Morgan Stanley Warns Record Flood Of Retail Investors Is Buying The VIX, Could Trigger Huge Squeeze

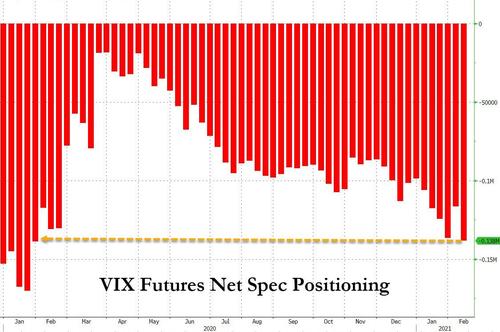

At the start of February, SocGen’s derivatives strategists made a fascinating, if very controversial, observation: with short positioning in VIX futures back to pre-covid levels…

… the bank, like everyone else stunned by the recent bursts of short squeezes bull ramps emanating from the WSB subreddit, analyzed where a squeeze blitz could strike next and concluded that the VIX complex itself (primarily via retail-friendly long VIX ETFs and calls on said ETFs) could become a target due to its not insubstantial short interest.

“If we were to see the Gamestop wave carry over to the VIX ETP complex, it would be easy to imagine increased volatility and some very large moves”, the SocGen analysts warned referring to the violent surge in GME, adding that “we could potentially see a similar repricing of S&P500 options this time around”, especially when one considers that the net short positioning in the VIX future is not that far off its all time high.

Then, after scouring through Reddit and noting that “the volatility complex has been the topic of recent discussions on the forum”, the French bank said that “the hedging activity from market makers could initially lead to some exacerbation in price moves on the upside. Thereafter, there is also some runway for strikes to be rolled. We would therefore recommend investors to be prepared for some upcoming turbulence in the implied volatility market.“

Many were quick to brush SocGen’s suggestion as a wildly improbably event shaped by a desire to “goalseek” one’s expertise… except they were right.

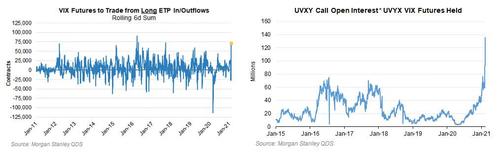

As Amanda Levenberg from Morgan Stanley’s Quantitative and Derivatives Strategy writes today, VIX exchange traded products (ETPs) have seen record inflows over the last 6 days, with 71k futures bought as a result of long VIX ETP inflows, the 3rd most extreme episode on record.

Adding to this – and further validating SocGen’s hypothesis – there has also been a remarkable increase in call activity in these long volatility products with call open interest rising sharply. The majority of flows in these products are typically driven by retail. And while retail did monetize some futures as VIX spiked in late January, over the last few weeks those outflows have more than reversed and the net amount of volatility held by VIX ETPs is the highest level since pre-COVID and in the 95th %ile versus the last 10 years.

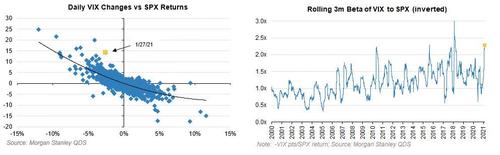

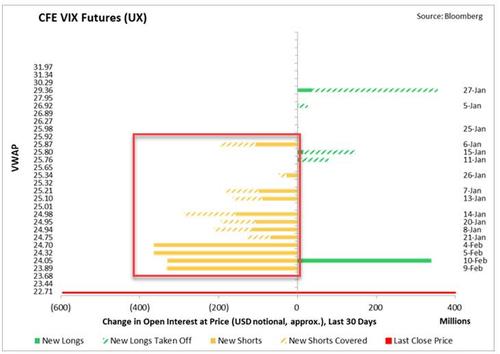

Picking up where SocGen left off, Morgan Stanley then concedes that “the retail long vol position can create squeezes in VIX, and did so as recently as late January. On January 27th, VIX rose by over 14 points, far more than what VIX’s typical beta to SPX would suggest (SPX fell by ~2.67%, and the VIX beta-implied move was roughly 4 points, so that’s 10 points more than what was expected).”

This means that, according to Morgan Stanley, retail did in fact participate in and squeeze the VIX far higher than it would have moved on its own.

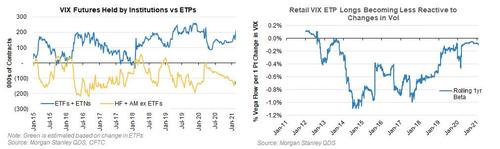

As if reading from the SocGen report, Morgan Stanley then warns that inflows to VIX ETPs raise the risk of vol squeezes because as ETP issuers buy VIX futures, hedge funds and other institutions generally take the other side of these trades and sell VIX futures. And, as the size of the opposing positions rises as it has been doing if one looks at VIX futures which is the preferred venue of institutional investors, the risks of a VIX short squeeze rise.

And here an interesting observation: typically ETP holders (such as retail investors mostly) monetize and sell to HFs looking to cover as vol rises, and retail did monetize holdings in late January. But MS notes that they monetized relatively little compared to HF demand, and this is not just a one-off: there has been a trend of retail becoming less reactive to changes in volatility and are therefore monetizing less as vol rises: This makes imbalances and subsequent volatility squeezes more common.

So after VIX’s roundtrip in the last 3 weeks, the MS Futures team estimates that “$2.2bn of new shorts in VIX futures have been initiated YTD (~80k contracts, or about 50% of VIX futures ADV), and these shorts are at risk of being caught offsides on a rise in volatility.“

As such, the bank concludes that “while these flows don’t necessarily mean a spike in volatility is going to repeat itself in the imminent future, as they grow, it does mean that the risks of future volatility squeezes remain elevated“, and concludes thete whereas it “continues to like selling volatility to capture what should be a continued wide implied versus realized spread in the coming months… the above positioning dynamic creates a risk.”

Whether or not retail investors manage to squeeze hedge funds and institutions short the VIX similar to what they did on January 27, remains to be seen, but a broader read of the above indicates that retail investors are now taking on the Fed itself as a counterparty. We have previously shown that not only has Fed intervention directly and indirectly helped depress the VIX lower, but none other than Jerome Powell back in 2012 admitted tacitly that “The Fed Has A Short Volatility Position.”

This means that the Fed now has a new nemesis in the market: the retail investors themselves… which is ironic since it is those same retail investors that the Fed claims wants to see prosper and their wealth effect grow, even as it implicitly sides with the hedge funds and institutions that consistently short VIX into every spike.

How this plays out remains to be seen, but in many ways this is a mirror image of the Volmageddon we saw in Feb 2018 when retail investors were once again massively involved in the VIX via ETF, but on the short side. Now, retail appears to be actually cheering for – and is set to profit from – a market crash…

Tyler Durden

Fri, 02/12/2021 – 16:40![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com