Goldman’s Clients Are Starting To Sweat The Coming Tax Hikes

One week after Goldman’s clients were focused on capital markets, asking the bank’s chief equity strategist David Kostin if there were any cheap stocks left in a time of sudden bursts of volatility and not so sudden spikes in yields, in the past week they have voiced somewhat more pragmatic concerns, and while they “remain anxiously focused on interest rates and inflation as core PCE rises above 2%” in his latest Weekly Kickstart Kostin writes that “a looming macro issue is the next round of fiscal legislation, which will include corporate and personal tax hikes.“

In other words, having priced in all the good news from Biden’s mega stimulus, investors are finally starting to realize that all those trillions in spending will lead to (much) higher taxes.

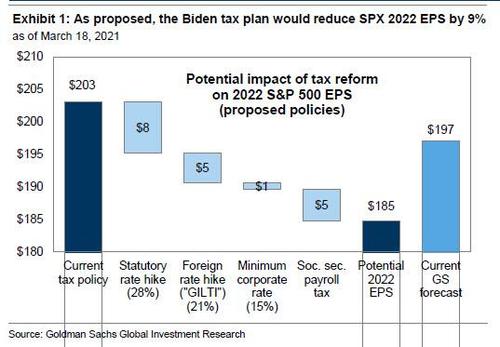

Here, as usual, Goldman tries to downplay the potential hit, writing that while “full implementation of candidate Biden’s tax plan would reduce S&P 500 EPS by 9%…. the eventual impact will depend on the specifics” and Goldman’s current 2022 EPS estimate assumes just a 3% drag from taxes.

Some more details.

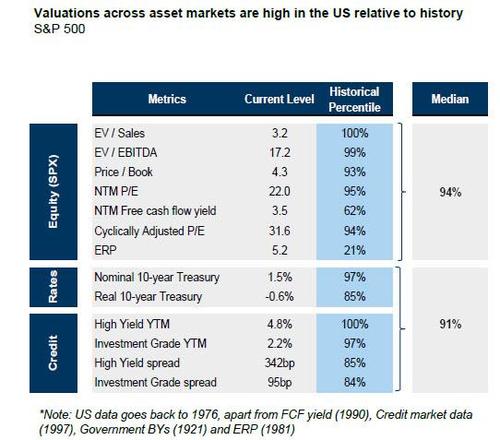

One week after seemingly putting to rest fears that everything is massively overvalued – spoiler alert, it is…

… Kostin writes that a looming macro focus for investors is the next round of fiscal legislation:

The final $1.8 trillion American Rescue Plan ended up close to the $1.9 trillion size of President Biden’s original proposal. Although details of the administration’s next fiscal plan have not yet been released, our economists currently expect a package that will include at least $2 trillion in infrastructure spending and could reach $4 trillion if it also funds health care, education, and child care initiatives.

The problem is that while the US could and probably should just issue a few more trillion in debt to fund the whole thing, Goldman notes that the next package will be paid for in part by higher tax rates, including on corporate earnings. Sure enough, the tax plan proposed by President Biden in his election campaign would raise the statutory corporate tax rate on domestic income from 21% to 28%, partially reversing the cut from a rate of 35% passed in the Trump tax cuts. The plan would also raise the tax rate on foreign income (also called the “GILTI” tax) and institute a minimum corporate tax rate.

All of this will hit the corporate bottom line: Goldman estimates the Biden tax plan would reduce 2022 S&P 500 EPS by about 9%, however, the bank’s economists believe Congress will pass a smaller increase: its current $197 EPS estimate assumes the statutory rate rises to 25%, representing a 3% drag on earnings. That said, Kostin concedes that “a hike to a rate above 25% or the passage of other proposals like the GILTI tax hike would represent downside risk to our estimate.” Alternatively, hikes implemented with a phase-in period could spread the earnings hit across multiple years, but as usual investors will price the full impact as soon as it becomes clear.

How to trade this

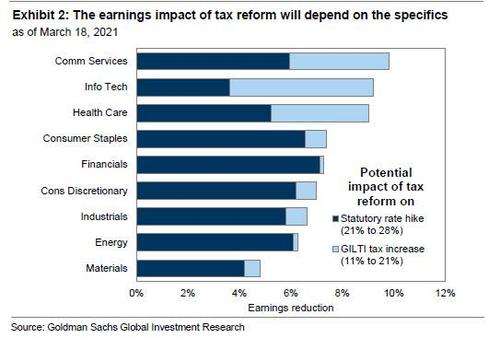

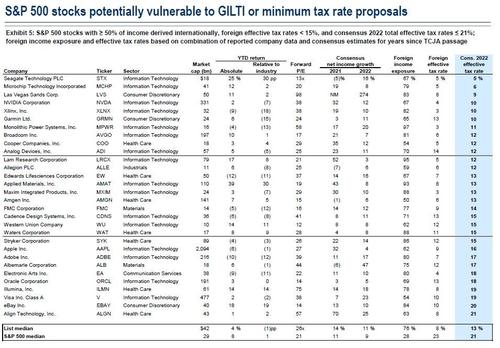

Kostin notes that the relative winners and losers of the next fiscal package will depend on the specific provisions. For example, traditional infrastructure investment would benefit industrial and construction materials companies, while green investment would expand the winners to include renewable energy companies. With regard to corporate tax reform, increases to the domestic statutory rate would primarily affect companies with high domestic business exposure and effective rates close to the statutory rate, which were the primary beneficiaries of the 2017 tax cuts. In sector terms, this includes Financials, Industrials, and Consumer firms. In contrast, proposals like a minimum tax rate on foreign earnings pose the greatest risk to low-tax “growth” sectors like Info Tech and Health Care and would have a much smaller impact on domestic-facing sectors

