Just How Reliant Is Europe On Russian Gas

While European politicians have been busy trying to pin the cause of Europe’s energy crisis on the Kremlin and Gazprom in hopes of deflecting from their woeful mismanagement of European energy needs, not to mention their torrid push into green energy at the expense of fossil fuels when Europe is clearly not ready for a full transition and won’t be for years if not decades, the truth is that the European gas market crisis has highlighted the market’s unprecedented vulnerability to Russian supply. And, as Goldman writes in a recent note from its European gas analysts, Gazprom’s decision not to book for October the full capacity available at one of the main pipelines that delivers gas to Germany poses an increased tightening risk to NW European gas balances and, hence, (much higher) upside risk to TTF prices this winter.

If said risk is realized, Goldman’s Samantha Dart warns that it could lead Gazprom to further physical buying at the TTF hub to help fulfill their contractual obligations for Q4 21 and Q1 22,when demand increases seasonally. More importantly, this could potentially create a squeeze at the physical hub, further exacerbating the upside to gas prices well above the$32/mmBtu soft ceiling scenario which Goldman had penned previously. Considering that European gas prices are already at insane levels, this could lead to a civilizational shock across Europe which should be absolutely dreading the coming winter.

Taking a step back, for most of 2021 the uncertainty surrounding Russian has has been largely focused on the timing and impact of the upcoming NS2 pipeline, which remains unclear owing to limited visible pipeline spare capacity that would take NS2 flows further west into NW Europe (although as noted earlier, the NS2 operator is starting to fill the pipeline and just waiting for the green light).

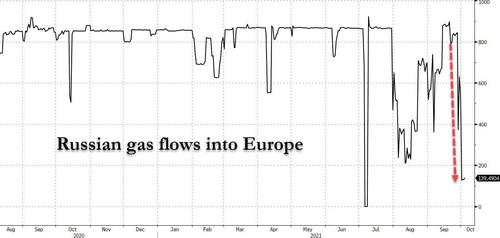

Over the past few weeks, however, these supply concerns have been exacerbated by the possibility that Russian sendouts to NW Europe through existing pipelines might disappoint vs market expectations. Indeed, as the continued drop in flows to Germany’s Mallnow via the key Yamal-Europe pipeline shows, Russian supplies are currently about 70% below their recent averages.

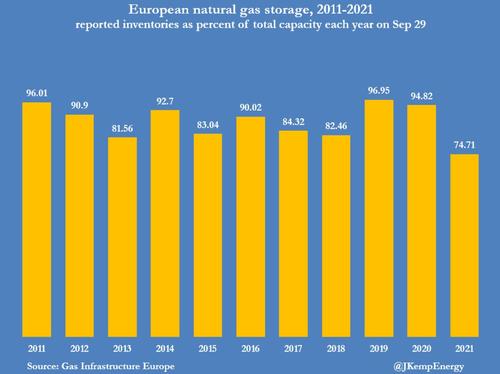

If Russia’s export volumes through winter are lower than expected, this will increase the storage drawdown over the next several months, leaving European gas markets which already have the lowest storage in 15 years…

… even more vulnerable to colder-than-average weather and, as a result, increasing the chance of further sharp TTF price spikes during the winter. Importantly, the potential bullish impact on the market from a restricted Russia pipeline flow would be particularly significant if Gazprom planned to supply their NW European contracted winter volumes at least partly by taking physical delivery at the hub to compensate for lower pipeline flows in the context of already depleted inventories in the region. This, as Goldman notes above, “could create a physical squeeze at TTF, potentially sending gas prices well above the soft ceiling of $32/mmBtu” the bank had discussed recently.

