“Banging Between Big Strikes” – Levels To Watch Ahead Of FOMC Statement

As we detailed overnight, today’s FOMC is widely expected to be “steady as she goes” with Biden conveying that the FOMC is not yet thinking about shifting its dovish stance.

The only “risk” associated with today could be a “semantics” acknowledgement of better data (though we note the surprises are dominated by ‘soft’ survey data)…

But, as Nomura’s Charlie McElligott notes:

I’d be beyond-shocked at anything strong enough to see the market adjust or pull-forward their current tapering view, with most sell-side consensus targeting early 2022 (although pockets of late ’21).

Here is the Nomura Econ team’s timeline:

-

June – tapering discussions begin to intensify as incoming data remains strong

-

June/July FOMC minutes, speeches and Jackson Hole – additional comments that participants are beginning to see signs of “substantial further progress”

-

September – adjustment to the post-meeting statement to acknowledge that “substantial further progress” is likely to be made “in coming months”

-

December – official announcement that tapering will start in January 2022

-

January – tapering starts, with a $20bn ($10bn) reduction in the pace of Treasury (MBS) purchases every six months. Tapering finishes by Q3 2023, the same quarter we expect liftoff

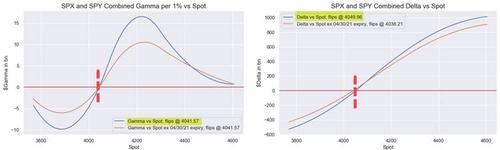

From a “Gamma vs spot” perspective, Nomura’s equity options analysis shows dealers comfortably “long gamma (vs spot price)” now almost across the board… which is currently insulating the market from big swings, as evidenced by yesterday’s “chokehold” with -2bps in SPX / -40bps in QQQ / +15bps in IWM / -5bps in EEM.

So where do we start to get worried?

McElligott notes that “we’re still banging between big strikes” with the levels that matter for S&P being $5.46B $Gamma at 4200 strike, $3.86B at 4250, $2.68B at 4150.

But where would a move to the downside get slippery? Down around ~4040-4050 level, with the overlapping of both Gamma- and Delta- “flips” at approx same level.

As SpotGamma notes, while the S&P has a neutral vanna setup, both QQQ and IWM have a “skew” to their models which (along with being flat gamma) implies a dealer tailwind on rallies, but dealers shorting on weakness.

So we again look for high volatility in those indices.

Tyler Durden

Wed, 04/28/2021 – 13:25![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com