Democrats Unveil Stopgap Funding Bill, Debt Ceiling Suspension As Goldman Warns Of Shutdown “Collision Course”

Moments ago House Democrats released the text of a long-awaited stopgap bill (link) that would suspend the U.S. debt ceiling until after the 2022 congressional elections and temporarily fund the government to avert a shutdown after the end of this month. Dems also set up a Tuesday vote on a bill which according to Goldman analysts will set the US on “collision course” to a shutdown as soon as Oct 1.

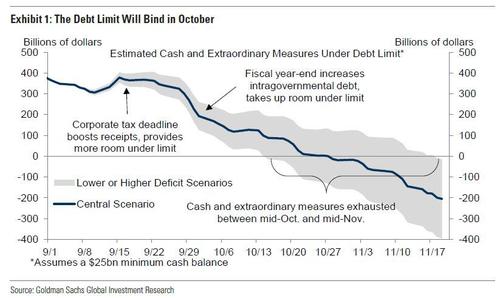

The proposed debt ceiling suspension – to Dec. 16, 2022 – is needed because the “drop dead date” when the Treasury runs out of accounting measures to stave off a payment default sometime in October…

… although the exact date is tough to pin due to changing government revenues and outlays.

But, as we have discussed extensively before for reasons the latest WSJ editorial makes abundantly clear, Republicans have vowed to block the measure in the Senate as long as Democrats are pursuing their separate package of tax hikes and spending.

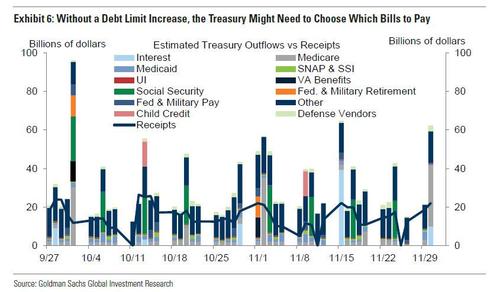

That standoff raises the odds of twin fiscal disasters – a government shutdown and a default – that could have “catastrophic” consequences, in the words of Janet Yellen for the US, for the global economy, but most importantly, for artificially levitated “markets.”

The proposed stopgap bill would prevent a shutdown of most U.S. federal agencies and keep them operating through Dec. 3. The bill also contains $28.6 billion for recovery from a series of hurricanes and wildfires as well as $6.3 billion to resettle refugees from the U.S. war in Afghanistan. These are included to shame republicans into voting for the bill even though even RINOs such as Mitt Romney have said they would not vote for rising a debt ceiling.

Indeed, as Bloomberg adds, “Republicans in the House and Senate are expected to vote against the bill over the debt ceiling provision. That makes it likely the Senate will have to revise the spending bill, stripping out the debt ceiling language, before the Oct. 1 deadline.”

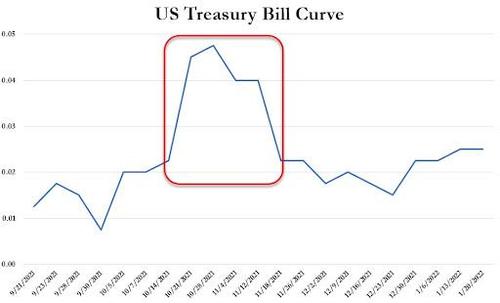

And while most expect some amicable resolution after much huffing and puffing, the Democrat gamble with the debt ceiling makes the political endgame remains murky if Senate Republicans continue to block the suspension, and which as Goldman warns has substantially raised the odds of not only a government shutdown but also debt ceiling crisis, something the market is increasingly concerned about as judging by the growing kink in Treasury Bills around the Drop Dead date.

In terms of specific, House Budget Chairman John Yarmuth said Democrats alone can raise the debt ceiling using the fast-track budget process that bypasses the Senate filibuster — but doing so would require specifying a numerical debt ceiling increase rather than a time-limited suspension.

But more importantly, Democrats are loathe to take sole political responsibility for the debt even though it is their insistence on pushing through a $3.5 trillion fiscal stimulus.

And with neither party willing to budge, Goldman chief political economist Alec Phillips warns that the US is headed for a collision course on both the debt ceiling and a government shutdown. Below we excerpt from his latest note which was written late last night before the final text of the proposed bill dropped (highlights ours):

House Speaker Pelosi and Senate Majority Leader Schumer have announced that they plan to move forward with legislation that ties an extension of government spending authority (a “continuing resolution”) with a suspension of the debt limit. A vote in the House looks likely this week. Republican leaders have reiterated their opposition to pairing the two measures and look likely to vote against the combined bills in the Senate. If Republicans block the bill in the Senate, this would leave Democratic leaders with three options between now and Sep. 30:

1. Pass a short-term extension of spending authority without the debt limit attached. The deadline to extend spending authority is Sep. 30, while the deadline to suspend or increase the debt limit is likely sometime in the last week of October. If Senate Republicans block the combined measure, Democratic leaders may opt to pass a short-term extension of spending authority–for three weeks, for example–to better align the next spending deadline with the debt limit deadline.

2. Pass an extension of spending authority and separately increase the debt limit via the reconciliation process. Democrats could increase the debt limit without Republican support if they choose. Doing so would require reopening the recently approved budget resolution and inserting “reconciliation instructions” to raise the debt limit by a certain dollar amount, which would likely need to be in the trillions to take the next deadline past the midterm election. While Republicans would prefer this option, Democratic leaders are likely to try to avoid doing this if possible, as a specific dollar amount would get more (negative) public attention than a calendar-based suspension, it would put responsibility solely on Democrats to pass the increase, and it could risk reopening the instructions for the $3.5 trillion fiscal package that is already encountering resistance among centrist Democrats.

3. Democratic leaders could stick to their plan. If Democratic leaders believe that Republicans might change their position at the last minute, they might continue along the current path. While it is hard to predict what Republicans in the Senate would do at the deadline, this path would be more likely than not to result in a shutdown October 1.

A shutdown October 1 is not the base case, in our view, because there is a fair chance that Democrats will shift strategy before the deadline. However, the longer Congress remains on this course, the more likely a shutdown becomes.

Tyler Durden

Tue, 09/21/2021 – 10:30![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com