OPEC+ Agrees To Boost Oil Output In July As Demand Rises

As expected, OPEC+ announced it would hike oil output in July, sticking to its previously leaked plan as Saudi Arabia’s energy minister struck a bullish tone about the global recovery. As Energy Intel’s Amena Bakr summarized:

- OPEC+ agreed to keep the existing April 2020 deal unchanged

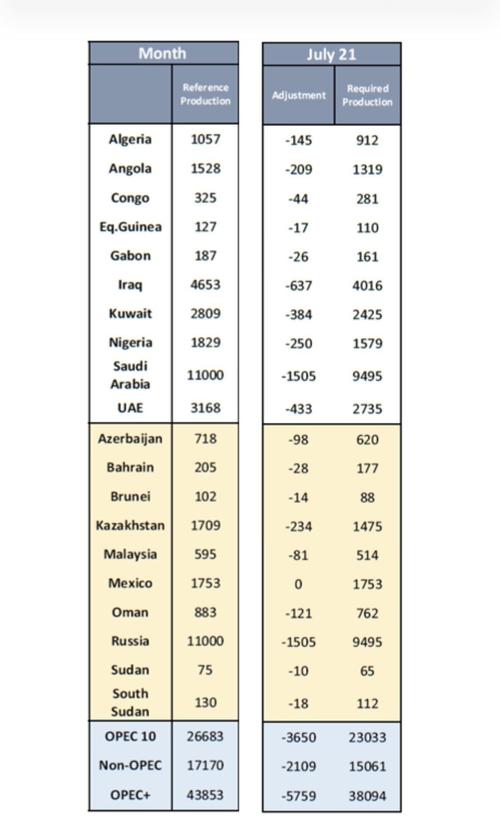

- Reconfirmed the existing commitment of the 10th OPEC and non-OPEC Ministerial in April 2020 amended in June, September, and December 2020, as well as in January and April 2021 to gradually return 2 mb/d to the market, with the pace being determined according to market conditions.

Saudi Energy Minister Prince Abdulaziz bin Salman recapped the prevailing optimism as the meeting started: “The demand picture has shown clear signs of improvement.” Russia’s Alexander Novak also spoke of the “gradual economic recovery.”

As part of the return to normal, the oil producers will push ahead with an increase of 841,000 barrels per day in July, following hikes in May and June, Bloomberg reported citing delegates.

OPEC and its non-US allies have spent more the past 14 months rescuing prices from historic lows and an unprecedented plunge in negative territory for WTI on April 20, 2020, and are only cautiously returning supply. Now the story is shifting: oil prices above $71 are fueling inflation concerns and if OPEC doesn’t add more oil, there’s a risk the market becomes too tight, undermining the global recovery. Furthermore, as OPEC+ hopes to capitalize on rising prices, it doesn’t want prices to rise too high as to push US shale producers out of hibernation and into overdrive, resulting in another production glut.

For now, the cartel is also embracing caution. Prince Abdulaziz echoed the concerns of his fellow delegates when he said there are still “clouds” on the horizon, first and foremost the question of what happens to millions of daily barrels in Iranian oil supply.

Iran’s potential return to international markets is one factor weighing on ministers’ decision-making. The impact of new variants of Covid-19 is another. And while there’s a wide deficit in the market to fill in the second half of the year, those two considerations could see some producers argue for a pause before further hikes.

“Covid-19 is a persistent and unpredictable foe, and vicious mutations remain a threat,” OPEC Secretary-General Mohammad Barkindo said.

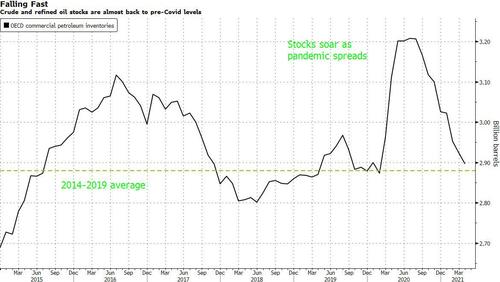

The organization is now scheduled to hold supply unchanged until April 2022, according to the deal signed a year ago to rescue producers from a bitter price war. While the agreement can be renegotiated – and there’ll be pressure to do so as demand continues to recover – it provides a fallback position for the group, with the excess oil inventories built up during the pandemic now back to pre-covid levels.

Tuesday’s meeting didn’t tackle the period after July, delegates told their preferred news outlets.

Fatih Birol, executive director of the International Energy Agency, told Bloomberg that if the alliance doesn’t boost output later this year, prices will face further upward pressure, with $80 oil increasingly likely. Some are even whispering of triple digit prices.

“One thing is clear: in the absence of changing the policies, with the strong growth coming from the U.S., China, Europe, we will see a widening gap” between demand and supply, Birol said.

Tyler Durden

Tue, 06/01/2021 – 10:50![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com