Rabobank: The World’s Biggest Oil Consumer Showed Its Political Vulnerability To Higher Oil Prices And Skyrocketing Inflation

By Ryan Fitzmaurice of Rabobank

Summary

- The White House released a statement on Wednesday pleading with OPEC+ to increase oil production to stem off inflationary pressures from higher domestic gasoline prices

- The world’s biggest oil consumer showed its political vulnerability to higher oil prices this week and more specifically skyrocketing consumer inflation

- The push for “green” energy is also putting upward pressure on commodity price inflation

Oil markets started off the week under pressure as continued speculative “long” liquidation amid delta variant demand concerns weighed on prices. However, in an ironic twist, the oil market got a boost from an unlikely source on Wednesday as the Biden administration announced it was pleading with OPEC+ members to increase oil production to stem inflationary pressures from rising domestic gasoline prices.

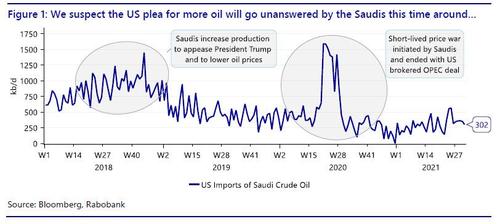

The White House announcement was naturally intended to pressure oil prices lower as has worked under past administrations but instead the opposite occurred as the oil market saw right through the veiled attempt (while spurring criticism from all sides including industry lobbyists, “climate scientists”, progressives and conservatives). For starters, OPEC+ and more importantly Saudi Arabia, are unlikely to answer Biden’s calls for more crude oil as they already have a fully agreed to plan in place. Further to that end, the US/Saudi relationship is quite strained as the Biden administration has pivoted towards Iran as it anxiously looks to re-enter the Iran nuclear deal, but so far with little success. As such, the oil market rightly interpreted the desperate plea as coming from a place of weakness and not strength which led to strong gains in the notoriously unforgiving financial oil markets on Wednesday.

Adding to the irony, oil prices had actually been trending lower prior to the announcement but consequently found a new source of strength as the world’s biggest oil consumer showed its political vulnerability to higher oil prices and more specifically skyrocketing consumer inflation. In addition to shifting the short-term oil momentum back to the upside, the plea to OPEC+ also enraged oil producers in the US and Canada given there is plenty of capacity available in North America that can be called upon rather than increasing dependency on Middle East oil. Furthermore, not only was this North American oil not called upon, but it has also been intentionally stifled by the Biden administration by cancelling the Keystone XL pipeline and vowing to ban drilling on federal lands, to name a few.

The “green” energy conundrum

In addition to angering North American oil producers, the plea for more OPEC+ oil is also not sitting well with the “green” energy enthusiasts that make up a meaningful percentage of Biden’s base. This outrage should come as no surprise as increased oil production undermines the push to decarbonize economies and reduces the incentive to shift away from fossil fuels and towards electric vehicles, a key part of the current administration’s agenda.

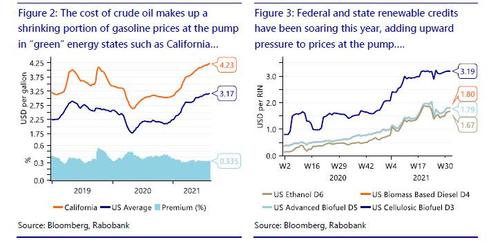

Perhaps more importantly though, the plea to OPEC+ to lower US gasoline prices shines a bright light on the cost of going “green” which can be quite expensive it turns out (as discussed here back in June in “Why One Bank Thinks ESG Could Trigger Hyperinflation“). After all, the cost of crude oil makes up a shrinking portion of retail prices at the pump in states such as California, the US leader when it comes to decarbonisation and “green” policies.

As you can see in Figure 2 below, the average cost of regular gasoline is significantly more expensive than the national average. In fact, looking at the most recent price of $4.35 per gallon in California, that equates to a cost of $183 per barrel, or more than 2.5x the cost of Brent crude oil. So why the huge mark-up in retail gasoline prices?

For starters, California requires a very strict and specific grade of gasoline known as CARBOB, that has tighter specifications than the rest of the US meant to address air quality issues in the state. This reduces the gasoline supply pool for California as not all refiners can produce the specifications while also increasing the cost of production for refiners. In addition to tighter specs, federal and state renewable credits have been soaring this year, adding even more upwards pressure to prices at the pump as a large portion of these costs are passed on to the consumer.

Perhaps more importantly, the huge run-up in renewable credits has US oil refiners shutting crude oil capacity in favor of renewable fuels production. As a result, the US has less operable refining capacity than it did prior to the pandemic, but the renewable facilities are still under construction. As such, the refined products are experiencing supply tightness and upward pressure on prices.

Looking Forward

Looking forward, the oil market is heading into next week with a mixed technical picture. On the bullish side of things, the spot Brent contract recaptured the psychologically important $70/bbl level on the upside this week, but on the other hand, the market remains below its 20-day moving average. Looking at the big picture though, inflation remains a key concern for consumers, politicians, and investors alike.

This dynamic was on full display this week as the Biden administration’s pleaded for OPEC+ to pump more oil and reduce gasoline prices. As we explained though, we do not expect OPEC+ to change course on its already agreed to production increases and, as such, we expect oil prices will likely stay high and US balances will remain tight. Furthermore, this dynamic could work to reignite inflation-driven commodity index flows from large asset managers that have been so important to the oil market this year.

Tyler Durden

Sat, 08/14/2021 – 20:30![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com