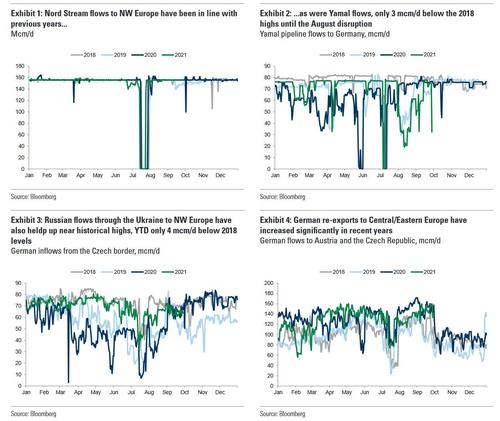

Looking at the historical pattern of flows, one can point to a couple of notable changes: one more structural, and the other much more recent and “unexplained”: indeed, for most of the summer, Russian gas flows to NW Europe sustained relatively high levels, near the highs of 2018 across all three delivery routes, namely, Nord Stream, flows through Poland via the Yamal pipeline, and flows through the Ukraine (into Slovakia, then the Czech Republic, and finally into Germany) (Exhibit 1-Exhibit 3). But, as Goldman notes, what has kept net Russian flows to NW Europe more than 30 mcm/d down from the 2018 highs has primarily been the high re-exports from Germany towards the Czech Republic (Exhibit 4).

These re-exports have increased in recent years, partly as gas buyers in Eastern Europe, such as the Ukraine have looked to become more independent from Russia for their gas purchases. Hence, up until August, it was hard to argue that Russian flows were squeezing European gas markets. More recently, however, the prolonged reduction of flows through Yamal post the August fire at a processing facility and, in particular, the reduced capacity booked at Yamal for the month of October, potentially suggest otherwise.

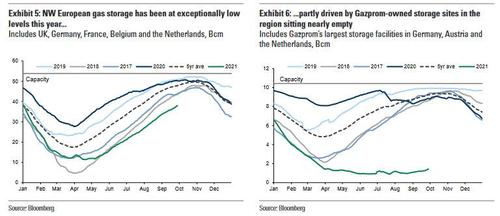

So given the ongoing tightness in NW European gas markets, including exceptionally low inventory levels at Gazprom storage facilities within the region, Goldman would have expected flows to remain high wherever possible to help improve Gazprom storage availability to fulfill contractual obligations in the winter. And yet, the bank notes that Yamal capacity booked last week for the month of October is only 31 mcm/d, vs the 74 mcm/d Gazprom typically flows through the pipe that time of the year.

While this scenario of a restricted pipeline flow could still by avoided with incremental daily gas nominations during October, a renewed drop in Yamal flows this week (as seen in Exhibit 2) and early nominations for Oct 1st suggest that’s not likely Gazprom’s current strategy, signaling October flows are likely to indeed remain well below normal.

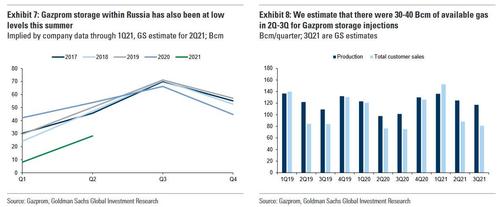

Not that this necessarily implies a political motive: one possible reason for this curtailed flow, according to Goldman, could be a lack of Gazprom supply to refill both their storage within NW Europe and in Russia. While Gazprom inventory levels in Russia are not publicly available, implied 2Q21 levels based on their reported historical storage injections would point to exceptionally low stocks this summer (Exhibit 7). However, quarterly Gazprom balances through 2Q21 estimated by Goldman strategists and the bank’s preliminary estimates for 3Q21 suggest 30-40 Bcm of gas availability for storage injections in both 2Q21 and 3Q21 (Exhibit 8), while Gazprom storage sites in NW Europe have remained nearly empty all summer.

In 2Q21, when Gazprom sendouts to NW Europe were near-historical highs, this could be explained by exceptionally high heating-related demand in NW Europe delaying the start of injections. Later in 3Q21, however, we saw a drop in Russian sendouts to the region, suggesting an allocation of available gas elsewhere. While this has been partly driven by the August fire at a Russian processing facility, which caused a significant disruption to Yamal flows to Germany, the normalization of flows was particularly slow and inconsistent for the remainder of September. The decision last week to only book reduced Yamal flows also for October – shown in the chart above – leads Goldman to believe that Gazprom may be sending their available gas elsewhere, at least for now.

In any case, while the lack of data prevents clearly reconciling Gazprom’s natural gas supply, flows and inventories, EU lawmakers have quickly alleged that moves such as this reduced Yamal booking are designed to pressure EU regulators into accelerating the certification of the newly built NS2 pipeline relative to its Jan 22 deadline. At the same time Russian government officials have suggested that Russia could quickly resolve the ongoing tightness in European gas markets with the start-up of NS2.

