Netflix Is Hiking Prices 13% In Japan

As new, low cost streaming competitors are emerging left and right, Netflix appears ready to move in for the kill.

That’s because, after spreading its platform globally, all Netflix has to do is flip “the pricing switch” in order to make a positive impact to the company’s free cash. And in Japan, that appears to be exactly what the platform is doing.

Starting today, Netflix’s basic and standard tier prices will rise about 13% in Japan, while premium service pricing remains unchanged, according to Bloomberg. The company’s basic plan will rise to 990 yen ($9.39) from 880 yen. Its standard tier rises from 1,320 yen to 1,490 yen.

Asia is the company’s second fastest growing region, the report notes. Netflix has invested heavily in anime for the market, which is popular in Japan.

The company said in a statement: “We’re updating our prices so that we can continue to offer more variety of TV shows and films — in addition to local shows such as ‘Alice in Borderland,’ and our ever-growing anime lineup. As always, we offer a range of plans so that people can pick a price that works best for their budget.”

The market liked the move, with Netflix stock finishing Thursday’s session up 2.3%. Shares had been little changed since January.

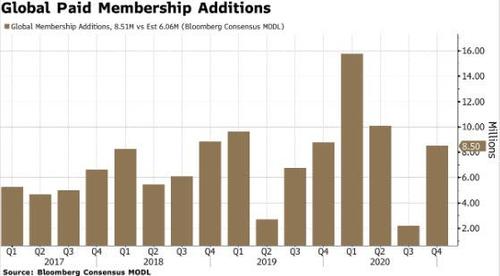

Recall, Netflix just posted an earnings report in January that saw its stock soar. The company posted a big subscriber beat and noted that it would be free cash flow positive in all quarters going fowrward.

At the same time, as we noted, the world’s largest paid streaming service is also facing more intense and cutthroat (or rather cut-price) competition than ever. Comcast’s Peacock platform has been rolling out for a few months, along with the short-form video service Quibi. And AT&T’s big bet on streaming, HBO Max is also up and running now while Disney+ has been a massive hit.

Bloomberg notes that in the all-important Netflix subscriber guessing game, the web traffic research site SimilarWeb suggests the service averaged about 1.5 million new subscribers globally per month in Q4. That’s below the 6 million target the company has given and down from Q4 2019. On the plus side, SimilarWeb notes, subscribers have been rising each month in the quarter and are up sharply from the disappointing Q3.

Tyler Durden

Sat, 02/06/2021 – 00:00![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com