Eight Bond Deals Pulled On Evergrande Contagion

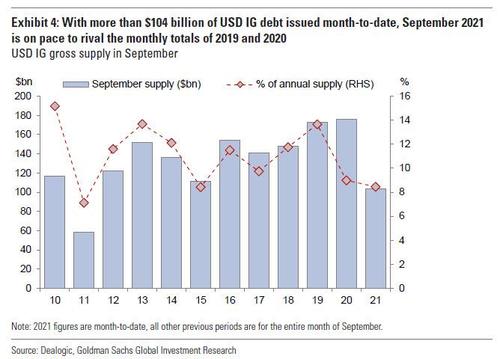

After a record post-Labor day bond offering frenzy, and a September calendar which has seen $104BN in IG debt issuance to date, and which Goldman believed (as of last week) will rival the monthly totals of 2019 and 2020…

… the mood has soured sharply, and on Monday, at least eight investment-grade companies are said to have pulled their bond offerings amid the crash in risk assets, according to Bloomberg which notes that “the issuance backdrop isn’t inviting with equity futures lower by about 1.5% and the IG CDX index trading over 6.5 basis points wider (largely due top the roll which put an extra six months of maturity on the new contracts).

Today’s pullbacks follow Friday’s vacuum when nothing priced amid the market’s sharp opex drop; last Monday some 13 deals priced.

That said, even without the Evergrande contagion, issuance was slowing: this week syndicate desks expect issuance to hit $20 billion to $25 billion, a slowdown from frenzied, record pace of sales since the market returned from the Labor Day holiday.

It is possible that most companies that had planned to come look again on Tuesday, but that will be contingent on stabilization in markets, which in turn will depend on what Beijing does in the next 24 hours.

Tyler Durden

Mon, 09/20/2021 – 10:33![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com