Industry Icon Seeing Housing “Hyperinflation”

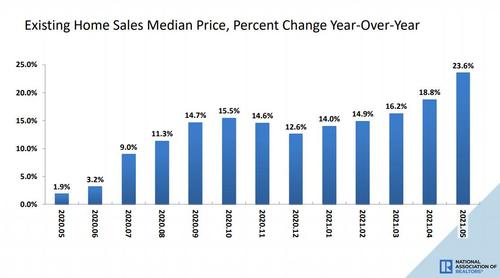

It has been a week of staggering home prices increase news which has seen the median existing home price surge to a record $350,000…

… up a whopping 24% from a year ago…

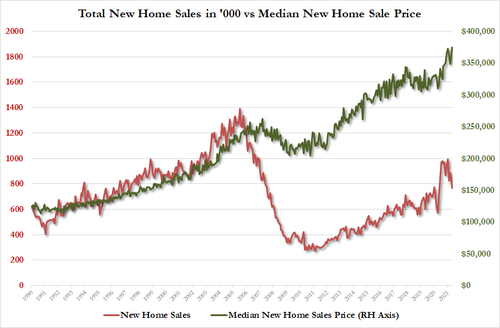

… while today we learned that the median new home price surged 18%, also to a record $374,400 (the average selling price was also a record $430,600)…

… the result being a collapse in homebuyer sentiment…

… leading to a sharp slowdown in actual sale transactions, as the soaring prices start to adversely impact the broader market.

Remarkably summing up what’s going on in the housing market, veteran housing analyst Ivy Zelman said she was seeing “hyperinflation” in the US housing “ecosystem” fraught with labor and materials bottlenecks.

Zelman’s warning comes as investors are closely watching whether a broad surge in inflation as the economy recovers from pandemic lockdowns will prove to be transitory. At least it validates one part of a recent Bank of America warning which said that the US is facing “hyperinflation” if transitory. Well we now have the hyperinflation part; for the sake of the dollar and cilivization, one can only hope that BofA is also right about the transitory part.

Speaking in a Wednesday webcast with Walker & Dunlop Chief Executive Officer Willy Walker, CEO of real estate research firm Zelman & Associates cited a truck-driver shortage along with shipping constraints and soaring costs as among the biggest problems homebuilders are facing. She underscored difficulty in moving shingles from Canada to the U.S. in particular, along with kinks in the supply chain for other staple building materials including drywall and insulation.

And, confirming the sudden drop in new transactions, Zelman also warned that home buyers are stretched.

“At some point the consumer cries uncle,” she said, quoted by Bloomberg.

She also warned that surging prices today could lead to tumbling prices tomorrow, cautioning about the impact of higher interest rates on home prices and the prospects the Fed may start to taper asset purchases. While more supply is set to come on the market eventually, Zelman sees homebuilder stocks as expensive, and she envisions a tough second half. Her cautious stance would accelerate if rates were to rise.

Perhaps in response to her warning, or today’s huge miss in new home sales, homebuilder stocks fell with the S&P homebuilding index closing down 1.2% on Wednesday after paring a drop of as much as 2.5%. Lennar Corp., M/I Homes Inc., PulteGroup Inc. and D.R. Horton Inc. were among worst performers. The index has dropped more than 13% from its all-time high in May.

Zelman’s “hyperinflation” warning echoes a recent analysis from Bank of America in which the bank’s chief economist Michelle Meyer said that the US economy “is facing an imbalance: a burst in demand has been met with constrained supply. Economics 101 tells us that when the demand curve shifts more than the supply curve, prices will rise, which continues until the balance is restored from a combination of slowing demand and greater supply.”

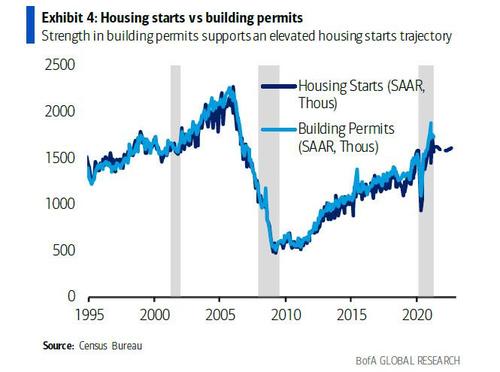

This narrative, Meyer said, describes the US housing market. Demand for housing climbed higher in the months following the onset of the pandemic, leaving existing home sales to reach a peak of 6.7 million saar in October, the highest since 2006. This has left builders to scramble to respond, sending building permits to a high of 1.9 million saar in January. The result: home prices and building costs have surged higher.

