Chinese Coal Prices Soar To Record High Ahead Of Surge In Mining

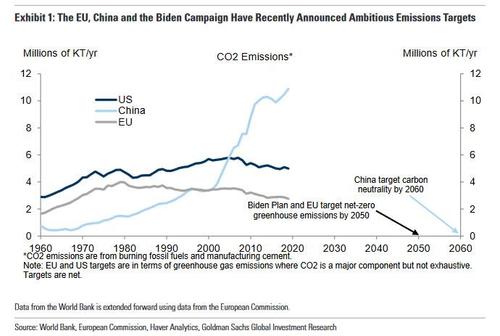

Remember when China vowed last year hit peak carbon emissions in 2030 and to reach carbon neutrality in 2060? Maybe it will (spoiler alert: it won’t)…

… but long before we hit 2060, China plans on taking coal-based pollution to the next level.

Overnight coal futures prices a hit record level and are almost +80% higher than a year ago, signalling a desperate need for China to increase domestic production in the short term, notwithstanding the government’s plan to reduce reliance on coal in the long term. As Reuters energy analyst John Kemp writes, “electricity consumption is surging and the country is struggling to import sufficient volumes of competitively priced spot LNG, boosting the need for coal for power generation.”

Prices for the most-traded thermal coal futures contract on the Zhengzhou Commodity Exchange hit $150 a tonne on Tuesday, up from $85 a year ago, which was also the five-year average before the COVID-19 pandemic.

At the same time, coking coal on the Dalian Commodity Exchange jumped 4.3% to $448 per ton – both rose to intraday records.

As Reuters notes, surging prices are an indication of the tension between the country’s surging electricity demand and the government’s stated aim to limit coal output and reduce it over time in favor of renewable energy sources.

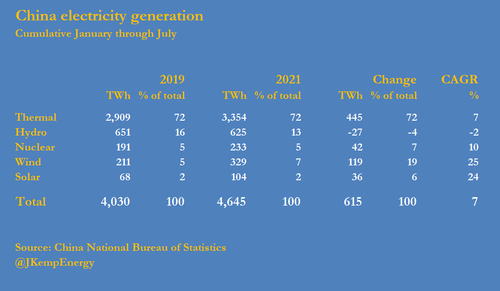

Coal production in the first seven months of the year was up at a compound annual rate of only 4.1% compared with the same period in 2019, according to the National Bureau of Statistics. But the country’s electricity generation increased at a compound annual rate of 7.4% over the same period in response to strong residential and industrial demand.

The fastest growth came from wind farms (+25% compound annual rate) and solar power (+24%), with slower growth from nuclear (+10%) and thermal generators (+7%) and a fall in hydroelectric output (-2%).

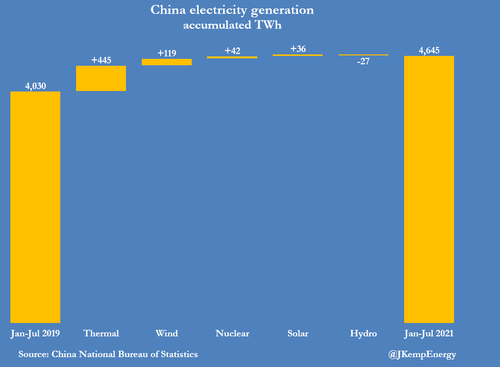

But both wind and solar are growing from a very low base so they have contributed only a small share of the extra generation required, with most of the extra generation coming from thermal sources, mainly coal.

In the first seven months of the year, China’s power producers generated 4,645 terawatt-hours (TWh), which was 615 more than in the same period in 2019.

But only a minority of the extra generation came from wind (+119 TWh) and solar (+36 TWh) sources, with most coming from thermal plants (+445 TWh).

While China is installing more wind and solar capacity than any other country, it is not enough to keep pace with surging electricity demand, forcing greater reliance on coal in the short term. As a result, the country is having to run new and existing thermal power plants for more hours; the average thermal generating unit ran for 2,589 hours in the first seven months of this year, up 268 hours (+12%) from the same period in 2020, according to data compiled by the China Electricity Council.

Reflecting the tightening coal supply situation, the National Development and Reform Commission (NDRC), the country’s top economic regulator, this summer called for more coal output to help to meet peak demand for air-conditioning.

“Key coal-producing regions such as Shanxi, Shaanxi and Mongolia should take the lead in … increasing production and supply,” the commission said in a circular issued on July 23.

The NDRC directed all areas and coal mining companies to boost output from larger and more productive mines, accelerating capacity replacement and new construction. It also ordered them to make the production of thermal coal their top priority and do everything possible to help power plants with low stocks to increase their number of days of coal storage, meaning that a deluge of domestic coal production is coming.

Indeed, Daiwa reported that thermal coal stockpiles at the port city Qinhuangdao located in the northern Hebei region, recorded a 12% decline for the week of Sept. 3 to less than 4 million tons. Chan said stockpiles of coking coal dropped 11% from last year. With coal imports sliding, China has just one option left: crank up its domestic coal-mining industry to 11.

Commenting on the soaring prices, Bloomberg echoed Reuters’ observations that the ability to source coal has been challenging due to stricter safety policies imposed by the government following a series of deadly mine accidents. There have also been new measures to prevent mine flooding, which is also dwindling supplies.

“Under current high prices, miners have been incentivized to boost production. This poses higher risk of accidents, which in turn leads to more frequent examinations,” Morgan Stanley analyst Sara Chan said in a report. “Coal production is constrained as a result and this creates a circular loop for even higher prices.”

The circular loop may persist for now, but it’s only a matter of time before China ramps up production as the alternative is an unacceptable surge in prices. This means much more pollution emerging from China in the coming year; this is happening as 23 of the world’s 25 most polluting cities are already in China.

Like other countries in Asia and Europe, China’s coal shortages and surging prices reflect the contradiction between the long-term need to move away from coal and the short-term challenge of meeting power demand. In the short term, higher coal prices are signalling the need to boost production to meet power producers’ needs and build sufficient stocks ahead of the winter heating season.

Meanwhile, demonstrating just how much of a straw man China’s promises to clean up its act truly are, also on Tuesday China’s carbon price slumped to a new low even as trading volumes increased. Emission allowances traded on China’s carbon market, the largest in the world, declined -0.2% Tuesday to close at 43.90 yuan ($6.80) a metric ton, the National Carbon Emissions Trading Agency said in a statement. Price is lowest since the market launched in July, with allowances closing Monday at 44 yuan a ton, signifying that virtually nobody on the mainland is actually serious about reducing the intensity of emissions generation.

Meanwhile, with everyone across the Pacific thinking coal is trash, perhaps there is some material upside opportunity as coal prices rise. Take a look at the Dow Jones U.S. Coal Index has been basing since March.

Is the index ready for an upswing on higher prices? And while we wait, we eagerly look forward to climate change messiah Greta Thunberg launching a critical tirade of China for the smog storm it is about to unleash.

Tyler Durden

Tue, 09/07/2021 – 23:50![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com