Are Investors Wrong To Worry About China? Morgan Stanley Responds…

By Chetan Ahya, Morgan Stanley Chief Asia Economist

The start of every deleveraging process in China prompts fears about downward pressure on growth. These investor concerns are re-emerging, reflected in wider credit spreads. However, we believe that some of these concerns are overdone.

Investors are focused on three issues.

First, is there a risk of a financial shock?

The fear is that rising default risks could turn disorderly, leading to a rapid tightening of financial conditions and a sharper slowdown in growth. We don’t see this materializing given the self-funded nature of China’s growth. The macro set-up and policy-makers’ preference for orderly defaults imply that policy-makers should be able to maintain control over domestic financial conditions (i.e., real rates), allowing China to avoid a financial shock.

China’s macro set-up of low foreign currency external debt (at only 9% of GDP), a current account that remains in surplus, low inflation and high real interest rate differentials with the US limits its external funding risk. The spillovers from the property and construction sectors can be contained by:

- ensuring an orderly restructuring process for property developers and

- easing policy to keep growth within a reasonable range.

The banking system has limited exposure to the property sector. Since non-performing loans and credit costs sit at low levels overall, it should be able to handle any rise in delinquencies in the property and construction sectors.

Policy-makers have the tools to manage aggregate demand by controlling the pace of deleveraging. In this cycle, China’s zero-Covid policy and adherence to its energy intensity and consumption targets have added downward pressure on GDP growth, which has weakened to a 4.9% 2Y CAGR (underlying growth adjusted for base effects) in 3Q21. This has prompted policy-makers to hit a pause to balance their growth and debt-management objectives. Chief China economist Robin Xing expects further easing measures, which would lift growth higher from 1Q22.

Second, even if China avoids a financial shock, how much will elevated debt levels constrain medium-term growth?

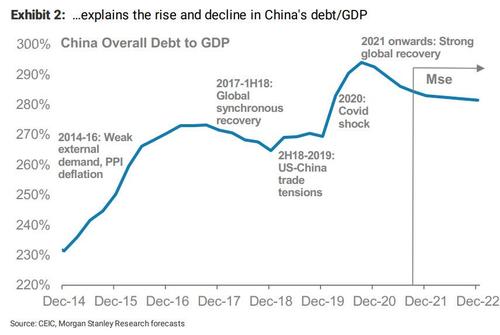

A total debt/GDP ratio of 284% implies that a lot of growth has been borrowed from the future. Reducing leverage where it is particularly elevated – in this instance the property sector – would mean slower growth there, with implications for overall GDP growth.

A related challenge is that net land sales revenues account for 3.3% of GDP and local governments rely on these revenues to fund infrastructure projects. As the policy goal is still to curb excessive leverage in the property sector (i.e., the three red lines), and as the property tax trial widens to more cities, a key source of funding for infrastructure projects faces constraints.

On the flip side, China has further scope for urbanization – its urbanization ratio is 64% versus 83% in the US and 92% in Japan. In this context, we think that the process of slowing property and infrastructure investment can be measured rather than disruptive.

This natural moderation in property and infrastructure investment as a percentage of GDP is part of the evolution of China’s growth model. A shrinking working-age population and higher per capita income mean less scope for catch-up growth rates, and less demand for property, infrastructure and overall investment.

With this in mind, we are forecasting a natural transition to a slower GDP growth path of an average of 4.6%Y over 2022-25. Yet, China’s GDP will reach US$22.2 trillion by 2025 and per capita incomes will be closer to US$16,000, well above the high-income threshold.

Third, how will China achieve debt stabilization?

Despite the moderation in overall GDP growth, we think that China will be able to stabilise its debt/GDP ratio and deleverage modestly over the next 2-3 years.

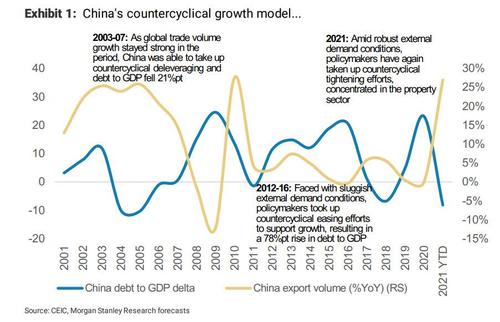

The ebbs and flows in the global trade cycle explain the fluctuations in China’s debt/GDP. When external demand is weak, policy-makers aim to stimulate domestic demand (via infrastructure and property investment), effectively pushing debt/GDP ratios higher, and they withdraw this support countercyclically when external demand recovers. In this year alone, the recovery in global trade has in effect helped policy-makers to bring debt/GDP down by 10 percentage points.

Ultimately, China’s debt sustainability hinges on two factors:

- Reform efforts to reduce its reliance on highly levered sectors to drive growth; and

- The external demand environment.

As we expect the global trade cycle to remain stronger than the sub-par growth environment of 2010-16, China’s growth should continue to be driven more by exports and private capex than by policy stimulus. This improving productivity dynamic creates a favorable environment for reforms to reduce reliance on less productive sources of growth like property.

Moreover, we expect policy-makers to continue implementing measures to move up the value chain and sustain technological progress, ensuring that China remains on the path to high-income status. Therefore, the risks we see to China’s debt outlook are a significant weakening in the global trade cycle due to a demand shock or renewed trade tensions.

Tyler Durden

Sun, 11/07/2021 – 14:00![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com