Australia including the state capital of Perth which was placed on a snap 5-day lockdown after a quarantine hotel guard tested positive for the UK COVID-19 variant, although the index then recovered alongside the gradually improving mood in the region and with upside led by miners after silver prices surged again on the Reddit short squeeze play. Nikkei 225 (+1.6%) shrugged off early cautiousness and reclaimed the 28K level with newsflow dominated by earnings results, while the KOSPI (+2.7%) was boosted after better-than-expected trade figures which showed Exports jumped by 11.4% Y/Y for January. Hang Seng (+2.1%) and Shanghai Comp. (+0.6%) were kept afloat as China’s overnight repo rate eased from a 5-year high after the PBoC injected liquidity through open market operations, although the mainland lagged as longer-term money market rates began to creep up again and with participants digested the latest Official Manufacturing, Non-Manufacturing and Caixin Manufacturing PMI data which all fell short of estimates but remained in expansion territory. Finally, 10yr JGBs languished after its recent declines and with demand hampered after risk appetite steadily improved, while the BoJ also reduced its purchase intentions for Rinban operations this month in 1yr-3yr and 3yr-5yr maturities.

Top Asian News

- Nintendo Raises Outlook After Surpassing High Expectations

- AIA, China Strategic Said Among Bidders for BEA Life Insurer

- Japan Mulls Extension of Covid Emergency as Economy Sputters

- China Eases Funding Stress After Worst Cash Squeeze Since 2015

European indices kick the month off on a constructive note with gains across the board (Euro Stoxx 50 +1.5%) as the region picked up a similarly positive APAC baton. State-side futures meanwhile see gains in a similar vein with ES (+1.0%), NQ (+1.1%), RTY (+1.0%) and YM (+0.8%) posting relatively broad-based performance. Fundamental catalysts have been light thus far as participant’s head into another earnings-packed week with giants Alphabet and Amazon among some of the highlights. Back to Europe, sectors are mostly higher with the exception of Oil & Gas as crude prices wane off highs, whilst weekend reports via WSJ suggested Exxon (+2.2% premkt) and Chevron’s (+1.7%) CEOs discussed a potential merger – which would form an entity larger than Saudi’s ARAMCO. Elsewhere, the mining sector is faring rather well as the Reddit dash for silver bolsters the precious metal miners Fresnillo (+15.5%) and Polymetal International (7.4%), with optimism also seeping in some base metal miners. In terms of individual movers, Ryanair (-0.6%) is modesty softer after an overall mixed Q3 report which missed on revenue but noted that cash burn has been lowered and recent lockdowns will reduce forecast FY21 traffic to between 26mln and 30mln (previously “up to 35mn”), with more risk towards the lower end of the range. Elsewhere over in the Italian banking sphere, Unicredit (+1.7%) may consider a combination with BMPS (+2.2%) without any political pressure to do so and based on the industrial feasibility and contingent on not too high a social price, with some reports also suggesting the potential for a three-way merger with BPER ( +1.7%).

Top European News

- Merkel to Convene Crisis Talks Amid Chaotic EU Vaccine Rollout

- Swedish Economy Dodged Quarterly Decline as Pandemic Worsens

- Julius Baer Starts New Buybacks as Profit Jumps on Trading

- U.K. Meets Key Vaccination Milestone, Secures More Supplies

In FX, the Dollar was looking relatively fragile amidst an upturn in risk sentiment to kick off the new month, with the DXY only holding above 90.500 by a whisker before a firm rebound to 90.924 at best, as the Franc fell and Euro came tumbling after, albeit with weakness in other majors also helping the Buck withstand pressure from elsewhere, like precious metals where XAG extended its retail-inspired surge to just over Usd 30/oz at one stage. Usd/Chf failed to breach 0.8900 with the aid of a pick-up in Swiss retail sales or stronger than expected manufacturing PMI and has subsequently rebounded to around 0.8957, as weekly bank sight deposits rise again, while Eur/Usd largely shrugged off mostly better than forecast Eurozone manufacturing PMIs on the way down through 1.2100 and Friday’s 1.2093 session low.

