ECB Preview: This One Will Be A Snoozer

The ECB policy announcement is due at 07:45ET (12:45BST) with the press conference 45 minutes later at 08:30ET.

No adjustments are expected to current policy settings. The meeting takes place against the backdrop of lockdown restrictions offset by increasing pace of vaccinations. Messaging from the ECB is likely to focus on financing conditions and support from PEPP purchases.

With the euro below its multi-quarter average and the European Central Bank already announcing front-loaded purchases in March, the April ECB meeting should have a muted impact on the single currency, according to ING. Instead, the focus will be on improving eurozone data in coming months, and with EUR/USD still trading cheap, further upside lies ahead.

* * *

Courtesy of Newsquawk here is a detailed preview of what to expect.

OVERVIEW: The upcoming meeting is set to pass with little in the way of fanfare. Rates are expected to remain unchanged with the PEPP envelope held at EUR 1.85trl until the end of March 2022. The meeting takes place against the backdrop of lockdown measures across the Eurozone and a vaccination campaign that is continuing to pick up steam. Balancing these factors will likely be a key part of the ECB’s messaging, alongside the preserving of financing conditions in the region. Elsewhere, Lagarde will likely be questioned on the current pace of PEPP purchases and risks surrounding the recent challenge by the German Constitutional Court to the EU’s Recovery Fund. Note, the upcoming meeting will not be accompanied by staff economic projections.

PRIOR MEETING: As expected, the ECB stood pat on rates and maintained the size of the PEPP envelope at EUR 1.85trln, which will run until at least the end of March 2022. The key change to the policy statement was the inclusion of guidance that the Governing Council expects purchases under the PEPP over the next quarter to be conducted at a significantly higher pace than during the first months of this year. When questioned what “significantly” meant when it came to purchases, Lagarde refrained from giving a specific number. However, sources after the meeting said that policymakers agreed on a monthly PEPP purchase target at the meeting, saying it will be lower than EUR 100bln but well above the EUR 60bln seen in February. Sources also noted that opinions differed, with one source suggesting yields should be pushed down to the range seen in December, while others said improved prospects meant part of the recent yield increase was justified. Lagarde stressed the importance of financial conditions for policymaking, but refrained from giving detail on how to exactly quantify these metrics. Meanwhile, the ECB’s macro projections saw little changes to the growth forecasts, whilst 2021 inflation was revised higher to 1.5% from 1.0% amid transitory factors, and headline HICP is seen cooling to 1.4% by 2023, and therefore short of the ECB’s target.

RECENT DATA: The March inflation figures revealed an increase in Y/Y CPI to 1.3% from 0.9% with the core metric (ex-food and energy) languishing at 1.0%. On the growth front, Q1 Eurozone GDP will not be released until 30th April. However, the latest survey data for March revealed that the manufacturing sector climbed further into expansionary territory with a reading of 62.5 vs. prev. 57.9, while services picked up to 49.6 from the 45.7 but remained in contractionary territory. Overall, the composite came in at 53.2 vs. prev. 48.8 with Markit noting the survey “indicates that the economy has weathered recent lockdowns far better than many had expected”. However, this statement might be further tested in upcoming reports with German states recently agreeing to extend lockdown measures by a further three weeks and local press suggesting that Germany could see six to eight weeks of heightened infections and longer restrictions than initially expected.

RECENT COMMUNICATIONS: Since the previous meeting, commentary from President Lagarde largely echoed that of the March press conference. Lagarde reaffirmed that the ECB will respond to yield increases that get ahead of the economic recovery, adding that PEPP will be used with maximum flexibility and even going as far as saying that the “markets can test as much as they want”. Chief Economist Lane has continued to strike a cautious tone noting that the near-term economic situation continues to be dominated by uncertainty, adding that inflation can be largely attributed to the pandemic shock and there is no basis for the shift in inflation dynamics. Germany’s Schnabel has remarked that lowering interest rates further from very low levels may not only result in diminishing returns, it may also come with increasing costs. Additionally, the policymaker noted that an increase in real interest rates is not necessarily a sign that financing conditions are becoming less favourable, however, there are instances when rising rates would unduly tighten the policy stance. On the more hawkish end of the spectrum, Netherland’s Knot drew attention with comments stating that if the ECB’s baseline forecast holds up, the ECB could begin phasing out PEPP as of Q3 and conclude purchases in March 2022. This received pushback from the likes of France’s Villeroy. However, the comments from Knot indicated the potential areas of debate that will take place on the Governing Council in H2. Elsewhere, policymakers have continued to stress the importance of the EU passing its Recovery Fund.