And while prices are soaring, the long journey to restore the equilibrium has at least started as existing home sales have come off the highs and housing starts have increased. For what it’s worth, Bank of America thinks existing home sales will continue to moderate while starts run at a high 1.6 million pace through this year and next until supply has returned to the historical average between 5-6 months, eventually allowing home price appreciation to cool. But, as Meye warns, “this will not be resolved overnight – it will be a long journey to balance the housing market.“

So yes, hyperinflation now… and utopia at some indefinite point in the future.

For those curious, BofA has summarized the recent housing trends in charts covering four key themes:

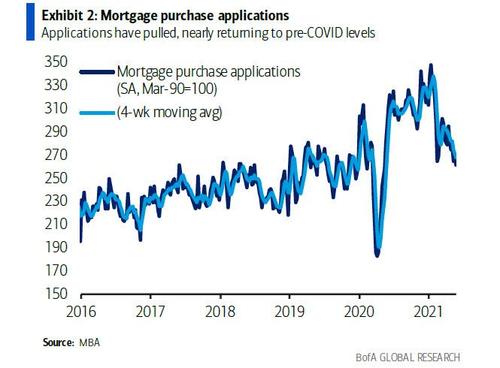

- Signs from the recent data: Mortgage purchase applications and existing homes sales have been declining this year and are expected to slip further. In contrast, we see upside for new home sales and housing starts but with speed bumps due to high costs.

- Surveys show discouraged buyers: As shown above, buyer sentiment has fallen to the lowest since 1982, reportedly due to high prices. But yet paradoxically homebuilder sentiment is holding close to record highs given exceptionally low inventory. This can only end in tears.

- Builders are facing incredible cost pressure: All else equal, the rise in the price in lumber and related products has added over $34K to the price of a new home over the past year. The sharp gains in builder costs are starting to hold back production.

- Double-digit home price gains are not sustainable: Home prices have soared over the year. The trajectory is unsustainable and price appreciation should cool next year but only slowly given the extreme imbalance between supply and demand

The latest data on the housing market

- After roaring higher last year, mortgage purchase applications have seen a pullback suggesting a cooling off in housing demand. The 4-week moving average is nearly back to the pre-COVID highs.

- Mortgage rates have risen this year with the 30yr fixed rate reaching as high as 3.3% in mid-March from a low of 2.8% in February before settling at its recent level of 3.1%. The timing of the rates move coincides with the drop in purchase applications.

- Looking ahead, most rates strategists expect interest rates to move higher with the 10yr Treasury benchmark rising to 2.15% by 1Q22 from its current level around 1.6%. Higher rates will therefore remain a headwind going forward.

- Existing home sales showed a similar trajectory as mortgage applications: running currently at 5.80mm saar which is down from the peak last fall but still up from 5.66mn in 2020.

- The trajectory of new home sales has also cooled, but the data have seen more of a plateau than a pullback with new home sales of 863k saar in April. Through the first four months of 2021, new home sales are averaging 907k saar, which is well above 2020 sales of 828k.

- Looking ahead, the risks are for existing home sales to head even lower due to the combination of declining affordability and tight inventories. Meanwhile, new home sales may grind higher as these supply challenges funnel demand towards new construction.

- Housing starts slid by 9.5% mom in April to 1.57mn saar, although few consider this the start of a downturn. Building permits have remained elevated at 1.73mn saar suggesting robust underlying demand for new residential construction.

- The components of building permits are also promising. Single family permits have been bouncing between 1.1-1.2mn saar and historically run close together with single family starts. Meanwhile, the noisier multifamily sector has been running just under 600k.

- Housing starts are expected to remain at an elevated trend and grind higher, much like new home sales, totaling 1.6mn in 2021 versus 1.4mn in 2020.

What do the surveys say?

