“Customers Want To Get Out And Shop”: Walmart Soars After Smashing Expectations, Boosting Guidance

Walmart stock is surging premarket after the largest bricks and mortar retailer in the US not only reported blowout Q1 earnings, but also raised guidance, a remarkable achievement since it laps the pre-covid hoarding from a year ago.

Here are the details:

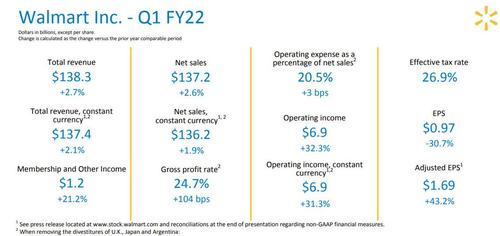

- Q1 Adjusted EPS $1.69, up from $1.18 y/y, and not only smashed expectations of $1.22 , but came above the highest estimate of $1.40.

- Q1 Revenue $138.31BN, up 2.7% y/y, and also blowing away estimates of $131.97 billion

- Walmart U.S. eCommerce sales increased 37%, also blowing out the 24% expected

Same Store Sales:

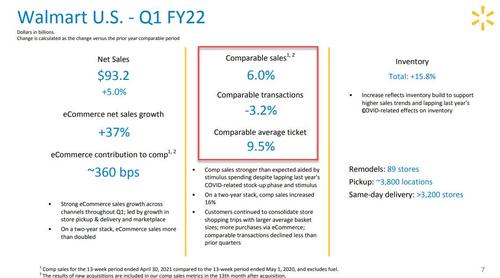

- Total U.S. comparable sales ex-gas +6.2% vs. +10.3% y/y, estimate +2.03%

- Walmart U.S. comp sales ex-fuel grew 16.0% on a two-year stack

- Walmart-only U.S. stores comparable sales ex-gas +6% vs. +10% y/y, estimate +1.97%

- Sam’s Club U.S. comparable sales ex-gas +7.2% vs. +12% y/y, estimate +3.08%

Of note, in the US while the number of transactions again declined some 3.2%, the average ticket jumped 9.5% as buyer make less trips but buy more.

Here is how Walmart explained the blistering same store sales performance:

- Comp sales stronger than expected aided by stimulus spending despite lapping last year’s COVID-related stock-up phase and stimulus

- On a two-year stack, comp sales increased 16%

- Customers continued to consolidate store shopping trips with larger average basket sizes; more purchases via eCommerce; comparable transactions declined less than prior quarters

Some more observations, via Bloomberg:

- The company attributed the strong performance to growing market share in grocery, U.S. stimulus checks and pent-up demand after a year in lockdown — a trend economists have dubbed revenge spending. “Our optimism is higher than it was at the beginning of the year. In the U.S., customers clearly want to get out and shop,” Chief Executive Officer Doug McMillon said in a statement announcing the results. Customer traffic — which includes in-store and online — increased in April for the first time in over a year.

- Walmart reported its U.S. e-commerce sales rose 37% in the quarter, compared with the average analyst estimate of 24%. Online sales have been expected to decelerate as shoppers venture back into stores, but Americans continue to buy from all the channels. To counter rival Amazon.com Inc. and better compete online, Walmart has opened its third-party web marketplace to non-U.S. vendors and is trying to sell more apparel online by purchasing a virtual-fitting room business.

- Adjusted earnings in the quarter came in above estimates. Retailers face increased costs for labor and transportation, along with price hikes expected from big vendors like Procter & Gamble Co. Offsetting those headwinds are lower Covid-related costs, which for Walmart totaled almost a billion dollars in last year’s first quarter. Analysts will be listening for more on these costs and savings during today’s earnings call.

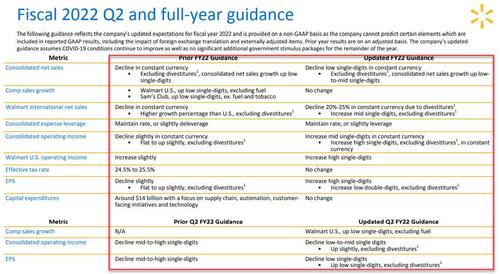

More remarkable even than its historical earnings was Walmart’s guidance: the company now expects earnings per share to rise by a high single-digit percentage this year, compared to earlier estimates for a slight decline. In the second quarter, that same metric will fall by a low single-digit percentage, but that’s still better than the mid-to-high single-digit drop it had been expecting earlier, specifically:

- Sees EPS to decline low single digits, saw decline mid to high single digits

- Sees EPS up low single digits excluding divestitures

- Sees Walmart U.S. comp sales ex-fuel up low single digits

In response, Walmart shares jumped 3% of 7:30 am ET in premarket trading. The shares had fallen 3.6% this year before Tuesday.

Tyler Durden

Tue, 05/18/2021 – 07:35![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com