In Shocking Overhaul China Bans For-Profit Tutoring, Wiping Out Billions In Value

Call it the end of “capitalism with Chinese characteristics” and the beginning of “socialism with socialist characteristics.”

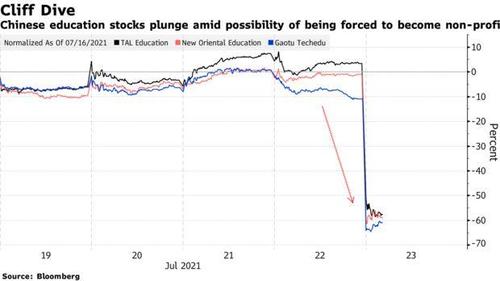

One day after Chinese tutoring and techedu stocks cratered the most in history after a report that China was seeking to ban for-profit school tutoring companies in a sweeping overhaul of the education sector, Beijing has done just that and on Saturday China unveiled an unprecedented crackdown on its $100 billion education tech sector, banning companies that teach the school curriculum from making profits, raising capital or going public.

The reason: as we explained yesterday, Beijing is scapegoating the sector for its own failure to reverse the ongoing shrinkage of China’s population, and is blaming declining birth rates on “financial burdens from raising a child” as a result of surging tutoring costs. Apparently it never occurred to Beijing that the local housing bubble for example – the biggest in Chinese history – may have a far greater role in making “discretionary” spending – such as more children for example – impossible as the simplest of staples cost an arm and a kidney and apparently a second (and first) child. But of course, Xi would have to take the blame for that particular bubble; in the case of rampant tutoring costs, it’s easier just to blame someone else.

And that’s precisely what Beijing is doing with the following list of new regulations on the education sector:

-

Companies and institutions that teach the school curriculum must go non-profit

-

Such institutions cannot pursue IPOs, or take foreign capital

-

Listed companies will be prohibited from issuing stock or raising money in capital markets to invest in school-subject tutoring institutions, or acquiring their assets via stock or cash

-

Foreign firms are banned from acquiring or holding shares in school curriculum tutoring institutions, or using VIEs (variable interest entities) to do so. Those already in violation need to rectify the situation

-

All vacation and holiday cirriculum tutoring is off-limits

-

Online tutoring and school-curriculum teaching for kids below six years of age is forbidden

-

Agencies cannot teach foreign curriculums

The unprecedented regulatory overhaul published on Saturday, threatens to up-end the sector and jeopardize billions of dollars in foreign investment. As previewed yesterday, tutoring companies that teach school subjects can no longer accept overseas investment, which could include capital from the offshore registered entities of Chinese firms; Companies in violation of that rule must take steps to rectify the situation, the country’s most powerful administrative authority said, without elaborating.

Additionally, public tutoring companies will no longer be allowed to raise capital via stock markets to invest in businesses that teach classroom subjects, while outright acquisitions are forbidden; all vacation and weekend tutoring related to the school syllabus is now off-limits. Finally, online tutoring agencies will also be forbidden from accepting pupils under the age of six. To make up for the shortfall, China will improve the quality of state-run online education services and make them free of charge, the State Council said, a good reminder that China is and always will be first and foremost a despotic, communist regime.

“All regions can no longer approve new subject-based off-campus training institutions for students in the compulsory education stage, and existing subject-based training institutions are uniformly registered as non-profit institutions,” according to the State Council notice.

As discussed yesterday, the regulations will wipe out the outsized growth that made stock market darlings of TAL Education Group, New Oriental Education & Technology Group and Gaotu Techedu, while also putting the Chinese techedu largely out of reach of global investors. Education technology had emerged as one of the hottest investment plays in China in recent years, attracting billions from the likes of Tiger Global Management, Temasek Holdings Pte and SoftBank Group.

As a reminder, one of Archegos’ largest massively levered positions – courtesy of the Credit Suisse prime brokerage – was Gaotu, formerly GSX Techedu.

Indeed, during the total return swamp ramp up of a handful of China tech names by Archegos boss Bill Hwang, GOTU hit a record price of just over $142. It closed at $3.52 on Friday.

It’s a stunning reversal of fortune for an industry that once boasted some of the fastest growth rates in the country. Alibaba, Tencent Holdings Ltd. and ByteDance Ltd. were among the big names that have invested in a sector that had been expected to generate 491 billion yuan ($76 billion) in revenue by 2024. Those lofty expectations groomed a generation of giant startups like Yuanfudao and Zuoyebang. Online education platforms attracted about 103 billion yuan of capital in 2020 alone, according to iResearch.

China’s action – which in recent weeks has intervened aggressively in the market wiping out over $1 trillion in the market cap of former investor darlings – mirrors Beijing’s broader campaign against the growing influence of Chinese internet companies from Didi to Alibaba Group.

As Bloomberg puts it, China’s crackdown “stems from a deeper backlash against the industry, as excessive tutoring torments youths, burdens parents with excessive fees and exacerbates inequalities in society.” So instead of burdening their parents, Beijing would rather just have a generation of generally dumber kids.

The out-of-school education industry has been “severely hijacked by capital,” according to a separate article posted on the site of the Ministry of Education. “That broke the nature of education as welfare.”

But at its core, the crackdown is meant to distract from one of Beijing’s main demographic failures this decade: to boost China’s growth rate: as Bloomberg explains, “once regarded as a sure-fire way for aspiring children (and parents) to get ahead, after-school tutoring is now viewed as an impediment to one of Xi Jinping’s top priorities: boosting a declining birth rate.”

The rules unveiled Saturday were devised and overseen by a dedicated branch set up just last month to regulate the industry, and were couched in general terms that could be applied broadly to common practices throughout the industry. The new regulations are focused on compulsory subjects, meaning critical material like math, science and history. Classes for art or music mostly would not fall under the new restrictions.

As one would expect with any regulatory overhaul of China, there was a distinct nationalist flavor to the new rules: among other things, they also ban the teaching of foreign curriculums, tighten scrutiny over the import of textbooks and forbid the hiring of foreign teachers outside of China — a curb that could have severe consequences for startups like VIPKid that specialize in overseas tutors. The government also ordered local authorities to tighten approvals for companies providing training on extra-curriculum subjects.

In any case, it’s ultimately unclear how the government clampdown will turn out – according to Bloomberg, many believe Beijing won’t seek to annihilate an industry that still plays an essential role in grooming its future workforce. Doing away with tutoring entirely will likely lead to some additional funds being saved away by nervous parents but that money will then quickly be sunk into China’s gaping housing bubble. Meanwhile, an entire generation of kids will grow up much dumber.

As for investors, they will choose to err on the side of caution. The government’s desire to assert control over the economy and one of its most valuable resources lies at the heart of recent regulatory clampdowns on online industries. Companies that operate as internet platforms have come increasingly under scrutiny because of the reams of data they collect, stirring government concern over issues of privacy and security. It all comes as Beijing is trying to roll out the digital yuan in an attempt to micromanage every aspect of the economy. And the reason why Beijing has been in a terrible mood lately is because said eCNY rollout has been disastrous so far, with lack of popular interest making China’s biggest monetary overhaul in centuries into one giant flop.

Tyler Durden

Sat, 07/24/2021 – 13:00![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com