This Shows Why The Yuan Is Defying Economic Slowdown

By Ye Xie, Bloomberg markets live commentator and analyst

Three things we learned last week:

1. The yuan keeps rising even as the economy slows. China’s growth slipped below 5% in the third quarter. Excluding pandemic-hit 2020, that would be the slowest in more than three decades. Yet the yuan is surprisingly strong with the trade-weighted index hovering near the highest in almost six years. Friday’s FX settlement data show why the yuan is so resilient.

A proxy for foreign-currency inflows, the net yuan purchases by banks’ clients amounted to 174 billion yuan ($27 billion) in September. The 12-month average rose to a record 159 billion yuan, thanks to strong exports and inflows to China’s stock and bond markets. The portfolio inflow will likely keep coming. The widely-followed FTSE WGBI index will include Chinese bonds by the end of this month, a move that Citigroup estimated will bring in about $3 billion a month. Against this background, any expectation for large yuan deprecation is likely to be misplaced.

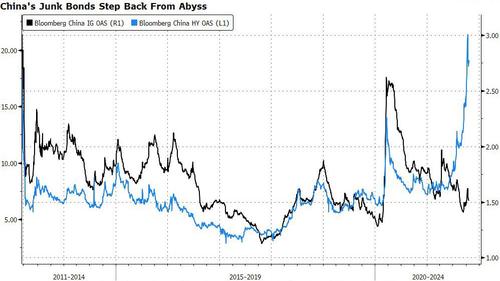

2. Beijing is making moves to calm the property market. A slew of senior officials, including Vice Premier Liu He, came out to try to shore up the struggling real-estate sector and reassure everyone that risks from Evergrande are contained. Evergrande’s surprising payment of interest rates last week helped it avoid an imminent default, triggering the biggest weekly rally in Chinese junk bonds since 2012. The crisis is by no means ending. But China’s fine-tuning of housing policy, including encouraging banks to increase mortgages, should bring some relief for property developers.

It’s part of broad efforts by policy makers to keep the economy from faltering further. On Friday, a Ministry of Finance official said Beijing has urged local governments to speed up bond issuance to fund infrastructure projects.

3. Inflation is bringing forward central bank rate expectations across the world. The global bond selloff continued last week as inflation expectations rose. The U.S. five-year breakeven rate reached the highest in more than a decade. In Russia, the central bank stunned investors with a bigger-than-expected rate increase Friday, and warned that more tightening may come to curb inflation. In China, while consumer prices are held back by lower pork prices, bond yields have also increased in recent weeks as expectations of reserve ratio cuts waned.

Tyler Durden

Sun, 10/24/2021 – 18:30![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com