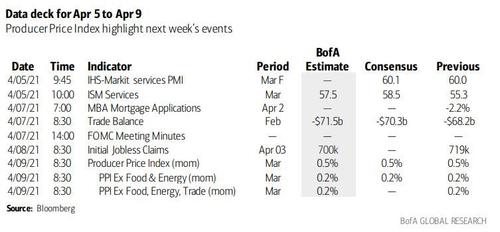

Key Events This Week: Minutes, Services And Producer Prices

Looking at the key events this week which takes place in the usual post payrolls data lull, the main event will be the latest FOMC minutes on Wednesday, which will offer a more upbeat assessment of the economy but reiterate the need to be patience in order to understand transient vs. sustained gains. Monday’s ISM services likely rebounded in March as consensus expects the index to rise to 59.0. Other notable reports include the jobless claims report on Thursday, and the PPI report on Friday. There are several speaking engagements from Fed officials this week, including from Chair Powell on Thursday.

In its FOMC Minutes prview, BofA expects the Fed to reveal that participants have become more constructive on the outlook, generally seeing greater upside risks, owing to a stimulus-induced rise in consumer spending. This will be consistent with the notable upgrade in the SEP forecasts. There will likely be a discussion about the sustainability of the recovery with many noting that the strength in the upcoming data could prove fleeting. Inflation will also be in focus given the significant rise in forecasts – it will be interesting to see which measures of inflation are front and center and if there is a sense of a comfort range for inflation.

In regards to monetary policy, many participants will note that it is prudent to wait for confirmation in the actual data to signal a change in the policy stance but others will argue for preemptive policy. Given that a 7 participants looked for hikes in 2023 and a number more in 2022, BofA expects the minutes to show a divide in regards to the reaction function.

A snapshot of the week’s key events courtesy of Goldman is below:

Monday, April 5

- 09:45 AM Markit services PMI, March final (consensus 60.2, last 60.0)

- 10:00 AM ISM services index, March (GS 59.0, consensus 58.5, last 55.3): We estimate the ISM services index increased by 3.7pt to 59.0 in March, reflecting a rebound from winter storm disruptions in February and a boost from reopening.

- 10:00 AM Factory orders, February (GS -0.1%, consensus -0.5%, last +2.6%); Durable goods orders, February final (last -1.1%); Durable goods orders ex-transportation, February final (last -0.9%); Core capital goods orders, February final (last -0.8%); Core capital goods shipments, February final (last -1.0%): We estimate factory orders decreased by 0.1% in February following a 2.6% increase in January. Durable goods orders decreased by 1.1% in the February advance report, and core capital goods orders declined by 0.8%.

Tuesday, April 6

- 10:00 AM JOLTS Job Openings, February (consensus 6,900k, last 6,917)

Wednesday, April 7

- 08:30 AM Trade balance, February (GS -$70.3bn, consensus -$70.2bn, last -$68.2bn): We estimate the trade deficit increased by $2.1bn in February, reflecting an increase in the goods trade deficit. Goods imports are now well above their pre-pandemic level, and goods exports are only slightly below their pre-pandemic level. Both imports and exports of services have recovered only slightly from their 2020Q2 troughs.

- 09:00 AM: Chicago Fed President Evans (FOMC voter) speaks: Chicago Fed President Charles Evans will speak on the economic outlook during a virtual event. Audience and media Q&A are expected.

- 11:00 AM: Dallas Fed President Kaplan (FOMC non-voter) speaks: Dallas Fed President Robert Kaplan will participate in a panel discussion.

- 12:00 PM: Richmond Fed President Barkin (FOMC voter) speaks: Richmond Fed President Thomas Barkin will speak on monetary policy and the economy in a moderated discussion at a virtual event hosted by the Global Interdependence Center.

- 02:00 PM Minutes from the March 16-17 FOMC meeting: At its March meeting, the FOMC left the funds rate target range unchanged at 0–0.25%, as widely expected. In the Summary of Economic Projections, the median participant project a 3.5% unemployment rate and 2.1% core PCE inflation for the end of 2023.

Thursday, April 8

- 08:30 AM Initial jobless claims, week ended April 3 (GS 710k, consensus n.a., last 718k); Continuing jobless claims, week ended March 27 (consensus n.a., last 3,749k); We estimate initial jobless claims decreased to 710k in the week ended April 3.

- 11:00 AM: St. Louis Fed President Bullard (FOMC non-voter) speaks: St. Louis Fed President James Bullard will speak on the economy and monetary policy at an event hosted by Southern Illinois University. Audience and media Q&A are expected.

- 12:00 PM: Fed Chair Powell speaks: Federal Reserve Board Chair Jerome Powell will participate in a panel discussion alongside IMF Managing Director Kristalina Georgieva, Minister for Finance for Ireland Paschal Donohoe, and World Trade Organization Director General Ngozi Okonjo-Iweala. Questions from a moderator are expected.

Friday, April 9

- 08:30 AM PPI final demand, March (GS +0.5%, consensus +0.5%, last +0.5%); PPI ex-food and energy, March (GS +0.2%, consensus +0.2%, last +0.2%); PPI ex-food, energy, and trade, March (GS +0.2%, consensus n.a., last +0.2%): We estimate that headline PPI increased by 0.5% in March, reflecting increases in energy prices. We expect a 0.2% increase in the core measure excluding food and energy, and also a 0.2% increase in the core measure excluding food, energy, and trade.

- 10:00 AM: Wholesale inventories, February final (consensus +0.5%, last +0.5%)

- 10:00 AM: Dallas Fed President Kaplan (FOMC non-voter) speaks: Dallas Fed President Robert Kaplan will participate in a moderated Q&A in a virtual event.

- 12:00 PM: Dallas Fed President Kaplan (FOMC non-voter) speaks: Dallas Fed President Robert Kaplan will participate in a moderated Q&A in a virtual event.

Source: BofA, Goldman

Tyler Durden

Mon, 04/05/2021 – 09:25![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com