Blackstone Doubles Down On Las Vegas Bet By Buying Vdara & Aria Properties

As a record-breaking heatwave finally recedes, private equity giant Blackstone is adding to its already-considerable real-estate holdings in Las Vegas.

Bloomberg reported Thursday morning that Blackstone-managed funds would acquire MGM Resorts’ (not to be confused with the MGM movie studio that Amazon is trying to acquire) Aria and Vdara properties for $3.39 billion in cash.

Following the acquisition, both properties will be leased back to MGM Resorts for initial annual rent of $215MM. Blackstone will own the properties, but management and operations will remain in the hands of MGM. The 10-figure windfall will provide an advantageous cash-cushion to the company, which was forced to make dramatic cuts and layoffs in order to survive the pandemic.

“We expect to continue executing on our asset-light strategy and utilizing the proceeds from our real estate transactions to enhance our financial flexibility and secure new growth opportunities,” said Bill Hornbuckle, CEO and president of MGM Resorts.

Meanwhile, more than half of the money from the Blackstone deal will immediately be spent on buying the remaining 50% stake in the CityCenter from Infinity World Development for $2.125 billion. The deals are expected to close in Q3, and the closing of the CityCenter deal isn’t contingent on the successful completion of the sale to Blackstone. MGM’s purchase of the stake in CityCenter represents an implied valuation of $5.8 billion based on net debt of $1.5 billion, after giving effect to the recently closed sale of a two-acre parcel

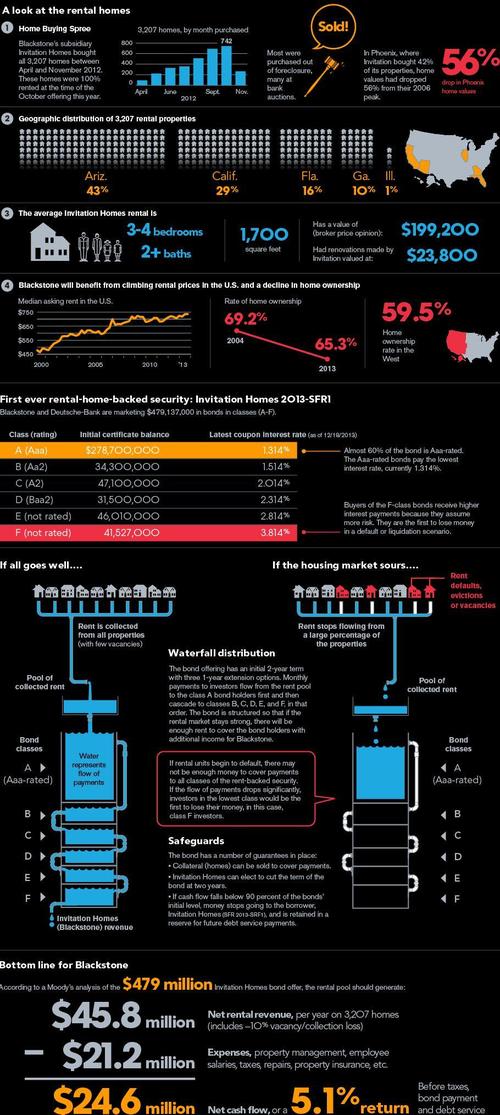

Blackstone has been facing public criticism over the firm’s aggressive investment in residential real-estate across the US that have bolstered its status as America’s largest landlord.

The PE firm has been ravenously gobbling up property – both commercial and residential – for years now. But only recently did criticism of its efforts (which we have been reporting on for years) become a bipartisan issue, as JB Vance, the “Hillbilly Elegy” author and Senate candidate, slammed BlackRock and other Wall Street firms for buying up homes.

During the first quarter of 2021, Blackstone dumped billions into bets on the post-COVID travel and tourism turnaround (which, as we noted earlier, is in danger of being delayed by the rise of media fearmongering about the “Delta” variant) buying hotels and investing in private-jet operators and other travel-linked businesses).

Tyler Durden

Thu, 07/01/2021 – 09:45![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com