One Bank Spots A “Major Development” In Today’s Inflation Report

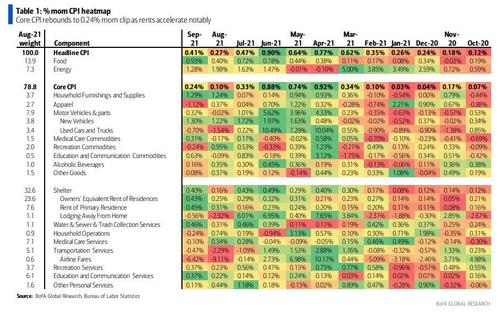

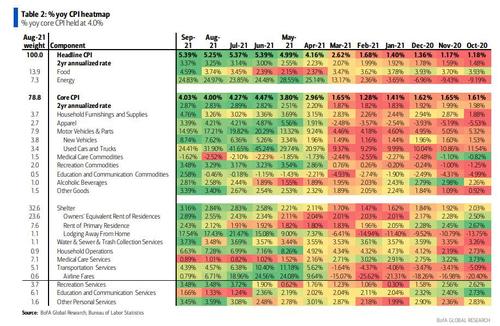

The latest CPI report came in hotter than expected, with Core CPI rising 0.24% mom in September, bouncing back from the 0.1% rise in August, and keeping the Y/Y rate steady at 4.0% (4.03% unrounded) yoy. Headline inflation rose 0.41% mom, above the 0.3% consensus estimate, which bumped up Y/Y to 5.4% from 5.3%. Energy prices soared 1.3% mom and food spiked to 0.9% mom.

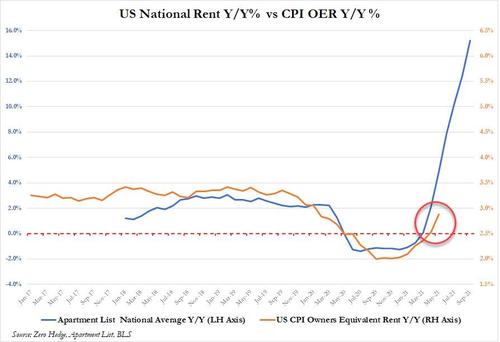

Taking a closer look at the report, BofA’s Alex Lin writes that “a major development in this report was a notable acceleration in OER to 0.43% mom and rent of primary residence to 0.45% from its prior 0.2-0.3% mom trend.” To be sure, this is hardly a surprise, with this website warning last month that the surge in rents meant an OER spike was just a matter of time.

Lin echos this today and writes that “given strength in the high frequency rent data, we believed it was only a matter of time before the CPI rent components broke out higher. While one month does not make a trend, this is an early signal of stronger persistent inflation pressures materializing, ultimately supporting continued above-target inflation over the medium term.”

All we can add to this is that if OER simply follows already realized rental price increases, OER is set for an orbital liftoff similar to that enjoyed by William Shatner just now.

Going down the list, BofA notes that medical care was an underwhelming -0.1% mom as health insurance remained a drag of -1.0% mom; to BofA, this indicates the BLS did not begin to incorporate the 2020 data just yet, but instead delayed it to October which means even more pent up official price increases on deck. Outside of health insurance, hospitals cooled to a 0.1% clip and professional services declined by -0.2% mom.

Surprisingly, core commodities were mixed this month suggesting muted transitory inflation from supply shortages. On one hand, both new cars and household furnishings & supplies rose 1.3% mom, education & communication commodities increased 0.6%, and medical commodities were up 0.3%. On the other hand, used cars fell -0.7% mom, apparel tanked -1.1% mom amid unfavorable seasonals, and recreation goods decreased -0.2% mom.

As we discussed earlier, used cars will turn higher in coming months as Manheim wholesale prices rebounded, ending a 3-mo streak of declines and modestly surpassing the prior high.

Meanwhile, reopening pressures were a drag as lodging declined -0.6% mom, airfares slid -6.4% mom, and rental prices fell -2.9% mom (looks like nobody at the BLS tried to book a flight last month). Broader transportation services were down – 0.5% mom, with motor vehicle insurance of +2.1% a positive offset.

As BofA summarizes, “overall the positive surprise in persistent inflation suggests we remain in a hot economy, which could prompt the Fed to move sooner.” Meanwhile higher energy and food prices but mixed core commodities may ease some recent concerns about “slowflation.”

Adding to price pressures, transitory prices can turn higher going forward, however, both from supply-shortages and reopening as high frequency data point to an inflection in activity especially with covid fears fading from consciousness.

In short, the print reflected that while transitory factors continue to roll-off, stickier more persistent factors are becoming more prevalent, which the Fed is more likely to respond to.

This helps explain the market reaction – the market reaction was as expected: nominal rates in the front-end to belly of the curve rose as much as 6bps, though the move has partially retraced, while longer dated tenors were little-changed; the sharp bear flattening as short-term yields rose but the 10Y tumbled as the market braced for another rate hike into a stagflation/recession.

The move was concentrated in inflation breakevens though real rates also initially moved higher on the back ofthe print. Market-implied longer term inflation expectations measured by five-year, five-year inflation breakevens were less than 1bp lower following the print. Policy-sensitive rates rose 4 to 5 bps across 2023 expiries, with the market pricing a modestly steeper near-term trajectory of rate hikes.

Finally, here is the M/M heatmap…

… and the YoY.

Tyler Durden

Wed, 10/13/2021 – 12:30![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com