Additionally, the restricted spot flows, accompanied by repeated statements by Gazprom that all of their contractual obligations are being met, could work as an incentive for consumers to enter incremental long-term agreements with Gazprom according to GS, much like the new agreement just announced with Hungary. Indeed, this has been stated by Russian officials and would be similar to what Qatar did post the 2011 Fukushima incident that forced the closure of all nuclear generation capacity in Japan. Higher contracted volumes would help protect Gazprom’s market share against the backdrop of repeated calls from politicians across the EU for increased energy independence from Russia, at the same time that US LNG supplies continue to grow.

Incidentally, a drop in Yamal flows to the 31 mcm/d that have been booked for October for the duration of winter vs the 74 mcm/d average historical flow would lower Goldman’s already low Mar 2022 storage levels to 12 Bcm or 23% of full, vs the previous 32% of full expectations. In the absence of large NS2 flows, this scenario of extended restricted Yamal flows could create a squeeze in physical markets this winter. While not conclusive, Wednesday’s expiration of the October TTF contract with a 9 EUR/MWh rally could suggest something like this might already be happening.

Importantly, even assuming this lower pipeline flow is not extended beyond October, there is the risk that, given Gazprom’s exceptionally low inventory levels in NW Europe as shown in chart 6 above, the company would not be able to meet its contractual obligations during the winter simply from maximizing flows on existing pipelines into Europe.

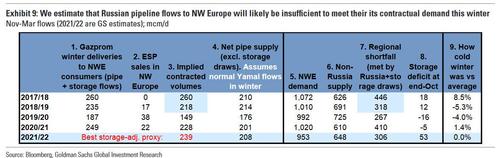

Specifically, Goldman looks at Gazprom’s historical pipeline flows, Electronic Sales Platform (ESP) volumes and NW European storage withdrawal data for recent winters (Nov-Mar) to derive an estimate of how large contracted flows in the region are (column 3 in Exhibit 9). But since estimated contracted volumes for the winter fluctuate over time, likely reflecting contract flexibility to swing volumes up or down depending on existing demand, it is not immediately clear which contracted amount is a reasonable assumption for the upcoming season. To solve this issue, the bank looks at its estimated shortage in the market this coming winter (column 7) to help point to which are the best analog years. Adjusting estimated shortages in the market by the storage deficit vs average at the start of each winter (column 8), GS concludes that the best analog-years contracted demand volumes are the 2017/18 and the 2018/19 winters. Assuming an average of our estimated contracted volumes for those two winters in column 3 gets us to 239 mcm/d, which we believe is a good proxy for the minimum volumes Gazprom will need to supply NW Europe this winter under average weather.

The problem is that expected net pipline imports from Russia into NW Europe this winter only add up to 208 mcm/d (column 4), and that includes normal Yamal flows and about 10 mcm/d of net incremental flows from NS2 through the season. This suggests Gazprom will likely need to find a way to supply the region with an incremental 30 mcm/d to meet its contractual obligations this winter given that its local inventories are nearly empty.

This would leave two options for Gazprom to source the 30 mmcf/d we estimate will be needed to satisfy its contractual obligations during the winter: relying on taking physical delivery at TTF to complement its pipeline flows, potentially causing significant upside pressure on physical markets, or expecting that NS2 will start this winter and will be able to bring significantly more gas to the region than the 10 mcm/d we base case. The threat of the former could be an incentive for a fast approval of the NS2 by German regulators.

Russian government officials have “suggested” this squeeze of the market can potentially be “resolved quickly” with the start-up of NS2 allowing for a rapid increase in Russian flows to Europe. Further, by also proposing to allow Rosneft to send gas via NS2 alongside Gazprom, Russia could use this as a work around to the current OPAL regulatory restrictions that require third-party access for an increased utilization of the pipeline, illustrating the extent to which the European gas market has become vulnerable to Russian supply.

The alternative: is a long, freezing and deadly winter across Europe whose outcome could radically change the political landscape of the old continent.

More in the full Goldman report “Russia’s impact on European gas market intensifies” available to professional subscribers

Tyler Durden

Tue, 10/05/2021 – 04:15![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com