Great News For Cryptocurrencies: Senate Budget Deal Hinges On Billions In Crypto Taxes

First the bad news: as part of the Senate’s bipartisan infrastructure deal, lawmakers quietly snuck in a provision imposing stricter rules on cryptocurrency investors to collect more taxes to fund a portion of the $550 billion investment into transportation and electricity infrastructure. According to Bloomberg, the provisions would raise an additional $28 billion from cryptocurrency transactions, according to a summary of the plan.

As had been discussed previously, the proposal – now formalized – would impose more rules on crypto brokers to report transactions of digital assets, including virtual currencies, to the IRS, and would also require businesses to report crypto transactions of more than $10,000.

Senator Rob Portman noted that Congress has expressed concerns regarding crypto reporting and taxation requirements for some time: “Everybody’s been talking about the appropriate way to provide more reporting in particular and that leads to better compliance.”

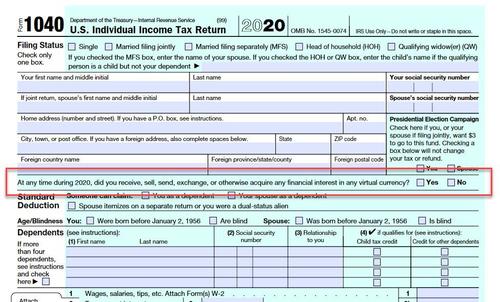

Naturally, this is nothing that crypto investors aren’t already mandated to do by the IRS anyway, as anyone who has filled out a 1040 form knows too well:

But when it comes to politics, even the patently obvious has to be explained, and in this case bitcoin – having long existed in regulatory no man’s land – is now set for its new role, as a “pay for” to fund the bipartisan deal. It’s why the measures was a last-minute additions to the infrastructure deal announced Wednesday after weeks of haggling between Republicans and Democrats over what spending to include in the deal and how to pay for it. Clearly, there was a roughly $30 billion hole, and the Senate decided to plug it with crypto taxes.

But not just crypto taxes: recurring crypto taxes.

And therein lies the rub, because now that the Senate has agreed to use bitcoin as a taxable piggybank to pay for billions in pork, it means that bitcoin isn’t going anywhere, and it certainly won’t be regulated out of existence which has long been one of the biggest existential risks facing the space.

The rest is just bureaucratic details: in May, the Treasury said that additional measures on crypto assets are necessary “to minimize the incentives and opportunity to shift income out of the new information reporting regime.” Cash transactions in excess of $10,000 are already subject to IRS reporting requirements. Meanwhile, as noted above, all bitcoin related income is already subject to ordinary income tax.

In other words, and this is the good news, nothing has actually changed when it comes to the tax treatment of bitcoin but what has changed is that by requiring the taxation of bitcoin as a core anchor of the bipartisan spending bill, we can now forget a worse case scenario that see regulators stomping away the nascent space. If anything, one can argue that in hopes of generating even more taxes in the future, Congress will not only facilitate transactions in cryptos, but will also make it easier for the broader public to generate profits, i.e. taxes.

Tyler Durden

Thu, 07/29/2021 – 11:45![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com