Kiwi Crumbles As New Zealand Targets Speculators To Burst “Dangerous” Housing Bubble

One month after the New Zealand government took the historic step of adding a fresh mandate to its central bank, tasking it with considering the impact its monetary and financial policy decisions have on housing prices, a move to help calm the country’s red-hot property market, overnight New Zealand’s government took another step at popping the local housing bubble by taking aim at property speculators with a suite of new measures to tackle runaway house prices and prevent the formation of a “dangerous” bubble.

As a reminder, back in February, Finance Minister Grant Robertson said the Reserve Bank of New Zealand (RBNZ) must take into account government policy relating to more sustainable house prices.

“Today’s announcement is just the first step as the government considers broader advice about how to cool the housing market,” Robertson said in a statement. “We know the rapid increases we have seen in recent months are not sustainable, which has meant many first-home buyers are struggling to access the market.”

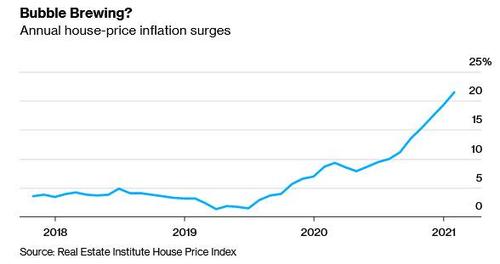

However, with home prices refusing to dip and stubbornly sticky at all time highs, rising by a record 21.5% in February…

… on Tuesday, Prime Minister Jacinda Ardern said the government will take more steps to cool the red hot housing market, and will remove tax incentives for investors to make speculation less lucrative and unlock more land to increase housing supply. The moves come as surging house prices keep first-time buyers and people on lower incomes out of the market, raising concerns about growing societal inequality. One wonders when the Fed will finally consider the impact of soaring home prices – largely the result of extremely easy financial conditions courtesy of the Fed – on social inequality (spoiler alert: never).

“The last thing home owners need right now is a dangerous housing bubble, but a number of indicators point towards that risk,” Ardern told a news conference. “Property investors are now the biggest share of buyers, with the highest amount of purchases on record. Last year, 15,000 people bought homes who already owned five or more.”

Not to mention the thousands of American billionaires who have decided to make New Zealand their beautiful bug-out location of choice.

As Bloomberg notes, New Zealand’s success in battling Covid-19 has seen its economy recover sooner than many others, putting it at the forefront of a global property boom as ultra-loose monetary policies encourage investment in higher-yielding assets. House prices surged 21.5% in the year through February and investors accounted for more than 40% of purchases that month, a record high.

So to dissuade speculation, the government will enforce the extraordinary step phasing out the ability of investors to claim mortgage interest as a tax-deductible expense, and will extend of the period in which profits on the sale of investment property are taxed to 10 years from five.

According to Westpac Banking Corp, the changes “will significantly reduce the financial incentives to invest in housing” and have “a chilling effect on investor demand. Today’s announcements indicate significant downside risk for house prices and economic activity more generally.”

The package is the latest salvo in Ardern’s assault on the booming property market, which is undermining her efforts to reduce inequality. Prices are soaring at double-digit rates around the country, taking the national median to NZ$780,000 ($556,000). In Auckland, the median price has reached NZ$1.1 million, making it the fourth least affordable city in the world, according to Demographia.

After tasking the central bank to pay more attention to the property market as noted above, NZ finmin Grant Robertson said today that New Zealand’s housing market has become the least affordable in the OECD and it was “essential the government takes steps to curb rampant speculation.”

Robertson said extending to 10 years the so-called “bright-line” test – effectively a capital gains tax on investment property sales – and removing interest deductibility for investors “will dampen speculative demand and tilt the balance towards first home buyers.” While the new bright-line test will apply to properties bought from March 27, the time horizon for new builds will remain at five years to encourage supply.

At the same time as the government tries to curb housing demand, it is also increasing supply which has been constrained by a raft of factors including planning rules and high construction costs. It said today it will establish a NZ$3.8 billion fund to unlock more land for housing development, and also make first home grants available to more people.

The irony, as Rabobank’s always perceptive Michael Every notes, is that virtually all of the proposed measures will have little to no impact on home prices:

- A NZD3.8bn fund to unlock more land for housing development – which won’t make any difference, as housing developers only build when prices are high.

- Government first home grants available to more people – which will also push prices up further;

- The extension of the period in which profits on the sale of investment property are taxed to 10 years from five – which won’t bother people if prices are rising 20% y/y; and

- Phasing out the ability of investors to claim mortgage interest as a tax-deductible expense.

Ardern disagreed and said that “the housing crisis is a problem decades in the making that will take time to turn around, but these measures will make a difference”, adding that while “there is no silver bullet, but combined all of these measures will start to make a difference.” Only they won’t, and instead the latest government intervention will only makes things worse as it will remove the impetuse from the RBNZ to tighten conditions earlier.

Speaking of which, the New Zealand dollar plunged by almost 2%, dropping to 70.20 US cents, down from 71.70 cents beforehand. Swap rates and bond yields also declined as traders speculated the central bank will be able to keep interest rates at a record low for longer thanks to the government’s own efforts to rein in home prices.

“The announcements made today relating to housing investors were bolder than most expected and will be more hard hitting because they basically take effect straight away,” said David Croy, an interest-rate strategist at Australia & New Zealand Banking Group in Wellington. If that cools the housing market, it will give the RBNZ more breathing space, and delay rate hikes.

And since the level of overall liquidity is all that matters, it means that New Zealand’s “dangerous” housing bubble is about to get even more dangerous.

Tyler Durden

Tue, 03/23/2021 – 12:10![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com