Fed On Verge Of Losing Control: 25% Of Consumers Expect Inflation In 3 Years To Explode To 8%

While central banks, tenured economists and the financial media are doing everything in their propaganda power to convince Americans that the current phase of hyperinflation is merely transitory (although it now appears that even the Fed is getting some doubts writing in its semi-annual monetary policy report that inflation is “more lasting but likely still temporary” until proven otherwise, of course), the shocking reality on the ground is that the Fed has effectively lost control over near-term inflation expectations, as the NY Fed’s own survey of consumer expectations reveals.

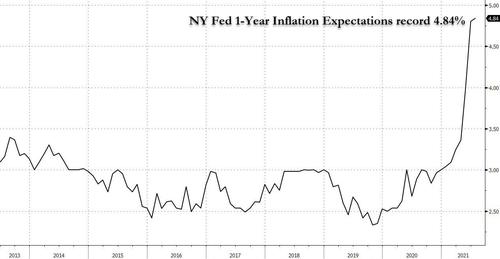

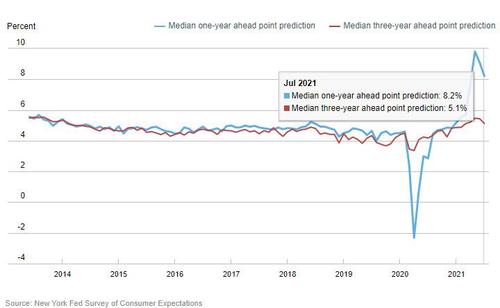

According to the latest, July, installment of this closely watched survey, consumer inflation expectations for one year ahead, hit a fresh all-time high for this series of 4.84% in June, rising from 4.80% in June which in turn posted the biggest increase on record, surging 0.8% from May’s 4.0%.

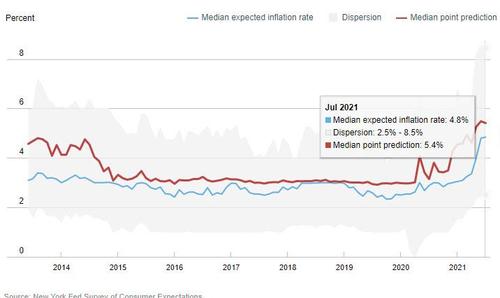

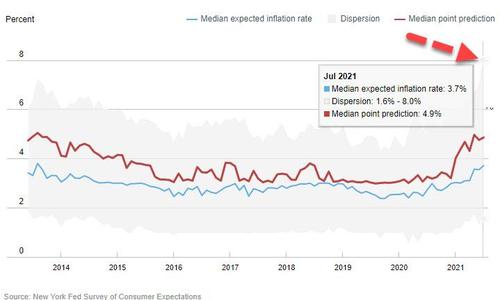

And in the clearest testament yet to just how close the Fed is to losing control over expectations, while the median 1 Year expected inflation rate was 4.8%, the upper end of the 25%/75% dispersion range was a mindblowing 8.5!

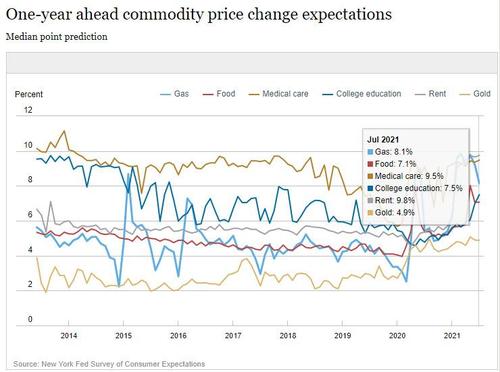

Looking at a breakdown of inflation expectations by commodity, the median one-year ahead expected change in the cost of college education increased to 7.5% from 7.0% in June, its highest reading since Jan 2018. In contrast, the median expected changes in the price of gasoline decreased to 8.1%, from 9.1% in June. The median expected change in the cost of medical care and rent remained unchanged at 9.4% and 9.7%; elsewhere medical costs are expected to rise 9.36%; and rent prices will rise 9.66%. Curiously, the price of gold is expected to jump 4.9% after being in the 2.3% range for much of the past decade.

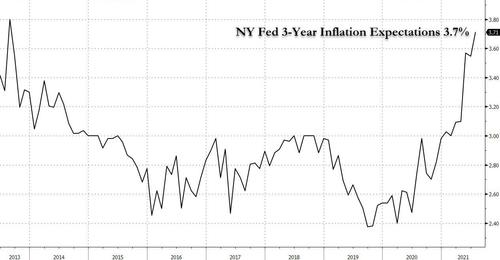

There was some hope that the US won’t end up as Weimar in the Fed’s median inflation expectations for the three-year horizon which remains below the 1-Year level, although there things are also startling to accelerate to the upside with the median expectation rising to.3.7% from 3.5%, the highest reading since August 2013!

