European Gas Prices Hit Escape Velocity After Russian Gas Supplies Plunge By 57% Overnight

Not much to add today that we didn’t already cover overnight in “All Hell Is Breaking Loose In Energy Markets” suffice to note that European gas prices (Dutch TTF and UK NBP) are up another 12% today to new all time highs…

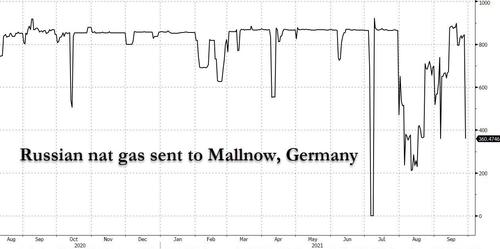

… and while all the dynamics we listed yesterday are all still applicable, we can add one more: a sudden drop off in Russian nat gas deliveries via the Yamal-Europe pipeline that runs across Belarus and Poland to Mallnow, Germany…

… which shrank lumped by 57% to the lowest level since Sept 6, just as a panicking Europe is scrambling for every BCF.

In an email seen by Bloomberg, Gazprom said that it continues to fully meet obligations under its supply contracts, adding that the current drop in Russian gas supplies via Mallnow is due to a request from a client and is temporary… although if it is anything as “temporary” as the current hyperinflation across the globe, then Europe is about to have a very unpleasant winter, at least until the Ukraine-bypassing Nord Stream 2 is activated – just as Putin wants.

Meanwhile, in an ominous development, US nat gas futures are starting to move in lockstep with Europe, and overnight Henry Hub topped $6/mmbtu for the first time since 2014.

And as iconic trader John Arnold warned on twitter recently, the surge in commodity prices will the surest way to crush any desire to go “green”, which of course was obvious to all and is why we – rhetorically – asked back in June whether ESG will trigger energy hyperinflation.

Higher fossil fuel prices will spur a faster shift to renewable sources, all else equal, as they become economically competitive in more uses/geographies. But very high oil/gas prices risk a voter backlash against decarbonization policies, which are vital to a cleaner future. 7/

— John Arnold (@JohnArnoldFndtn) September 24, 2021

Meanwhile, as we wait for Europe’s green dream to go up in carbon-heavy smoke as the continent has no choice but to destroy its virtue and ramp up coal plants, we leave the last word to Bloomberg’s Javie Blas who writes that he has “never seen a large economy like Europe (UK+EU) sleep walking into an energy crunch (maybe let’s call it a crisis since major industrial companies are having to shut down) and no a single politician appears to give a damn about it. Incredible.”

European one-year forward electricity, spot natural gas, spot thermal coal, and spot CO2 emissions prices have risen (again) this morning to fresh all-time highs.

— Javier Blas (@JavierBlas) September 28, 2021

Tyler Durden

Tue, 09/28/2021 – 10:30![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com