RATES: From a rates perspective, consensus looks for the Bank to stand pat on the deposit, main refi and marginal lending rates of -0.5%, 0.0% and 0.25% respectively. Some policymakers have previously suggested that the ECB is yet to hit its reversal rate for the deposit rate, however, a move further into negative territory is not expected at this stage. When faced with the option of lowering the deposit rate in March as the crisis was unfolding, policymakers refrained from doing so. As a guide: markets currently assign a 4% chance of a 10bps cut to the deposit rate at the upcoming meeting and around a 13.5% probability by the end of 2021.

BALANCE SHEET: Expectations are for the PEPP envelope to be held at EUR 1.85trl and run until the end of March 2022, whilst the APP is to be maintained at a clip of EUR 20bln per month on an open-ended basis. Given the ECB’s declaration that it will increase the pace of purchases at the prior meeting, great attention has been placed on how closely the Bank is fulfilling this pledge. Prior to the past few weeks (which were distorted by the Easter holiday), PEPP purchases were running at a clip of EUR 19-21bln vs. ~EUR 12bln ahead of the March announcement, whilst the most recent update revealed a pace of EUR 16.9bln. ING has speculated that any leveling off of purchases could underscore the ECB’s reluctance to micromanage markets and even let rates rise if that is deemed justifiable by an improving backdrop. Looking further ahead, UBS expects the ECB to announce in December that PEPP will not be extended beyond March 2022. However, alongside the conclusion of PEPP, the Governing Council will “beef up” its regular APP (currently EUR 20bln/month) by either raising the monthly volume or setting the APP volume as an envelope over a longer timeframe.

EURO REACTION: While the ECB is still cautious and unlikely to provide a positive catalyst for EUR any time soon, the EUR/USD uptrend which started this month should remain in place. Plenty of bad news has now been priced in, the currency has been trading with a persistent risk premium over the past few months and despite the recent rise, EUR/USD still screens cheap based on our short-term financial fair value model. The first quarter was rather dismal for eurozone economic data but this is likely to change in coming months as the pace of vaccination picks up. Improving eurozone data should translate into some upside for the euro. Indeed by summer, eurozone growth should be more synchronised with the US (particularly throughout the second half of the year – Fig 3) and this should provide support to the euro.

PRESS CONFERENCE: Areas of focus for the press conference will centre around the ECB’s assessment of the Eurozone outlook (not accompanied by staff economic projections). As it stands, “the risks surrounding the euro area growth outlook over the medium term have become more balanced, although downside risks remain in the near term”. The key for Lagarde will be balancing the pessimism surrounding existing lockdown measures across the Eurozone with increased vaccine optimism in recent weeks; ABN AMRO recently noted that the EU is on track to fully vaccinate 70% of the population by September. However, Lagarde will likely wish to avoid being too bullish on the outlook for the region as it could provide some ammunition to the hawks on the Governing Council with regards to the eventual unwind of monetary support. Furthermore, from a fiscal standpoint, the President will need to continue to make the case for the passage of the EU’s Recovery Fund, particularly in lieu of the recent challenge from the German Constitutional court, which could issue a ruling on the matter next month. Financing conditions will likely be a key aspect of the ECB’s messaging, on which, Lagarde will likely stick to the script outlined at the March meeting and offer a relatively technical, yet unspecific view on how the Bank characterises conditions. Last week, UBS observed that the ECB should draw comfort from the fact that the “imported tightening of financing conditions had stalled”. However, journalists might probe the President on whether some of the recent market moves warrant attention with ABN AMRO noting that (as of April 20th), “the eurozone 10y yield stood at +0.12% (average for April is +0.05%), even though the upswing in US yields has lost momentum”. Elsewhere, Lagarde will likely be questioned on how significant she deems the pick up in PEPP purchases to be and whether or not purchases will be ramped up further/lowered in the coming weeks and months. Finally, Lagarde will likely also be questioned on the Bank’s ongoing strategic review, however, the President is unlikely to front-run its findings, with the review set to be concluded in September.

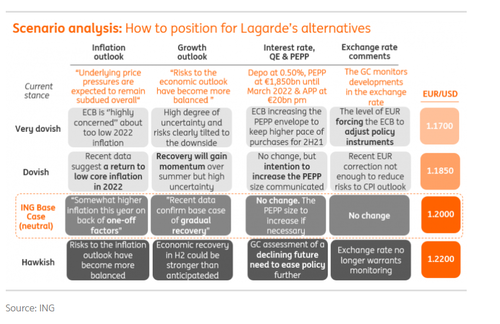

CHEAT SHEET (from ING):

Tyler Durden

Thu, 04/22/2021 – 07:22![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com