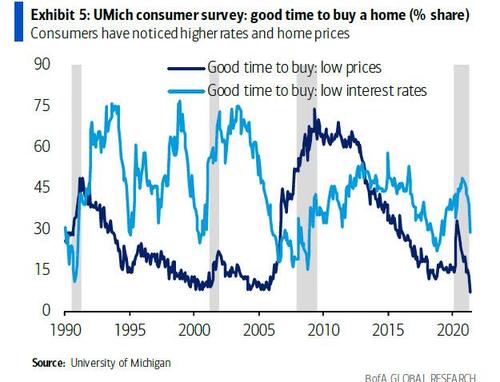

- Given the demand-supply imbalance in housing, it has become a seller’s market. According to the University of Michigan consumer sentiment survey, the share of those believing it is a good time to sell has soared to a record high 80% while the share of those believing it is a good time to buy has dropped to 46%, the lowest since 1982.

- Buyers have recently been pressured by dwindling affordability, reflecting a combination of higher prices and rising, albeit still low, interest rates. The share of those believing it was a good time to buy due to low prices dropped to a mere 7% in May, while those believing it is a good time due to low interest rates have moderated to 29%. The latter is still the primary buying reason.

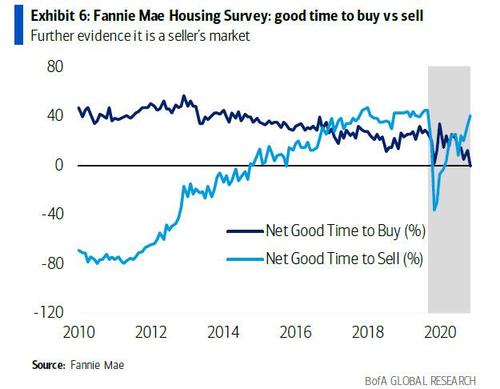

- The Fannie Mae National Housing Survey provides additional evidence that it has become a seller’s market. The net share of respondents who believe it is a good time to buy has dropped to -1% as of April, which is the lowest since the series goes back to 2010.

- Conversely, the net share who think it is a good time to sell has rebounded to 41%. This compares to the historical high of 47% achieved in 2018.

- The shifts in sentiment around market conditions supports our view that the trend is lower for existing home sales as the market needs to rebalance

- The run up in home prices is partly a function of strong demand but also historically tight housing supply, which has been a decade in the making. In order to ease these price pressures, there is a strong need to build.

- The NAHB housing index, a measure of homebuilder sentiment, reached a record high of 90 in November and has cooled to a robust 83 as of the past two months. Given the need for housing supply, homebuilders are feeling quite optimistic about the outlook.

- The strength in homebuilder sentiment underpins our outlook for additional upside in housing starts and new home sales.

Rising Costs and Prices

- While there are clear supply challenges in housing inventories, builders are also facing their own supply constraints, creasing challenges for new construction.

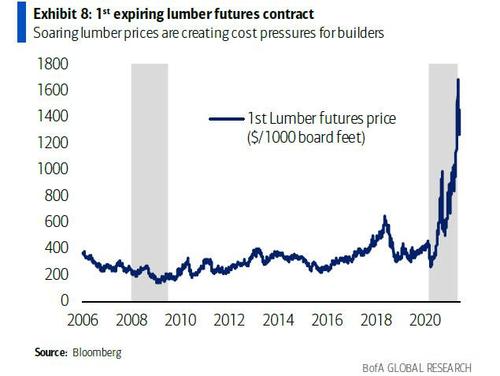

- One of the major constraints is soaring lumber prices. Looking at the first expiring contract for lumber futures, prices soared to a peak of $1,686/1000 board feet in early May before cooling off below $1,400 more recently, which is multiples higher than the $400 pre-pandemic trend.

- According to the NAHB, “the escalating lumber prices are largely due to insufficient domestic production and extremely large lumber mill curtailments that lasted well into the 2020 building season.”

- Given the rapid rise in lumber prices, the total cost of lumber and manufactured lumber products for an average single family home has soared 184% from April 2020 to April 2021, rising to $48,316. Put another way, the rise in lumber has added $35,872 more to the price of a new home. This is according to an NAHB analysis using Random Lengths data.

- The lumber costs for an average multifamily unit have spiked as well to $17,220, reflecting a $12,966 or 190% increase. The NAHB estimates that the rise in multifamily costs equate to a $119 per month increase in rents.

