Weibo Soars On Report Chairman Seeks To LBO China’s Twitter For Up To $100/Share

With Didi shares crashing as much as 25% in U.S. pre-market trade on Tuesday..

… ahead of its first session since Chinese regulators ordered the company’s app be taken down days after its $4.4 billion IPO, having become the latest stock to suffer the wrath of Beijing for daring to fly too close to the sun following well-known crackdowns against Jack Ma’s fintech empire, is China’s infatuation with public capital markets over?

That would be one conclusion from the just released Reuters report that Weibo chairman Charles Chao and a state investor are in talks to take the Chinese microblogging giant and twitter-equivalent private in a deal which would value the firm at at least $20 billion and facilitate major shareholder Alibaba Group exit.

Citing two sources, Reuters reported that Chao, whose holding company New Wave is the largest shareholder of Weibo, is teaming up with a Shanghai-based state firm to form a consortium for the deal. The identity of the state firm could not immediately be determined. New Wave held a 45% stake in Weibo as of February valued at $5.6 billion as per the stock’s Friday price, followed by Alibaba (9988.HK) with 30% worth $3.7 billion, according to the company’s 2020 annual report.

According to Reuters, the consortium looks to offer about $90-$100 per share to take Weibo private, two of the sources told Reuters, representing a premium of 80%-100% to the share’s $50 average price over the past month.

As Reuters notes, privatizing China’s largest microblogging platform would pave the way for second largest shareholder and top customer Alibaba to sell out, disposing of one of its key media assets, the sources noted. More importantly, it would mark a significant reversal in sentiment, one where instead of entering capital markets, local tech giants – faced with Beijing’s fury – are instead seeking to cash out.

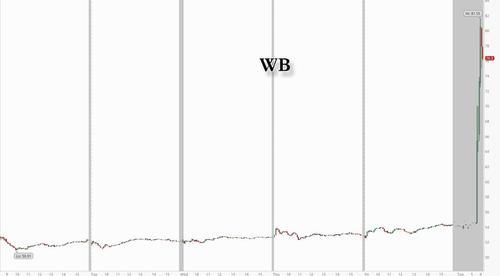

Weibo stock surged 40% in premarket trading, last seen just over $77, although if the report is accurate, there is a way to go until the $90-$100 price is reached.

The Weibo news comes just minutes after we learned that China pledged to further increase scrutiny of data practices at listed companies, firing another warning shot at the country’s technology giants just days after announcing a cybersecurity probe of Didi Global Inc.

The State Council said in a statement Tuesday it will crack down on securities violations, and increase supervision of Chinese companies listed overseas. It also said it will revise rules for overseas listings, without elaborating. The warning comes after the Cyberspace Administration of China said it found serious violations in Didi’s collection and usage of personal information, without giving details. The probe into China’s ride-hailing leader stunned investors and industry executives, hammering the Hong Kong shares of peers from Tencent Holdings Ltd. — one of Didi’s largest backers — to Alibaba Group Holding Ltd. and Meituan.

Tyler Durden

Tue, 07/06/2021 – 08:13![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com