“This Time Is Indeed Different” – Why Morgan Stanley Sees No Housing Bubble

By Vishwanath Tirupattur, Managing Director in Credit Securitized Products Research and Strategy at Morgan Stanley

US housing is on a hot streak. Home prices as measured by the S&P Case-Shiller Index rose 12.2%Y, with prices surging across all 20 of the metropolitan areas tracked by the Index. That amounts to an increase of $35,000 in the median selling price for homes from just a year ago and marks the fastest pace of increase since 2006.

Unsurprisingly, any comparison to the 2006 boom in home prices brings unhappy memories, considering the bust that followed, which culminated in the global financial crisis (GFC) in 2008. However, we argue that this time is indeed different. Unlike 15 years ago, the euphoria in today’s home prices comes down to the logic of demand and supply, and we conclude that the sector is on a sustainably sturdy foundation. We are not at all suggesting that home price appreciation will maintain its current torrid pace. Home prices will continue to rise, but more gradually. We have strong conviction that we are not experiencing a bubble in US housing.

Much has been written about the run-up to the pre-GFC housing bubble. We would boil it down to layers upon layers of leverage in the housing sector that led to a spectacularly painful bust. But contrary to the narrative that loose lending to people with lower credit scores – the ‘sub-prime’ borrowers – was central to the excesses, we think it was more about the type of credit they had access to. Mortgage credit risk consists of (1) borrower risk and (2) mortgage product risk. Borrower risk captures the metrics we typically use to assess the likelihood of default on a mortgage, such as credit score, loan-to-value, and debt-to-income. Product risk lies in giving a borrower a type of mortgage that has a higher risk of default, even controlling for those borrower characteristics. These so-called ‘affordability products’ included mortgages where the payment could vary significantly throughout the life of the loan. As James Egan, our US housing strategist has explained, product risk increased significantly more than borrower risk during the pre-GFC housing boom. The affordability products were inherently risky because they effectively required home prices to keep rising and lending standards to remain accommodative so that homeowners could refinance before their monthly payment became unaffordable. When home prices stopped climbing, these mortgages reset to payments that borrowers could not make, leading to delinquency and foreclosure. As foreclosures and the subsequent distressed sales piled up, home prices fell further, creating a vicious cycle.

Affordability products made up almost 40% of all first lien mortgages from 2004 to 2006. Today their share is down to 2%. Furthermore, the Mortgage Bankers Association’s index of credit standards, which peaked at nearly 900 in 2006, has stayed well below 200 for almost a decade and fell further to the low 100s post-COVID-19. Not only are lending standards much tighter this time around, but the leverage in the system has also been reduced dramatically. Prior to the GFC, the total value of the US housing market peaked at $25.6 trillion in 2006, with total mortgage debt outstanding of $10.5 trillion for an estimated loan-to-value (LTV) of 41.2% for the entire housing market. Today, the value of the housing market has jumped to $33.3 trillion, while total mortgage debt has only increased to $11.5 trillion with an estimated aggregate LTV of just 34.5%. These changes give us confidence that the current system of housing finance is healthy and on a sustainable footing.

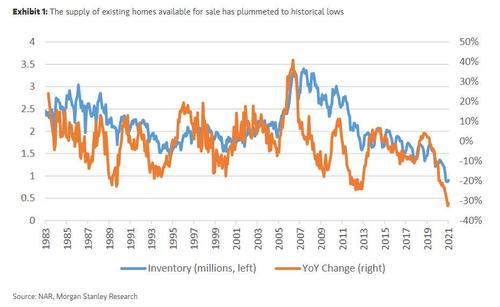

Demand and supply factors remain a tailwind for home prices. Thanks to the demographic dividend, millennials continue to drive household formation at a rate 30-50% above the long-run rate of new household formation. Thus, demand for shelter is likely to remain robust for some time to come. As James points out in his latest Housing Tracker, affordability remains good despite sustained increases in home prices and mortgage rates inching higher. Monthly mortgage payments as a percentage of income remain near the most affordable levels in the last five years. Against this backdrop, there is a nationwide shortage of supply. The number of existing homes available for sale has plummeted to historical lows while the supply of new homes remains muted, hence the overall supply of homes sits near record lows.

Robust demand and highly challenged supply along with tight mortgage lending standards augur well for home prices. Higher interest rates and post-pandemic moves will likely slow the pace of appreciation, but their upward trajectory remains on course.

Tyler Durden

Sun, 05/02/2021 – 17:50![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com