- The NAHB notes that other costs have contributed to higher home prices including interest, brokers’ fees, and margins required to attract capital and get loans underwritten.

- The rising cost of construction and therefore new home prices is evident when looking at the distribution of sales by price point. Builders are concentrating construction in the higher priced homes where the high costs can be more easily absorbed.

- The share of homes sold over $500k rose to 26% in April, which is the highest since the data go back to 2002, from a 2019 average of 18%. In addition, the share of homes sold between $300-500k has risen to 47% from 39% over the same period.

- Conversely, the share of homes sold below $300k reached a historic low of 27%, dropping from a 2019 average of 44%.

The path to normalize

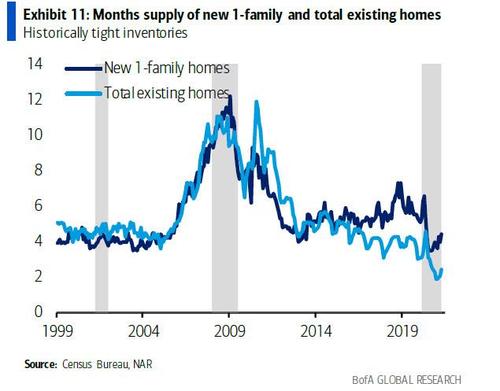

- The biggest challenge confronting the housing market is the lack of supply. Months supply of both new 1-family and total existing homes has dropped to historically low levels of 4.4 months and 2.4 months, respectively.

- Prior to the pandemic, demand in the new home market was more balanced around 5-6 months. That said, this stat doesn’t tell the whole story as builders primarily targeted the upper-end of the price spectrum during the last business cycle. On the aggregate, the last decade was a period of underbuilding.

- This put pressure on the existing home stock, with months supply generally trending lower and reaching historically tight levels of around 3 months even before COVID-19.

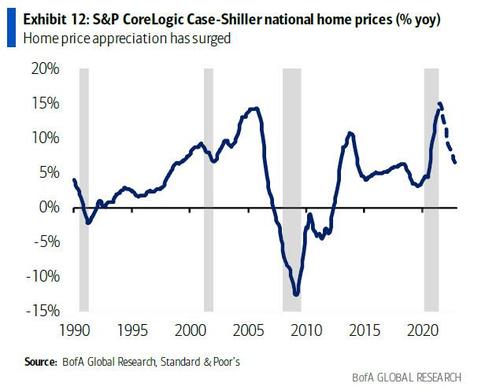

- The supply/demand imbalance has contributed to a rapid rise in home prices, with home price appreciation (HPA) reaching 13.2% yoy in March according to the S&P CoreLogic Case-Shiller index.

- The current trajectory is likely unsustainable as higher prices weigh on affordability and therefore housing demand. We also expect housing starts to drive up inventory. We look for HPA to end this year at 12% yoy and next year at a still-elevated 6% yoy. Looking ahead, home price appreciation should set back to a lower trend, more consistent with the growth in income.

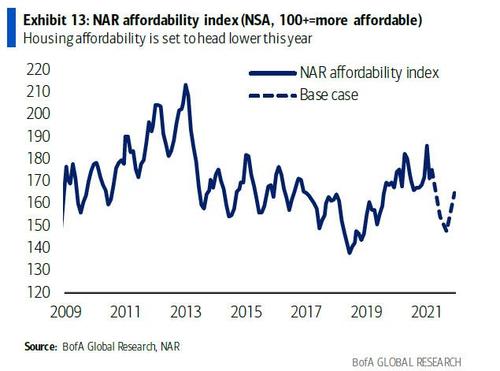

- Reflecting the pressure from home price gains, we expect the NAR affordability index to slide this year. The boosts to household income from recent stimulus have provided a positive offset to affordability over the past year as home prices have surged, but will no longer be a factor.

- Higher rates will be an additional headwind to affordability. As discussed earlier, our rates strategy team expects the 10y Treasury benchmark to reach 2.15% by 1Q 2022, which suggests roughly a 55bp increase.

- The decline in affordability should lead to a moderation in existing home sales.

Tyler Durden

Wed, 06/23/2021 – 18:40![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com