Social Unrest Fears Mount As World Food Prices Soar In April

Global inflation is headed into overdrive as the leading food price indicator that is the United Nations’ Food and Agriculture Organization’s food price index increased for an 11th consecutive month in April, hitting levels not seen since May 2014, with sugar prices leading the rise in the main index.

The Rome-based FAO released data Thursday showing the food price index, which measures monthly changes for a basket of cereals, oilseeds, dairy products, meat, and sugar, surged 2 points from 118.9 points in March to 120.9 in April.

That is a 30.7% YoY jump – the fastest rise since 2011…

The April surge was primarily led by price increases of sugar, oils, meat, dairy, and cereals.

FAO’s cereal price index moved up 1.2% in April M/M and 26% Y/Y. Drought conditions in Argentina, Brazil, and the US increased corn prices by 5.7% last month, while wheat prices were flat. Global rice prices slipped last month.

FAO’s vegetable oil price index rose 1.8% last month because of increasing soy, rapeseed, and palm oil prices, which offset lower sunflower oil prices.

Milk prices increased 1.2%, with surging demand from Asia, while the meat index rose 1.7%. FAO said there was “solid demand” for bovine and ovine meat in East Asia.

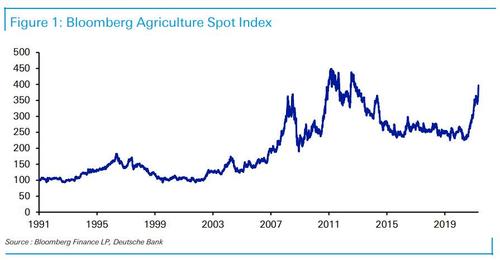

The idiots at the Marriner Eccles building seemingly have no interest in reading the extensive literature in connecting higher food prices to periods of social unrest. Indeed, you’ll notice from the chart below that the last big surge from the middle of 2010 to early 2011 coincided with the start of the Arab Spring, for which food inflation is regarded as a contributing factor.

While this is hardly new – we discussed it in “Why Albert Edwards Is Starting To Panic About Soaring Food Prices” and in “We Are Edging Closer To A Biblical Commodity Price Increase Scenario.”

DB’s Jim Reid reminds us that emerging markets are more vulnerable to this trend since their consumers spend a far greater share of their income on food than those in the developed world.

Inflation is always a monetary phenomenon, and this time is no different. Central bankers call transitory effects, but we beg to differ.

Tyler Durden

Fri, 05/07/2021 – 02:45![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com