US Housing Starts Plunge In July

Following the plunge in homebuilder sentiment (beginning to catch down to homebuyer sentiment) and the disappointment in home sales, analysts oddly expected mixed data with Starts falling but forward-looking permits rising modestly. They underestimated both…

After Housing Starts unexpectedly surged in June, July saw starts collapse, down 7.0% MoM (vs -2.6% expected). Building Permits went the other way, rising 2.6% MoM, better than the +1.0% expected (this is the first MoM rise in permits since March)…

Source: Bloomberg

Total Permits and Starts are back at pre-COVID levels…

Source: Bloomberg

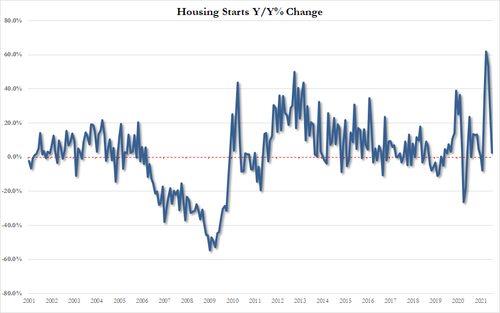

The base effect from last year’s brief collapse is now over and Housing Starts YoY have normalized…

Source: Bloomberg

The plunge in Starts was dominated by multi-family units:

-

single family units down 4.5%

-

multifamily units down -13.6%

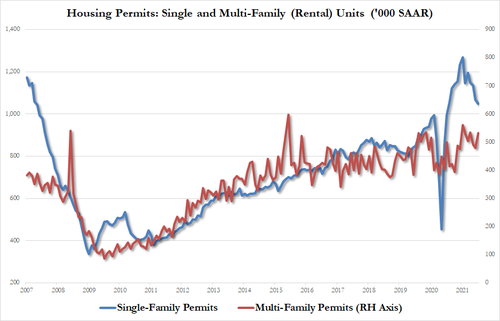

And on the Permits side, the picture was entirely different with multi-family rebounding as single-family permits continue to slide…

-

Singlefamily units -1.7%

-

Multifamily units +12.2%

And so with home prices at record-er and record-er high prices, thanks in large part to Wall Street’s domination of the bid, we wonder just what damage The Fed can do to this nascent bubble next?

Tyler Durden

Wed, 08/18/2021 – 08:38![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com