Saudi-Backed Lucid Motors Nears SPAC Deal As Early As Next Week

While Elon Musk goes off on tangents about Dogecoin on his Twitter feed, the folks over at competitor Lucid Motors – who, as a reminder, are backed by the little ole’ Saudi sovereign wealth fund – look as though they are setting up to announce a deal to go public as soon as this coming week.

Lucid will be going public with a blank-check company started by investment banker Michael Klein, Bloomberg reports.

The entity is Churchill Capital Corp IV, Klein’s largest SPAC that has raised more than $2 billion. The entity will be valued as much as $15 billion.

The SPAC it is using to go public is looking to raise up to $1.5 billion in funding. Both the funding and the valuation are variable and based on investor demand.

Meanwhile, CCIV has already surged to a nearly $14 billion market cap in anticipation of the news, as rumors started to swirl last week about the tie-up. CCIV is up nearly 5x from early January, despite no “official” deal terms being released yet.

It should come as no surprise that the Saudi-backed Lucid is working with Churchill Capital Corp IV. Klein has ties to the Saudi Public Investment Fund and has acted as an adviser for the PIF. He also advised on the Aramco initial public offering.

Lucid will join the ranks of other EV companies who have gone public via SPAC in an effort to chase the industry leader (in terms of valuation, at least) Tesla. This deal would be one of the largest SPAC deals consummated since the trend began, just slightly below United Wholesale Mortgage LLC’s $16 billion merger with Gores Holdings IV Inc.

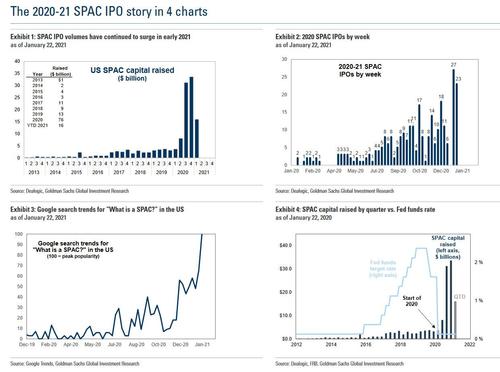

Several months into 2021, the SPAC boom doesn’t look like it’s going to let up anytime soon. Goldman Sachs told clients in a recent note about all of the SPAC excitement outlined in the four charts below.

Meanwhile, billionaire real-estate investor Sam Zell spoke with CNBC two weeks ago and warned how SPACs reminded him of the “rampant speculation again, very much like the dot-com boom.”

Tyler Durden

Sun, 02/21/2021 – 17:20![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com