As the NY Fed explains “our measures of disagreement across respondents (the difference between the 75th and 25th percentiles of inflation expectations) declined slightly at the one-year horizon but increased at the three-year horizon due to a strong increase in the 75th percentile. Both measures of short- and medium-term inflation disagreement remain elevated compared to their pre-COVID-19 levels.“

What does that mean? It means that while the median 3Y inflation expectation number was below the 1Y expectations, some 25% of respondents are expecting inflation in 3-Years to surge as high as 8.0% – the highest on record – and a number that is tantamount to non-transitory hyperinflation.

Finally, while many claim it’s not a housing bubble, the median expectation is that home prices will rise by 8.2% in 1 year and a sizable 5.1% in 3 years.

Some other observations from the report:

Inflation

Median year-ahead home price change expectations decreased to 6.0% from 6.2% in June. The decrease was driven mostly by respondents aged 40 or above, and was largest for those who live in the “West” and “Midwest” Census regions.

Expectations about year-ahead price changes were flat for food prices (at 7.1%), increased by 0.1 percentage point for rent (to 9.8%) and medical care (to 9.5%), and increased by 0.5 percentage point for the cost of a college education (to 7.5%). The median one-year-ahead expected change in the price of gas declined by 1.1 percentage points to 8.1%.

Labor Market

- Median one-year-ahead expected earnings growth rose 0.3 percentage point in July to 2.9%, its fourth consecutive increase and a new series high. The increase was driven mostly by respondents with no more than a high school degree and with annual household incomes under $50,000.

- Mean unemployment expectations—or the mean probability that the U.S. unemployment rate will be higher one year from now—increased by 1.0 percentage point to 31.7%.

- The mean perceived probability of losing one’s job in the next 12 months increased slightly from a series low of 10.9% in June to 12.2%, the series’ second lowest reading. The mean probability of leaving one’s job voluntarily in the next 12 months also increased to 19.7% from 18.6%.

- The mean perceived probability of finding a job (if one’s current job was lost) rose sharply to 57.0% from 54.2% in June, the fourth consecutive month-to-month increase and the highest level since February 2020. The increase was broad-based across income groups and most pronounced among respondents with no more than a high school degree.

Household Finance

- The median expected growth in household income decreased by 0.1 percentage point to 2.9% in July, but remains elevated at pre-pandemic levels seen during late 2018 and early 2019.

- Median household spending growth expectations retreated slightly from a series high of 5.2% reached in June to 5.1% in July.

- Expectations about future credit availability improved slightly, with more respondents in July expecting it will be easier to obtain credit in the year ahead.

- The average perceived probability of missing a minimum debt payment over the next three months increased by 0.8 percentage point, to 10.4%, which is slightly above the 12-month trailing average of 10.0%. The increase was broad based across age and education groups.

- The median expectation regarding a year-ahead change in taxes (at current income level) was unchanged at 4.6%.

- Median year-ahead expected growth in government debt increased to 15.7%, from 15.0% in June.

- The mean perceived probability that the average interest rate on saving accounts will be higher 12 months from now decreased to 27.0%, from 29.9% in June.

- Perceptions about households’ current financial situations compared to a year ago deteriorated slightly in July, with more respondents reporting being financially worse off than they were a year ago. Respondents were also more pessimistic about their households’ financial situations in the year ahead, with fewer respondents expecting their financial situation to improve a year from now.

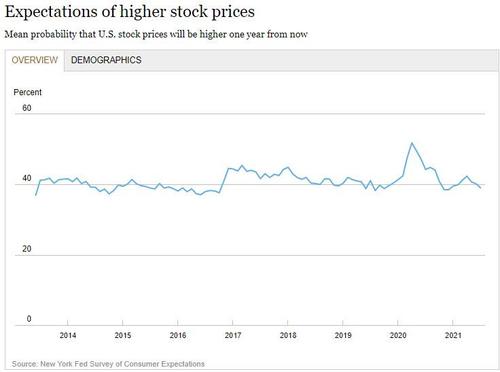

Finally, one for the market, where the mean perceived probability that U.S. stock prices will be higher 12 months from now decreased by 1.2 percentage points, to 39.0%.

Source: NY Fed

Tyler Durden

Mon, 08/09/2021 – 12:45![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com