Chinese Massacre Spreads To Bonds, FX Amid Rumors Of Foreign Liquidations

The rout in Chinese shares, which has demolished the country’s tech giants following Beijing’s regulatory crackdown on various sectors, extended into the bond and currency markets Tuesday amid unverified rumors swirled that U.S. funds are offloading China and Hong Kong assets.

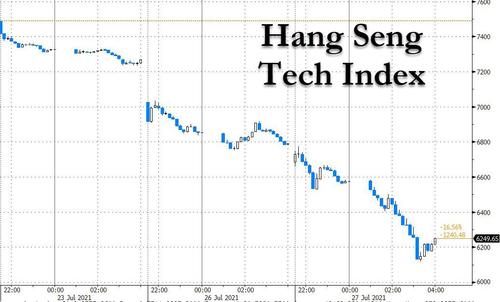

The speculation, first reported by Bloomberg, included talk that the U.S. may restrict investments in China and Hong Kong, circulated among traders in late afternoon in Asia, spurring a renewed bout of selling which sent Hong Kong’s Hang Seng Tech Index, a gauge of many Hong Kong-listed Chinese stocks, crashing as much as 10% to its lowest level since inception…

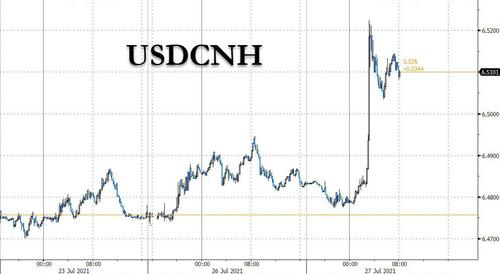

… while the offshore yuan slid to its weakest since April against the dollar, dropping as much as 0.6% to 6.52 per dollar and one-month volatility in the currency pair posted the biggest jump since May…

… and even Chinese bonds were dumped, with the yield on China’s most actively traded 10-year government notes rising seven basis points to 2.94%, the most in a year.

The liquidation spree spread into the offshore Chinese credit market as well, with high-yield notes down as much as 5 cents on the dollar, while investment-grade bond spreads widened by another 10 to 15 basis points, following the latest plunge in China’s Evergrande which overnight announced it would be scrapping its special dividend which artificially propped up its battered stock.

As Bloomberg notes, the drastic moves underscore how fragile investor confidence has become after a monthslong regulatory onslaught by Beijing that appears to be getting worse by day. Traders fear the latest crackdown on the nation’s education, food delivery and property sectors could expand to other industries such as health care, as China looks to tighten its grip on Big Tech and reduce the wealth gap.

“The spread of declines from the Chinese equities space into the yuan signals that the concerns over regulatory risk in China might have taken a turn for the worst,” said Terence Wu, foreign-exchange strategist at Oversea-Chinese Banking Corp. in Singapore.

As investors liquidated Chinese assets with the bathwater, treasuries rose with the traditional safehavens such as the dollar and the yen.

The liquidation firestorm, sparked by a rumor, was of the kind where traders sell first and ask questions later: “Although we can’t verify if it’s true or not, the market fears that foreign capital will flow out from the Chinese stock market and bond market on a large scale, so sentiment is badly hurt,” Li Kunkun, a trader from Guoyuan Securities Co. said of the speculation.

“The key concern now is whether regulators will do more and expand the crackdown to other sectors,” said Daniel So, strategist at CMB International Securities Ltd. “The regulatory concerns will be the key overhang to the market for the second half.” He added that it was too soon in his opinion for investors to “bottom fish.”

Amid the rout, technology and education shares were hammered hardest, while property stocks also fell on Tuesday. Tencent Holdings Ltd. slumped 9%, most in about a decade, after the company’s music arm gave up exclusive streaming rights and was hit with fines.

Its WeChat social media platform has stopped taking new users as it undergoes “security technical upgrade” in accordance with relevant laws and regulations. Meituan fell as much as 18%, its biggest decline ever, as investors digested new rules on online food platforms.

Tuesday’s rout followed the “panic selling” on Monday which followed the shocking news from Chinese regulators on Saturday revealing that will fundamentally alter the business model of private firms teaching the school curriculum. Hong Kong’s major retail brokers lowered margin financing for battered Chinese education stocks as investors suffered steep losses.

“There is no anchor for us to justify the stock valuations now given the regulation uncertainties,” said Dai Ming, a Shanghai-based fund manager at Huichen Asset Management. “In the past, the market was expecting normal regulations on certain sectors, but now it looks like the government can even tolerate killing a whole industry or some leading companies when it’s needed.”

Tyler Durden

Tue, 07/27/2021 – 08:44![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com