- GBP – In contrast to all the above, Sterling has made a solid start to February with Cable probing 1.3750 for a 3rd time since last Wednesday, and Eur/Gbp reverting to its downtrend to test stops below prior 2021 lows circa 0.8810. However, this was all before an upward revision to the final UK manufacturing PMI and courtesy of weakness in the Greenback and Euro rather than any real Pound positive aside from some decent developments on the coronavirus front as the number of infections and fatalities slowed over the weekend and the EU relented on the passage of vaccines flowing both ways across the channel.

- NOK – The other major outperformer, as Eur/Nok pulls back below 10.4000 on the first day of significantly higher Norges Bank daily FX action, eyeing a bounce in crude prices instead of a slowdown in Norway’s manufacturing PMI.

- JPY/CAD/AUD/NZD – All giving way to their US counterpart’s broad revival, with the Yen testing support and underlying bids ahead of 105.00, Loonie trying to contain losses under 1.2800 in the run up to Markit’s Canadian manufacturing PMI, the final US version and ISM, Aussie pivoting 0.7650 post-softer than anticipated Chinese PMIs and pre-RBA (preview on the Headline Feed at 10.24GMT and in the Research Suite), and Kiwi hovering midway between 0.7203-0.7150 parameters in advance of NZ jobs data on Tuesday.

- SEK/EM – Somewhat negative impulses for the Sek to digest as its straddles 10.1500 vs the Eur, with Sweden’s manufacturing PMI and Q4 GDP coming in below consensus, but the Try has been boosted Turkey’s manufacturing PMI gathering pace above 50.0 and perhaps President Erdogan’s latest personnel changes in the Finance Ministry via the replacement of 2 deputies, as it approaches 7.2000 against the Usd.

In commodities, Focus since the open has been on spot silver’s upward price action, fuelled by retail flocking into the precious metal and its ETFs as it trends on Reddit’s WallStreetBets. Spot prices have risen from a base around USD 27/oz and briefly eclipsed USD 30/oz to the upside. Furthermore, bullion brokers have started to issue warnings of transaction delays amid the surge in silver demand. That being said, some reports on the blog site caution into money inflows into silver as this helps the long-silver hedge-funds and that participants should not expect a short squeeze as seen in some single stocks. Technicians highlight the next potential point of resistance could be around the USD 30.30-70/oz which marks the 50% fib of the correction during 2011-20. A breach of that could open the door towards USD 33/oz. This surge in silver prices has also provided spot gold with some impetus, albeit to a much milder magnitude – with the yellow metal eyeing its 100 DMA (1876/oz) to the upside as it straddles around its 21 DMA around 1864/oz (vs. low 1847/oz). Base metals are conversely lacklustre amid a firmer Buck and lack of fresh fundamental news flow and underwhelming Chinese PMI data, with LME copper relatively flat intraday just above 7,800/oz. That being said, import premiums of the red metal into China have risen to their highest in over five months amid expected disruptions from Chile. Crude markets meanwhile have kicked off the week on a firmer footing with the ongoing reflationary hopes and OPEC+ flexibility themes keeping prices underpinned, although today’s price action seems to be in conjunction with the current constructive risk tone across markets. WTI resides around USD 52.50/bbl after waning from its 52.69 /bbl high, while its Brent counterpart trades on either side of USD 55.50/bbl in the runup to this week’s JMMC meeting.

US Event Calendar

- 9:45am: Jan. Markit US Manufacturing PMI, est. 59.1, prior 59.1

- 10am: Jan. ISM Manufacturing, est. 60.0, prior 60.7, revised 60.5

- 10am: Dec. Construction Spending MoM, est. 0.8%, prior 0.9%

DB’s Jim Reid concludes the overnight wrap

Lockdown is so dull, especially when it was as wet as it was yesterday, that we cleared out an old cupboard and found a big loose change jar, accumulated over several years, and decided to count it as a family. 2 hours and £103.56 later and it’s time to set up a Robinhood account and see if I can rival the 1625% seen from GameStop in January over the coming month. As you’ll see below given that the retail crowd have moved increasingly to silver, maybe melting it down in a few weeks might be the better option.

