Dip-Buying Retail Army Plows Into Chinese Stocks Just As Plunge-Protectors Arrive

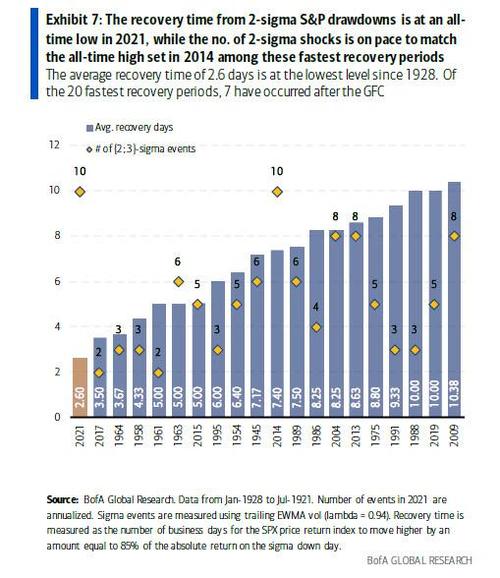

Just yesterday we presented readers with a new analysis from Bank of America, according to which the ferocious speed of dip buying had reached a new record and it now takes just 2.6 days for the S&P500 to recover from a 2-sigma decline (i.e., a sharp selloff), the fastest recovery since 1928.

In a testament to how little fear retail and institutional traders have of any prolonged drop in stocks – courtesy of activist central bankers and overzealous plunge protection teams – the already-record BTFD speed has been accelerating lately: two weeks ago, it took the S&P one day to recover from such a so-called two-sigma event. In another instance on Tuesday, the index fell more than 1.1% at one point but finished the session with a loss of less than 0.5%. A rebound of that magnitude from similar declines has happened only three other times this year, data compiled by Bloomberg show.

And sure enough, in this most recent example of the power of the only strategy that matters in this market, the BTFD crew was on deck and scrambling to buy stocks yesterday after the ongoing Chinese market turmoil led to a modest decline in US markets on Tuesday, when according to Vanda Research, retail investors plowed almost $1.7 billion into the market.

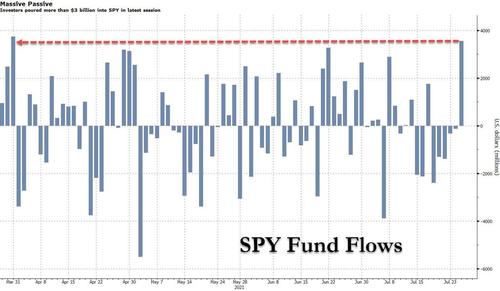

But unlike their usual fare of meme stocks, this time the Robinhood-powered cohort sunk their millions into exchange-traded funds, including technology stocks according to Bloomberg, which notes that the world’s largest ETF, the $383 billion SPY, posted the biggest inflow since March on Tuesday, adding $3.55 billion the most since March …

… while the Nasdaq-tracking QQQ received $474 million, bringing the four-day tally to more than $3.2 billion.

“As soon as U.S. equities dropped on Chinese contagion fears, the dip-buying army showed up again,” Ben Onatibia and Giacomo Pierantoni wrote in Vanda’s weekly note.

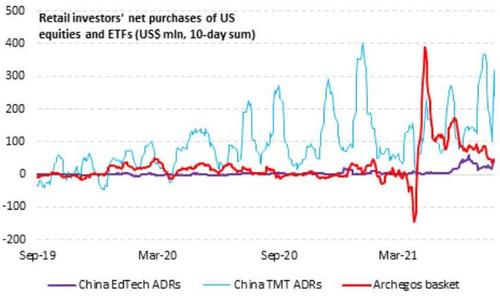

In addition to ETFs, retail investors also sought out beaten-up Chinese stocks, Vanda research shows. Three Chinese ADRs – NIO, XPeng and Alibaba – were among the most-purchased companies, according to the data provider which tracks order flows and traffic on trading platforms. Almost as if retail investors expected that China’s plunge protection team would arrive on the scene and restore order in China.

Well they were right, and on Wednesday, US-traded Chinese stocks rebounded sharply amid news that Beijing had convened banks to “restore calm after the market rout”: the Nasdaq Golden Dragon China Index rose as much as 6.6%, Alibaba gained 2.5%, JD.com rose 6.8%, Baidu was up 4.2%, Pinduoduo jumped 7.9% and Didi added 6.7%.

“Chinese ADRs are the latest example of how retail behavior has changed over the past four months,” Onatibia and Pierantoni wrote. “From driving triple digit returns in high multiple stocks, they have turned into dip buyers in underperforming ones.”

According to Vanda, there have been only a few cases this year when the retail crowd has moved in the same direction as equity prices: Meme stocks and space shares like Virgin Galactic Holdings.

And in what may come as good news for bitcoin bulls, in attempting to predict the next retail-driven melt-up, the Vanda strategist said cryptocurrencies “could enjoy a decent run.”

“The rebound in Bitcoin was most likely driven by a short squeeze,” they said. “We still haven’t seen a major increase in long positions but there are enough hints to suggest that retail investors are starting to pile in.”

Tyler Durden

Wed, 07/28/2021 – 10:20![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com