Copper Futures Plunge To Seven-Week Low As Base Metals Slip-On Fed, China Demand Woes

…time to ignore Dr.Copper once again!?

Copper prices plunged on Tuesday to their lowest levels in seven weeks over concerns about Federal Reserve’s monetary tightening and a pull-back in Chinese demand.

From aluminum to copper to lead to nickel to tin to zinc, the entire base metal complex is down anywhere from 2-4%.

Focusing on copper, future prices on the London Metal Exchange are down 4% to their lowest levels in seven weeks. Three-month LME copper futures were trading around $6,563 per ton, down 11% in 25 trading sessions since topping at $10,747 in early May.

Copper prices soared to a record in early May ($10,747 per ton) as stimuli, low-interest rates, and an economic recovery fueled a rally in base metals, along with most commodities. “Prices have since stumbled on concerns the Fed will pull back support, while China is looking to tap state reserves to accelerate its campaign to rein in surging raw material costs,” said Bloomberg.

“Market participants are worried that the U.S. Federal Reserve will signal this week that it intends to tighten its ultra-loose monetary policy,” Daniel Briesemann, an analyst at Commerzbank AG, said in a note. “In addition, the high metals prices appear to be slowing demand in China.”

China’s state planner has also been curbing speculation in commodity markets as domestic producer inflation soars to a 12-year high.

“The government knows that low material price and high manufactured good price are favorable to the Chinese economy,” said a China-based metals trader told Reuters.

According to Bloomberg, the Yangshan copper premium, a gauge of China’s demand for imports, continues to tumble to levels not seen since 2017. This could indicate that ample supply is flooding markets.

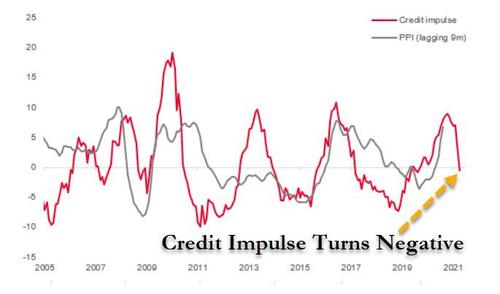

Readers may recall none of this should be surprising considering our ample coverage on China’s credit impulse (the 2nd derivative of the credit stock) turned negative in May. From peak to negative, it only took seven months this time, compared with 9-10 months in the past.

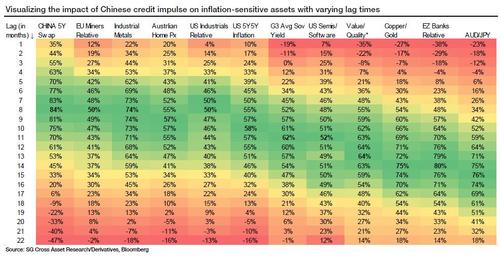

The slowdown in China’s credit has first reached assets driven primarily by the Chinese economy (Chinese bond yields and industrial metals). Next to be impacted are inflation breakevens and sovereign yields in Western economies. The peak correlation for other growth-sensitive assets such as eurozone banks and AUD/JPY arrives with bigger lag of around 4-5 quarters. This result, while logical, is quite significant, as it gives us a playbook for the ebb and flow in Chinese credit impulse.

The bottom line is China’s credit impulse has been in contraction for about a month which has coincided with the latest slump in base metal prices.

Tyler Durden

Tue, 06/15/2021 – 18:25![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com