As it’s now a new month we are just about to publish our monthly performance review. In spite of some wild markets over the past week, January overall has seen a remarkably stable start to the year for most of the assets we normally cover, with just 3 of the 43 assets in our sample seeing a move of more than 5% either way last month. Indeed, that’s the lowest number to see a move of that magnitude since November 2019.

So in the end a fairly quiet January? Far from it.We had a surprise Senate victory for the Democrats, a storming of Capitol Hill, Bitcoin doubling in around 3 weeks, a 360 degrees of Fed views in the tapering debate, vaccine trade war threats from the EU, a few hours where the EU technically imposed a hard border in Ireland before withdrawing it, and last but not least the most incredible last week of the month with GameStop becoming the most famous company in global financial markets for a week. All of this to a soundtrack of increasing covid restrictions around the world. To balance this with hope, the U.K. yesterday announced a remarkable day of vaccinations, with 598k done in one day, almost 1% of the population (1 in every 87 adults in one day). It really is possible to move fast when the supplies are available which should give everyone hope when more and more vaccines come on stream over the coming weeks and months.

Back to markets and in terms of the impact of the r/wallstreetbets movement, my personal view is that when the history books of this pandemic and its impact on financial markets will be written they will have a significant chapter but more as a story of the bubble like tendencies in certain parts of the market rather than the main market event. For me there is little doubt that huge central bank liquidity and government stimulus cheques in the hands of the underemployed/furloughed (through no fault of their own) retail investors will be a big part of this bubble story. I think this movement does create some systemic risks but is perhaps more of a smaller version of the risks associated with some of the eye watering valuations elsewhere in large corners of the technology sector. Retail has in many parts driven such valuations in the last 10 months. If this pops the wider market will have bigger issues than last week.

Looking forward, it’s another big week for data and earnings with the PMIs for January (today and Wednesday) as well as the US jobs report (Friday) the obvious highlights. In terms of a peak week of earnings, Amazon and Alphabet tomorrow are going to see the main macro focus. There’s also the Bank of England’s latest decision on Thursday, along with further political developments in Italy as consultations continue on forming a new government. Expect to hear more about the US stimulus package with the reconciliation process likely starting as a bipartisan approach is probably unlikely to work even if GOP lawmakers have offered a $600bn package over the weekend. Biden will meet with 10 Republican senators today to discuss.

Just on those PMIs, overnight China’s Caixin manufacturing PMI has slightly disappointed as it came in at 51.5 (vs. 52.6 expected). Earlier, official Chinese PMIs also showed the same theme with manufacturing printing at 51.3 (vs. 51.6 expected) and services at 52.4 (vs. 55.0 expected). Japan’s final manufacturing PMI was at 49.8, +0.1pt better than flash. Manufacturing PMIs for other countries in the region remained relatively stable, with Vietnam at 51.3 (vs. 51.7 last month), Taiwan at 60.2 (vs. 59.4 last month), India at 57.7 (vs. 56.4 last month) and Indonesia at 52.2 (vs. 51.3 last month).

Asian markets have started the week on the front foot with the Nikkei (+1.31%), Hang Seng (+1.94%), Shanghai Comp (+0.42%) and Kospi (+2.20%) all trading up. China’s recent liquidity squeeze is also easing as the PBoC injected a net $15bn of funds today. Futures on the S&P 500 are currently trading up +0.53% after reversing an early decline of as much as -1% while yields on 10yr USTs are up +1.4bps to 1.082%. Elsewhere, Brent crude oil prices are up +0.69% on news that OPEC+ estimated that they implemented 99% of their agreed oil supply curbs in January. Silver is also trading up +6.03% on increasing chatter in reddit groups about the commodity while spot gold prices are up +0.75%. Silver started being mentioned in this retail forum last Wednesday and given the weekend momentum has intensified it’ll be fascinating how this plays out in what is a deeper market that single stock equities.

Back to the week ahead and on payrolls our US economists are looking for a +100k increase, which comes off the back of a -140k decline in December, and see the unemployment rate remaining at 6.7%. That decline in nonfarm payrolls in December marked the first time that the US economy had shed jobs since the height of the first wave of the pandemic back in March and April 2020, and it’s worth noting that the number of people in work still remains nearly 10m lower than its prepandemic peak back in February, so there’s still a long way to go before we get back to normality in the labour market. After last week one wonders how many of these unfortunately displaced were part of the r/wallstreetbets crew.

