One Bank’s Non-Transitory Inflation Meter Just Hit A New Record High

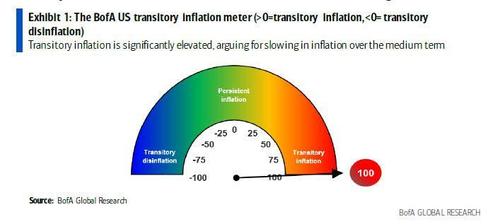

Two months ago we reported that Bank of America had released a new proprietary indicator tracking the level of transitory inflation, which incidentally was at the highest possible reading of 100.

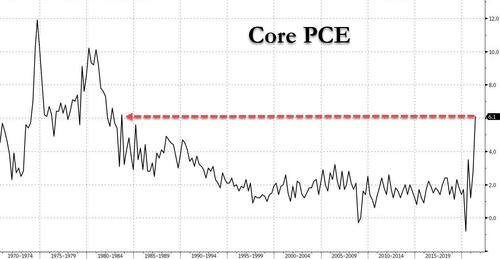

Of course, since then it’s only gotten worse and the core PCE report released earlier today revealed another explosion in all price pressures, not just transitory, rising to the highest level since 1983.

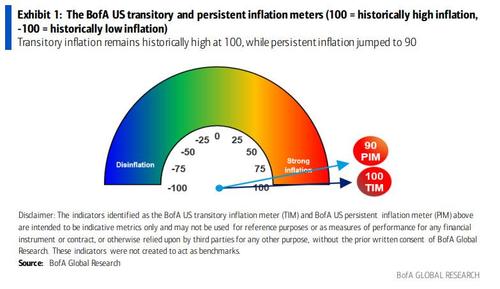

In other words, persistent (non-transitory) inflation is rising sharply as well. So to get a more complete picture of current inflation dynamics, last month BofA revised its transitory inflation meter with the BofA US Persistent Inflation Meter (PIM), and here, a “surprise”: it soared to 75 in June from 37 in May, indicating elevated persistent inflation.

Fast-forward to today when the latest BofA reading of both transitory and persistent inflation meters, showed what everyone already knew: both series hit record highs, with Transitory inflation at the highest possible reading of 100, while the sticky “Persistent” inflation rose from 75 to 90, which while also the highest on record, still has some more upside to go.

As BofA’s Alexander Lin explains, the July CPI report showed a cooling off in core inflation with core CPI rising a still elevated 0.3% (0.33% unrounded) mom. Transitory drivers of inflation ebbed as used cars slowed to a 0.2% mom clip and airline fares edged down -0.1% mom. That said, there was strength in new cars, up 1.7% mom, and lodging which spiked 6.0% mom. For more details, see Core CPI cools to 0.3% mom in July. And while transitory inflation cooled on a sequential basis, “it remains elevated on a % yoy basis.” As such, the BofA US transitory inflation meter (TIM) remained at 100 for the fourth consecutive month, signaling historically strong transitory inflation.

But the real story is that while transitory factors cooled in the July CPI report, stickier and more persistent components of inflation were solid.

Owners’ equivalent rent (OER) and medical care services both rose 0.3% mom, and rent of primary residence increased 0.2% mom. As a result, the BofA US persistent inflation meter (PIM) strengthened to 90 in July. In other words, both transitory and persistent inflation are running at historically elevated levels.

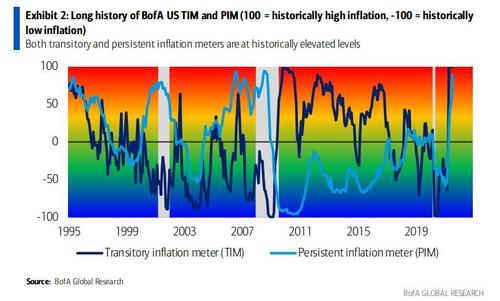

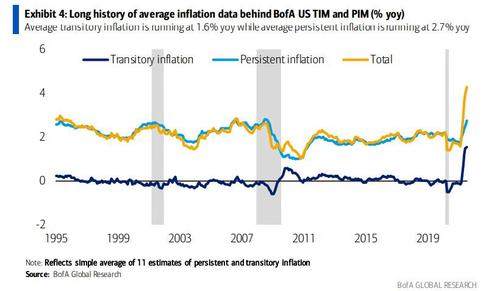

Finally, here is a longer chart history of average inflation data behind BofA US TIM and PIM. Both are at all time highs.

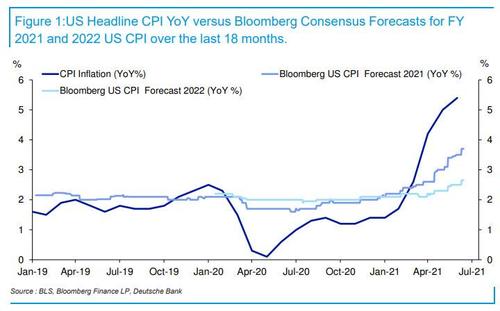

This confirms that contrary to its best wishes and naive expectations that inflation will somehow magically just go away in 2022, the Fed is already far behind the curve and has a major headache on its hands. Furthermore, as Deutsche Bank pointed out last month, Wall Street consensus inflation expectations for 2022 are already well above 2%, which is impossible if inflation is transitory and if there is going to be a deflationary phase after the current burst in transitory inflation ends.

In other words, the Fed is again wrong and sooner or later, 10Y yields which continue to pretend that everything is fine, will face a day of very painful reckoning.

Tyler Durden

Thu, 08/26/2021 – 11:41![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com