GameStop Just Collapsed After Topping Record Close

Update (1225ET): GME collapsed after we posted highlighting the craziness again, and is now halted…

* * *

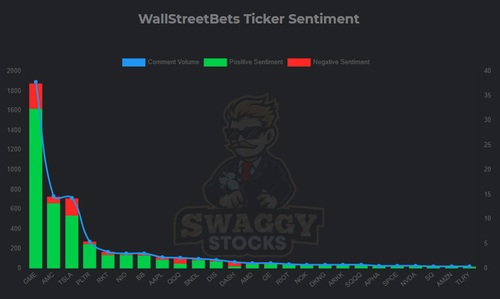

WallStreetBets sentiment is soaring in GME again…

And thanks to that, GME is up 40% today, up six days in a row (the longest streak in six months) and just topped $347.51 – its record closing price!

If GME again doesn’t sell stock here now that it is back at 350, it should become the 8th deadly sin

— zerohedge (@zerohedge) March 10, 2021

It appears the meme-stock meltup is back…

“It looks like the second wave of bullish speculation has clearly kicked off,” Ipek Ozkardeskaya, senior analyst at Swissquote, said by email.

He warned, however, that the recent corporate updates may not be enough to justify the stock’s surge.

“Given the massive volatility in this stock, the risk is huge as the rally in the GME stock price is boosted by expectations of future growth, and is not based on concrete results for now.”

The original basket of heavily-shorted WSB stocks is soaring along with GME…

Meanwhile, GameStop, at near $24 billion market cap, is now the biggest company in the Russell 2000, overtaking PLUG.

As @John13468388 noted so poignantly: “Smooth functioning market when a brick and mortar with a dead business model is the largest company in the russell.”

We wonder how Melvin Capital’s month is going?

Tyler Durden

Wed, 03/10/2021 – 12:14![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com