As US Becomes World’s Largest Bitcoin Miner, Riot Blockchain Unveils 200 Megawatt Immersion-Cooled Mining Operation

Not that long ago, China was the dominant power in global bitcoin mining, a position that presented the cryptoworld with a profound threat: if Beijing wanted it could simply take control over a majority of global mining rigs and launch a “51% attack“, in the process nuking the blockchain and effectively destroying the world’s greatest monetary experiment overnight.

However, in the span of just a few short months, back in May, China’s State Council – which was focused on marketing its disastrous digital yuan and hoped to eliminate all competition – expelled its domestic bitcoin mining industry citing environmental and financial concerns, under the pretext that bitcoin miners were using up too much dirty electricity (a rather hypocritical take for a country that has emerged as the world’s largest polluter) in a move that many have said will be remembered as the “single greatest geopolitical mistake of the 21st century” (it would subsequently proceed to ban all bitcoin activity in yet another catastrophic mistake by the country’s oligarchs). And with China voluntarily cedeing its sole veto control over bitcoin, we predicted that the outcome would be an extremely bullish one for the crypto sector especially since the ESG criticism against bitcoin would gradually fade away; indeed, with bitcoin now trading just shy of all time highs, we were right.

But… but… this is great news.

Means no more dirty coal bitcoin mining in Xinjiang.

How will the ESG cult bash bitcoin now?

— zerohedge (@zerohedge) May 21, 2021

The winner? The United States, which was just a minor player in recent years and has since blossomed into the world’s largest bitcoin mining hub.

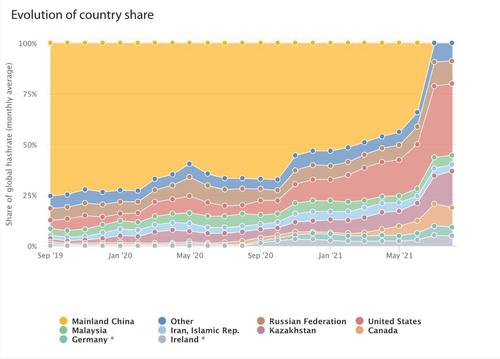

In just two months, the US overtook China as the world’s biggest source of bitcoin mining after Beijing banned crypto mining this year, new data have revealed. As shown above, China’s share of the global hashrate — the computational power required to create bitcoin — fell from 44 per cent to zero between May and July. The country accounted for three-quarters of the global hashrate in 2019.

The US share of the global hashrate increased from 17 per cent in April to 35 per in August, while Kazakhstan rose 10 percentage points to 18 per cent in the same period.

Michel Rauchs, digital assets lead at the closely watched Cambridge tracker, noted that “the effect of the Chinese crackdown is an increased geographic distribution of hashrate across the world”, adding that it could be seen as “a positive development for network security and the decentralized principles of bitcoin”.

Meanwhile, miners outside China enjoyed a digital coin minting spree in the months following the ban, as Chinese competitors hurried to relocate their operations.

But nobody has benefited more than the US: “The China shutdown has been great for the industry and US miners,” said Fred Thiel, chief executive of Marathon Digital Holdings, a Las Vegas-based crypto mining company. “Overnight, fewer players were going after the same finite number of coins.”

More importantly, in a radical departure from China’s coal-fueled mining free for all, the US is rapidly becoming a truly “environmentally-conscious” global mining hub, as demonstrated by today’s news from Riot Blockchain which announced their new 200 megawatt (MW) industrial-scale immersion-cooled bitcoin mining operation at its Whinstone facility in Rockdale, Texas which was acquired by the company earlier this year. This operation features two buildings that will host roughly 46,000 S19 series Antminer ASICs — all immersion-cooled.

“After months of research and development, utilizing partnerships across industries, Riot is proud to be a pioneer in the use of cutting-edge immersion-cooling technology at an unprecedented scale,” said Jason Les, CEO of Riot.

Riot is proud to pioneer the world’s first industrial-scale, immersion-cooled, #Bitcoin mining operation.$Riot #ImmersionCooling #BitcoinMining pic.twitter.com/3YBDQyspMD

— Riot Blockchain Inc. (@RiotBlockchain) October 19, 2021

According to the company, Immersion-Cooling is the process of submerging miner ASICs in a specialized fluid that circulates, allowing the miners integrated circuits to operate at lower temperatures. if it sounds vaguely similar to how one cools a nuclear power plant, it’s because it’s not too far off. This technique also increases the hash rate of the miners, as they no longer need fans for cooling, resulting in the machines using less energy. In fact, the machines themselves become sources of energy (and heat), which with the world facing a global energy crisis is a feature that both China and Europe would be delighted to have.

The company is expecting a 25% increase in hash rate from the miners being submerged, according to industry data and the company’s own preliminary immersion-cooling test results, but they could see a potential increase of ASIC performance by as much as 50%.

The initial deployment of these immersion-cooled ASICs is expected to begin in Q4, 2021. Riot will hardly be alone and as more bitcoin miners relocate out of the desolate communist wasteland that seems to only specialize in genetically engineering viruses these days, Texas will see tremendous monetary and socio-economic benefits as it becomes the global hub for clean bitcoin mining, much to the humiliation of Beijing which literally kicked out the digital golden goose.

Tyler Durden

Tue, 10/19/2021 – 19:45![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com