Greed Is Back: Stocks Rip Back To Record Highs

Well that didn’t take long…

The Dow and S&P 500 have ripped back from deep below their 100DMAs to record highs…

And that has pushed “greed” back to 2021 highs…

It appears that Goldman was right after all…

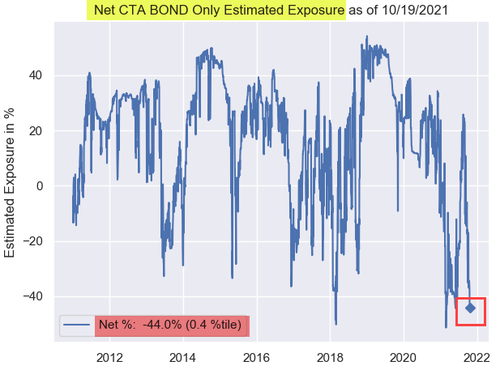

But, as Nomura’s Charlie McElligott notes, CTA Trend positioning analysis update is showing the strength of current signals in “Short Bonds, Long Equities,” which of course sets-up a larger crowding / unwind risk as each gets more extreme, as “stability (now) breeds (future) instability”:

The aggregate Bonds net exposure (“short”) is now an eye-watering 0.4%ile historical rank over the past decade and nearing all-time model lows made earlier this year (made on 2/26/21) after selling a net -$122.3B in G10 Bonds over the past 1 month, -$90.7B over past 2w, -$24.6B over past 1w and -$23.9B yday alone (almost entirely in the TY position at -$22.6B of shorting yday, FWIW).

The aggregate Equities net exposure (“long”) is up to 75%ile after having added an astounding +$122.7B over the past 1 week alone across global Equities futures…so the overall is not a historical “extreme” rank just yet, although the impulse “cover shorts à flip long” flow on signal turns over the past week + is v signficant nonetheless and will need to be monitored.

Tyler Durden

Wed, 10/20/2021 – 10:59![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com