VW’s North American Chief Says They Offer A “Counterbalance” To Tesla

VW’s North American Chief took to Bloomberg this week to continue the ongoing PR tour that the company is doing in hopes of keeping its stock price screaming and making itself a formidable player in the EV space.

Scott Keogh used his appearance on national television this week to trade barbs with Tesla, who is undoubtedly in the legacy automaker’s crosshairs.

“There never is someone who controls 85% market share, and that’s basically what Tesla has in the U.S. There is always a counterbalance,” Keogh said of Tesla. He continued to make the case that Volkswagen would benefit from its global scale and its strong dealership network, two things that – from an infrastructure perspective – Tesla can’t reliably fall back on.

Despite VW’s obvious target being Tesla, Keogh said that the company’s ID.4 electric SUV targets more traditional ICE vehicles, like Toyota’s RAV and Honda’s CRV. The SUV will be made in the U.S. starting September 2022.

Finally, Keogh said that an ongoing patent dispute between LG Energy and SK Innovation will be “straightened out”.

Recall, we have been closely covering Volkswagen’s ascent – not just in stock price, but in making a name for itself in the EV space – over the last couple weeks. Most recently, we wrote that Deutsche Bank said its EV business could be worth up to $230 billion.

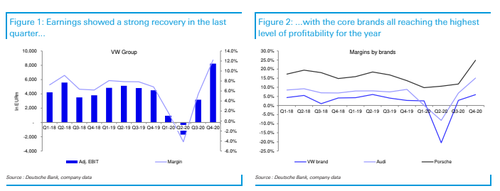

Analysts led by Tim Rokossa lifted their price target for VW shares by 46% to 270 euros this week. Last week, VW surpassed SAP as the largest member of the DAX.

Rokossa said there is a “good chance VW’s EV deliveries surpass Tesla’s in short order as its ID.4 compact SUV is rolled out globally”. Meanwhile, VW has said that it plans on turning its factory outside Barcelona into an EV hub with goals of making more than 500,000 vehicles per year.

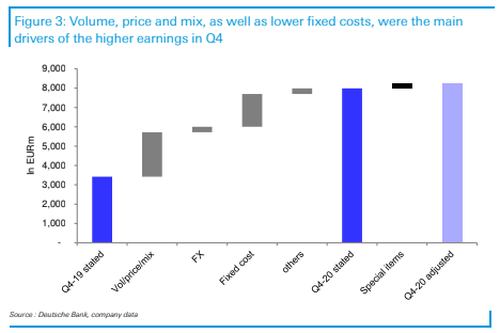

He also pointed to reduction of cost in items like batteries as key drivers of the financial bull case for VW:

VW’s truck unit, Traton SE, also said it was boosting investments into electric technology from 1 billion euros to 1.6 billion euros in 2025. Traton Chief Executive Officer Matthias Gruendler commented: “The future of commercial vehicles won’t be shaped by diesel anymore but by electric trucks.”

The note concludes:

“While we keep our existing valuation model, we increase the applied multiple that we think the market will deem fair and introduce a blue-sky valuation of the BEV business separately with this note. Applying the multiples of EV pure plays such as Tesla or NIO on sales generated by the MEB platform would yield a value of almost EUR400 per share (DBe) and we even ignore the premium PPE and luxury J1 platform in that calculation. We also ignore the potential value creation from a Porsche IPO (DBe: worth >EUR60bn). Overall, given the earnings momentum and the greater credibility of its EV story, we remain on Buy and increase our TP to EUR270.”

Recall, last week VW upgraded its profit guidance laid out plans for expanding the company’s EV offering out through 2030 which also includes dethroning Tesla as the reigning EV world champ. VW hosted its “Power Day” yesterday and revealed plans to build six “gigafactories” with a total capacity of 240 gigawatt hours per year.

“The company is aiming to achieve an operating margin between 7% and 8% after 2021. VOW also confirmed it is looking to finish the year at the upper and of a 5% – 6.5% range in 2021. Higher profitability will be achieved through lower costs with as much as 2 billion euros savings identified for 2023 compared to 2020,” the company said yesterday, according to StreetInsider.

Chief Executive Herbert Diess said on CNBC: “This period is probably the most crucial for the whole industry. Within the next 15 years we will see a total turnover of the industry. Electric cars are taking the lead and then software really becomes the core driver of the industry.”

Tyler Durden

Tue, 03/23/2021 – 21:05![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com