Below The Market’s Calm Surface, Sheer Panic As Skew Soars To All Time High

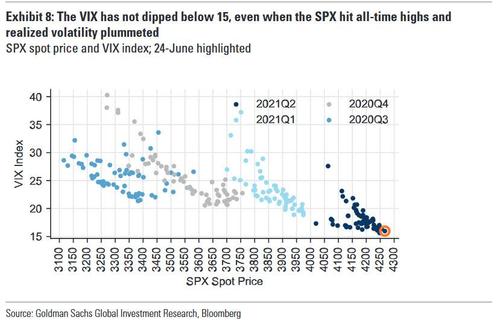

With last week’s post-Fed tantrum seemingly a distant memory, spoos just hit a new all time high at 4,275 as low realized volatility helped push the VIX near new Covid-era lows…

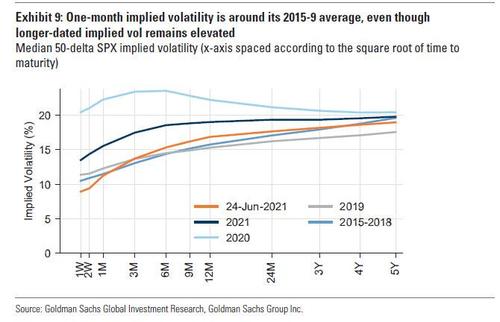

… if not the lowest level. Indeed, with the VIX at 16.0, and volatility risk premium elevated, Goldman notes that short-dated hedges are not cheap – especially relative to historically low implied volatility for other key markets (1M SPX implied vol is 43rd percentile vs. the last 5 years, vs. HYG, EEM, and HSCEI all below 15th percentile). As a result, Goldman also sees “heightened potential for realized volatility to approach June’s lows, leaving the VIX with moderate downside.”

The reason why VIX has so far failed to hit new lows despite , as Goldman’s Rocky Fishman explains, is because the skew index just hit a new all time high: this means that put options have been unusually expensive relative to at-the-money options, helping support the put-heavy VIX index. High skew, which compares put option prices with at-the-money option prices, has reached new all-time high, and reflects investor perception that high volatility would return should markets sell off.

In other words, while traders seem complacent, they have never been more nervous that even a modest wobble in the market could starts a crash. By extension, they have also never been more protected against a full-blown market crash.

So while the market appears to have internalized the FOMC surprise rather quickly so far, Goldman cautions that the sharp reaction to last week’s Fed meeting “points toward more economic data sensitivity ahead.” While index-level volatility did not initially react to last week’s hawkish surprise from the FOMC, in part because of low intra-SPX correlation, but then volatility picked up in the subsequent days. A parallel shift downward in the VIX futures curve implies that markets see last week as reducing late 2021 volatility.

In Goldman’s view, though, sensitivity to economic data will only increase once the current “transitory” period ends, which is why the bank recommends longer-dated hedges to shorter-dated ones. Heightened rates volatility, including 3M10Y US swaption vol in its 72nd percentile vs. the last 5 years, “supports the notion that markets will be increasingly sensitive to economic data” according to Goldman’s Fishman.

The bottom line, according to Goldman, “high skew, vol-of-vol, and VIX-spot beta all point toward market expectations that equity downside would bring much higher volatility.”

As Fishman elaborates, SPX implied volatility skew is at or near records for shorter-dated tenors, with put-vs-ATM skew especially strong. And while high skew does not have to mean that put prices are high, “the combination of high volatility risk premium and high skew does point to expensive puts.”

Putting it all together, Goldman summarizes that the current level of skew reflects views that:

- should the market sell off, it would do so in a volatile way;

- there is unfavorable asymmetry in potential returns; and

- stocks would become increasingly correlated with each other in a sell-off.

In short, “high recent volatility-spot beta and an elevated VVIX (vol-of-VIX) index both support the potential for a return to high volatility in a sell-off” or in other words, stocks may be at a record high, but they have also never been more fragile and more sensitive to even a modest drop.

Tyler Durden

Fri, 06/25/2021 – 15:45![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com