Powell Is Promoting A Public Perception Of Inflation That Is False: Fed Admits It In New Forecasts

Submitted by Joseph Carson, former chief economist of Alliance Bernstein

Fed Is Promoting A Public Perception of Inflation That Is False – Fed Admits It In New Forecasts

The Federal Reserve continues to claim that the current run-up in consumer price inflation is “transitory,” pushed higher due to base effects and a temporary burst in pent-up demand as the economy re-opens. Yet, that view is in direct conflict with policymakers’ latest inflation forecast and the inflation data.

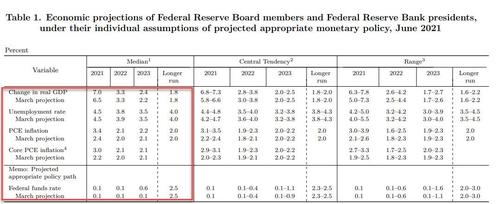

Updated forecasts by the Fed show that policymakers expect consumer inflation to increase 3.4% in 2021, 100 basis points higher than the March forecast and almost double what policymakers predicted at the outset of the year.

Policymakers’ forecasts for inflation represent changes from the fourth quarter of 2020 to the end of 2021. There is no base effect in that forecast since consumer price increases turned positive by the end of 2020.

As such, the base effect argument is false, and policymakers admit as much in their published forecasts. The “transitory” nature of the jump in inflation is also untrue as they expect it to run an entire year.

At the press conference following June 15-16, Fed Chair Jerome Powell also argued that inflation was boosted by special factors, citing the jump in lumber and used cars and truck prices as examples. Reported consumer price inflation does not include lumber prices. Lumber prices are an essential part of housing construction and housing inflation but not part of the reported consumer inflation.

The old CPI did include house prices in its measurement, and adjusting the currently reported inflation numbers for house price inflation would push CPI (and core CPI) to double-digit gains, something not seen since the 1970s. Too bad reporters did not challenge Mr. Powell on that.

Used cars and truck prices did boost consumer price inflation in May. Yet, the Bureau of Labor Statistics showed that core CPI excluding used car and truck prices and shelter (which does not include lumber costs or house prices) was 0.6%, matching the reported in core CPI. In other words, the downward pressure from the shelter component offsets the upward from used cars and truck prices, and the uptick in consumer price inflation is broad and not linked to special or one-time factors.

The most curious part of the Fed’s new inflation forecast is the one-year jump (biggest gain in core CPI in three decades), and then inflation miraculously moves back to the 2% target. How does that happen without any changes in monetary policy?

In recent years, policymakers have argued that inflation cycles nowadays are not linked to tight labor markets. Yet, they still say that inflation is a monetary phenomenon but forecast an abrupt slowing in consumer price inflation while maintaining the most aggressive monetary policy on record.

Policymakers are running a risky experiment with price and wage pressures present on a broad front and still opting to move forward with official rates at zero and the promise to buy billions of more financial assets. Are policymakers sending the message that monetary policy does not matter, or are they clueless about the economic and financial implications?

Unfortunately, this is not an academic debate as policymakers allow this to play out in real-time, with huge economic and financial risks if they are wrong. Investors forewarned.

Tyler Durden

Thu, 06/17/2021 – 17:02![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com