Earnings season continues in full flow over the week ahead, with a further 111 companies from the S&P 500 reporting and 71 Stoxx 600 companies. In terms of the highlights to look out for, today we’ll hear from Thermo Fisher Scientific, then tomorrow we’ll get results from Amazon, Alphabet, Pfizer, Exxon Mobil, Amgen, UPS, BP, Alibaba and Ferrari. Wednesday then brings releases from PayPal, AbbVie, Qualcomm, Novo Nordisk, Siemens, GlaxoSmithKline, Santander, Sony, Biogen, Volvo and Nomura. On Thursday, we’ll hear from Roche, Gilead, Merck & Co., T-Mobile US, Unilever, Royal Dutch Shell, Bristol Myers Squibb, Philip Morris International, Ford and Nokia. Finally on Friday there’s results from Linde, Sanofi and BNP Paribas.

Back to last week now and while a lot of attention was spent on the day-traders squeezing heavily shorted stocks, the overall equity market took a significant step back. The broad-based selloff came as risk sentiment swung negative on a mix of news ranging from poor tech earnings announcements, the new coronavirus variants, delayed vaccine deployments and worries around bubble-like conditions. The S&P 500 fell back -3.31% on the week (-1.93% Friday) while the NASDAQ composite dropped a further -3.49% (-2.00% Friday), in the worst month for the indices since October. This meant that the S&P was down -1.11% in January – the worst opening month to a year since 2016. In the risk off environment, the VIX volatility index rose +11.2pts to 33.1. This was the largest one week spike since June, when the second wave of infections was detected in the US. European equities equally struggled as the STOXX 600 ended the week -3.11% lower (-1.87% Friday) while the FTSE (-4.30%) and IBEX (-3.47%) notably lost ground.

At roughly the midpoint of earnings season – 52% of the S&P has reported – the market has seen a record high number of beats (85%), with the size of those beats roughly in line with last quarter at 17% which is close to the highest on record. This reflects how estimates have continued to lag the macro data, however the market has not necessarily rewarded these beats. Equity positioning was relatively high coming into the earnings season, valuations high and investors may be looking ahead to further lockdowns in the coming quarter and worries over upcoming guidance.

With a risk off sentiment roiling through markets, havens rose on the week. The US dollar rose +0.38% (+0.14% Friday) on the week for its third weekly gain in the last four. US Treasury yields fell under 1.0% midweek for the first time since the Democrats won control of the Senate in early January, with 10yr yields recovering slightly to finish down -2.0bps at 1.066%. 10Yr Bund yields dropped slightly as well, dropping -0.6bps lower to -0.52%, however 10yr Gilt yields rose +1.9bps to 0.33%. With the political realignment of the Italian government becoming clearer, and Prime Minister Conte resigning in order to try and construct a new government, the spread of 10yr Italian BTPs over German bunds tightened -10.2bps to 116bps. Elsewhere in fixed income, high yield spreads widened on both sides of the Atlantic as US HY cash spreads were +9bps wider, while in Europe they widened +11bps.

Data from Friday showed that the economic growth in the Euro Area may be avoiding a deeper recession even as lockdowns persist. Spanish GDP rose +0.4%, well above the -1.4% contraction expected. German GDP similarly surprised to the upside, growing 0.1% QoQ (0.0% expected), while France’s GDP fell just -1.3%, compared to the -4.0% drop expected. German unemployment was also better than expected, falling 41k (+7.5k expected), with the unemployment rate falling to 6.0%. Meanwhile in the US, personal income rose +0.6% (+0.1% expected) as spending fell -0.2% (-0.4% expected) for a second month in a row. The final January reading of the University of Michigan’s consumer sentiment index fell to 79.0 from 80.7pts last month as worsening coronavirus case counts and a potential delay in stimulus weighed on expectations. January MNI Chicago PMI came in at 63.8 (vs 58.5 expected), which was its highest reading since February 2019.

Tyler Durden

Mon, 02/01/2021 – 08:33![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com