Record Direct Bids Underscore Solid Demand For 20Y Auction

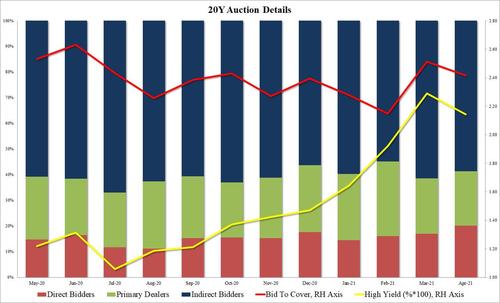

After eight consecutive auctions which saw the yield on the recently reintroduced 20Y Treasury rise, moments ago we got the latest 20Y bond auction (in the form of the 19-year 10-month reopening of CUSIP SW9), which saw the first sequential decline in the auction yield, and with a high yield of 2.144%, the April 20Y auction not only was below the March 2.29% high, but also stopped through the When Issued by 0.9bps.

The Bid to Cover was less exciting, dropping from 2.51 to 2.42, which still was above the six-auction average; the internals were mixed, with Indirects taking down 58.7%, down from 61.4% last month and below the recent average of 59.7. But while Indirects were muted, Directs jumped to 20.2%, the highest since the 20Y auction was reintroduced last May. That meant that Dealers were left with just 21.1% which in turn was the lowest since the reintroduction of the 20Y auction.

Overall, a solid showing and certainly far stronger compared to the March debacle when the entire bond market went haywire after “that” extremely ugly 7Y auction at the end of February unleashed rates turmoil.

Tyler Durden

Wed, 04/21/2021 – 13:17![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com