Ugly, Tailing 7Y Auction Pushes Yields Higher

After two solid auctions earlier this week ahead of the Fed which many rates experts predicted would tail (neither did), few were too concerned about today’s sale of $62BN in 7Y paper. Well, maybe they should have because while today’s auction was certainly better than the catastrophic, “failed” 7Y auction in February it was the ugliest in many months.

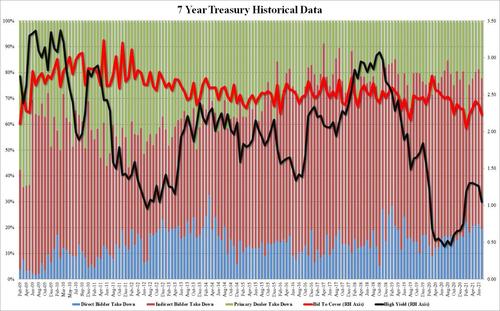

Stopping at a high yield of 1.050%, the auction priced well below last month’s 1.264%, however the tail of 1bps to the When Issued 1.040% was the biggest since March.

The Bid to Cover was also ugly and sliding to just 2.231, it was also the lowest since the 2.230 in March.

Finally, the internals were mediocre at best, with Indirects dropping to 58.4% from 60.0%, Directs sliding to 19.5% from 21.3%, the lowest since March, and Dealers left holding 22.2% of the takedown, the highest since April.

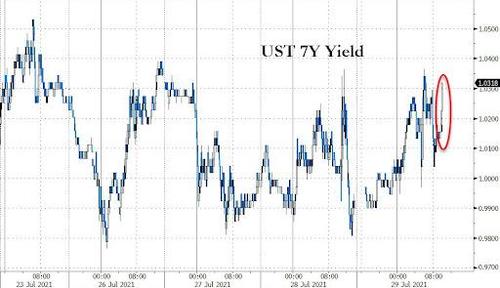

Overall, an ugly, tailing auction which was unexpected considering the generous concession as yields drifted higher all day. Alas, it was not enough, and the 10Y yields spiked briefly above 1.27% once the results were published as buyside sentiment is suddenly on the rocks following today’s massive Apple related rate locks.

Tyler Durden

Thu, 07/29/2021 – 13:12![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com