Central Banks Will Have To “Pick Their Poison”

Earlier today we pointed out the fireworks taking place in the gilt short-end, where 2Y yields surged by the most since 2010, spiking by as much as 17bps to 0.75% while GPB 3M libor soared the most since the Lehman failure.

The sharp move followed the latest weeked comments from BOE Governor Bailey (the Bank of England seems to be using the weekends of late to prime the markets for imminent rate hikes as DB’s Jim Reid noted) who said inflation “will last longer and it will of course get into the annual numbers for longer as a consequence… That raises for central banks the fear and concern of embedded expectations. That’s why we, at the Bank of England have signalled, and this is another signal, that we will have to act. But of course that action comes in our monetary policy meetings.”

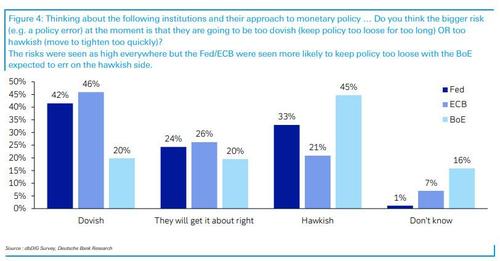

So going back to Deutsche Bank, chief credit strategist Jim Reid wrote that “the Bank of England might be the most interesting developed market central bank at the moment” as this morning we are pricing in around 35bps of hikes this year followed by nearly another 80bps next year. This takes place as respondents to DB’s latest monthly survey think they’ll be making a policy error with 45% thinking they are risking being too hawkish versus 20% who thought they might be too dovish, 20% thinking they’d get it about right and 16% not sure.

This, to Reid, highlights how difficult the current set up is where inflation is rising but the growth outlook is murky, especially since there are valid arguments on both sides of the interest rate ledger. Incidentally the risk of a policy error was seen as the other way round for the Fed and ECB in the survey (i.e. too dovish).

Summarizing the dilemma facing the BOE, Reid writes that perhaps ex-Governor Mervyn King’s assertion in 2008 that the NICE (non-inflationary consistently expansionary) era was over was a decade or so too early: “maybe it better fits the current environment. If inflation is stubbornly higher in an era of relatively low structural growth and high debt then life as a central banker becomes the most difficult it’s been for at least 40 years.” The bottom line – all else equal – is that central bankers can’t solve for all three and “will have to pick your poison.”

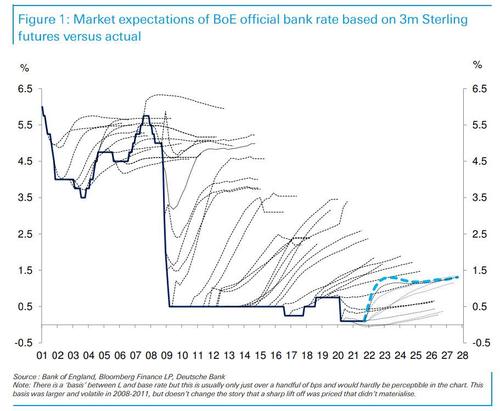

So will market pricing materialize?

Well, the silver lining for the BOE, and as shown in the Reid Chart Of The Day below, is that since the GFC, UK futures markets have been repeatedly too hawkish in their expectations. So if traders believe that the post GFC regime survives “then there is every chance that the BoE will have to stop or reverse course before these futures market levels are realized. However if you think something has changed regarding inflation then these forecasts are hardly excessive.”

Finally some context: “the BoE has been around since 1694 and base rates were never below 2% in the 314 years before the GFC.”

Tyler Durden

Mon, 10/18/2021 – 18:10![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com