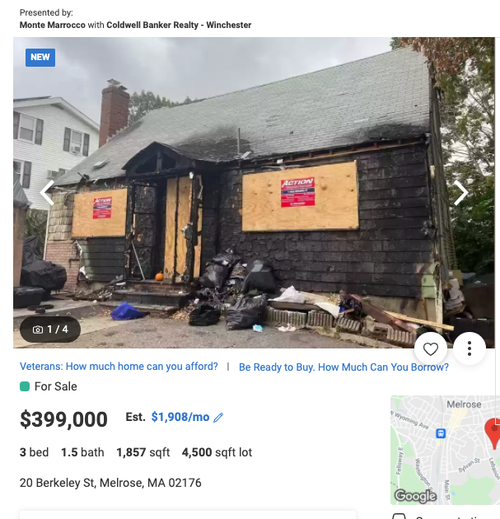

Housing’s On Fire… Literally: Burned-Out Boston Home Selling ‘As Is’ For $400K

If you’re looking for more evidence the housing market is in a bubble, look no further than this single-family home in Melrose, a suburb of Boston, Massachusetts.

A little more than a month ago, the 1,857 sqft, three-bedroom home built in the 1960s was severely damaged in a fire where much of the inside was charred now for sale for a whopping $399,000.

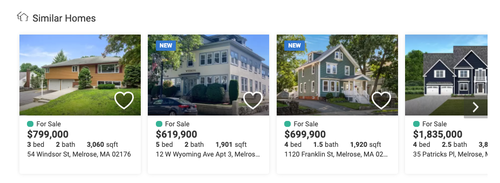

The burned-out house, sitting on a 4,500 sqft lot, or about 1/10th of an acre, is listed on multiple real estate websites. The agent selling the home writes in the description: “attention contractors!” referring to the idea that contractors can buy at a steep discount and flip the house for a potential profit in an environment of low inventory. Here are comparables in the neighborhood:

“House is in need of a complete renovation or potential tear down and rebuild. Buyer to do due diligence. House being sold as-is,” the listing states.

The listing comes as home-priced growth soared to a new record in July as low inventory sparked bidding wars across the country. According to the S&P CoreLogic Case-Shiller National Home Price Index, a measure of home prices across 20 major cities, rose 19.95% YoY (yet another record high)…the 14th straight month of accelerating price increases. July was the highest annual rate of price growth since the index began in 1987.

“The last several months have been extraordinary not only in the level of price gains but in the consistency of gains across the country,” said Craig Lazzara, managing director and global head of index investment strategy at S&P Dow Jones Indices.

There are plenty of examples of homeowners selling burnt-out homes or even uninhabitable shacks for impressive sums of money amid the latest housing craze.

Tyler Durden

Fri, 10/01/2021 – 22:40![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com