In addition to corporate rate hikes, Goldman economists note that higher capital gains taxes to be a key part of the next fiscal package. They predict the capital gains tax rate for top earners will be increased from 20%, although not all the way to the ordinary income rate as proposed by President Biden. And in a potentially ominous outcome for a market that is already redlining on steroids, Kostin warns that “past capital gains tax hikes have corresponded with reduced equity allocations, lower equity prices, and Momentum reversals. The good news is that all of those patterns were short-lived and reversed following the hikes, and Goldman expects that “any selling triggered by capital gains hikes late in 2021 would be similarly short-lived.”

What about timing

Goldman economists expect the White House will begin to outline its proposal in April and that legislation will eventually be passed around September.President Biden is scheduled to address Congress next month, when he will likely discuss his plan. Legislation should then be written in May and June, with passage likely ahead of the expiration of the five-year federal highway bill at the end of September. While parts of the infrastructure plan may be passed with bipartisan support, that the majority of the package will eventually pass through reconciliation and rely only on Democratic votes. Ultimately, Goldman’s EPS forecasts assume tax policy changes go into effect starting in 2022, so no retroactive adjustments to 2021.

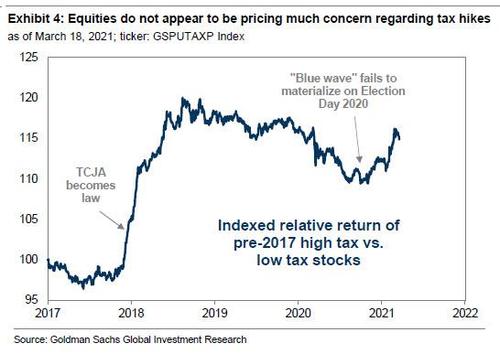

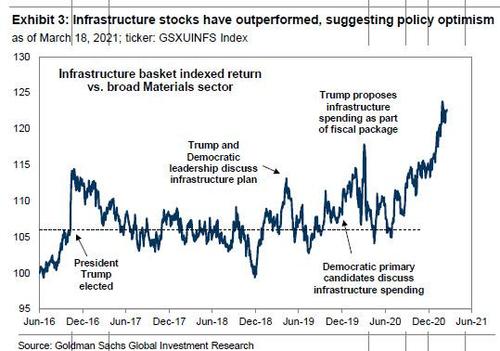

And while investors are becoming concerned about taxes in general, Goldman points out that even as equities are pricing in optimism around infrastructure spending, they should little concern about tax hikes.

A Goldman Infrastructure basket (GSXUINFS) that primarily consists of Construction Materials, Machinery, and Construction & Engineering firms has returned 27% since the Georgia Senate runoff races in January, outperforming the Materials sector by 18% and the Industrials sector by 14%.

This matches or exceeds the basket’s other periods of outperformance following President Trump’s 2016 election and various infrastructure proposals during his term. Meanwhile, a basket of Renewable Energy stocks has declined by 3% this year but gained 156% last year and has been particularly vulnerable to rising rates in recent weeks. In contrast, after trading closely with prediction market odds during the months ahead of the general election in November 2020, a pair of tax baskets containing the biggest winners and losers from the 2017 tax cuts has reversed and now appears to be pricing little risk of higher tax rates. Finally, screens of stocks facing potential risk from proposals like the GILTI tax hike have broadly performed in line with industry peers in recent months

That said, Kostin does not rush into specific recos, conceding that a dearth of details makes it hard to model and trade on the potential earnings impact of legislation that hasn’t yet been outlined. Indeed, reform focused on a higher statutory domestic tax rate would have very different implications than a plan focused on a minimum tax. Curiously, Goldman notes that many investors still remain very skeptical that Democrats will hike taxes given the ongoing economic recovery and the recent policy focus on fiscal expansion. Amusingly, Kostin then implicitly suggests that Republicans are likely to retake control of Congress next year: “A repeated pattern of corporate tax reversals each time political control of Washington, D.C., changes hands should also reduce the degree to which investors price the long-term earnings impact of each new tax legislation.

So between the lack of details and the political practicalities of any tax hike, Goldman concludes that “the market’s current focus on other macro issues like interest rates also makes it hard to justify trading on uncertain potential future tax hikes.”

Tyler Durden

Sun, 03/21/2021 – 21:00![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com