Infrastructure: What’s The Bang For The Buck?

By Philip Marey, Senior US Strategist at Rabobank

Summary

-

Last Friday, the House of Representatives finally approved the bipartisan infrastructure bill. Although long overdue given the state of US infrastructure, it will hit the economy at a time of full employment and after a couple of years of high inflation. This means that the bang for the buck will be substantially eroded.

-

The attention of Congress now turns to the health care, education and child care bill that the Democrats want to pass through reconciliation, i.e. without Republican support. However, so far Democratic unity on this bill has been more difficult to find than a bipartisan majority for infrastructure spending.

-

Meanwhile, the December 3 deadline for the debt ceiling and government funding is approaching rapidly.

Introduction

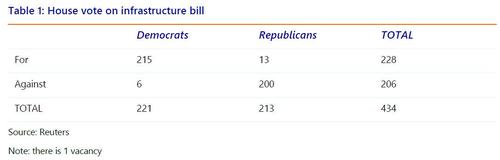

Last Friday, Nancy Pelosi made a U-turn and surprised everybody with the announcement that the House of Representatives would vote on the infrastructure bill and then take a procedural vote on the reconciliation bill, holding it for final passage until there was a CBO score. Until then, the two bills were tied together, as progressive Democrats were not willing to approve the infrastructure bill before the reconciliation bill (aimed at health care, education, child care), and moderate Democrats did not want to pass the reconciliation bill before the infrastructure bill. In order to break the deadlock, Pelosi called the progressives’ bluff and offered the CBO-contingent solution proposed by the Black Caucus. Although the progressives were not happy about this, they folded. While 6 Democrats defected, 13 Republicans more than made up for them. A victory for centrists in both parties, but those in the Democratic Party now have their hands tied to the numbers that the CBO comes up with for the reconciliation bill. And of course a victory for Nancy Pelosi, who finally took the risk of challenging the progressives. Ironically, she needed moderate Republicans to save the infrastructure bill from defecting progressive Democrats such as AOC.

Economic impact: what’s the bang for the buck?

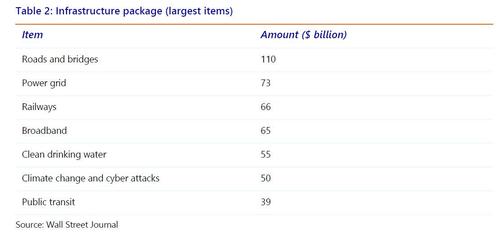

While the law is presented as a $1 trillion infrastructure package, this includes spending on infrastructure the government had already planned for the next decade. The additional spending amounts to about $550 billion for roads, passenger railways, subway systems, airports, ports, power facilities, and broadband networks. The funds are expected to start flowing in the second half of 2022, but the bulk would be spent in 2024 and later.

If an infrastructure plan arrives during a slowdown or recession, the bang for the buck is relatively high. Unemployed construction workers can get a job and idle machines are put to use. However, this time the recession is already behind us and we are even experiencing labor shortages. By the time the bulk of the infrastructure activities should start, the economy is expected to be at full employment. Note that the Fed expects to hike before the end of 2022 because of full employment. This means that the infrastructure builders will compete for workers and machines that are expected to be short in supply to begin with by 2024. This will make the projects more expensive, so the bang for the buck is much lower than in case of a recession. What’s more, with high inflation in 2021 and a large part of 2022, higher prices of materials and equipment will also erode the purchasing power of the infrastructure package. This comes on top of monopoly power in for example freight railroads and broadband, which is reducing the bang for the buck in any phase of the business cycle.

So after Trump slashed taxes during an economic expansion, Biden now launches an infrastructure spending package into full employment. The timing of US economic policies seems a bit off in recent years. Instead of counter-cyclical fiscal policies they have turned cyclical. Evidently, the political cycle trumps the business cycle in DC. Still, infrastructure spending has long-term benefits that will outlive the business cycle. Especially, in the US which has an outdated infrastructure compared to some other industrialized nations. What’s more, from a cyclical perspective the next recession could still hit the economy before the decade of additional infrastructure spending is over. In terms of additional annual GDP growth, estimates reach at most 0.1 to 0.2 percentage points in the coming years and even less in later years. So not a major change in economic growth.

Electoral impact: too late for this and next year’s elections

The electoral limitations of the infrastructure plan for the Democrats are twofold. In the first place, this is a bipartisan bill, supported by a minority of Republicans. Although most Republicans voted against it, the yes voters were predominantly from swing districts, increasing their electability next year. Meanwhile, the majority of Republicans will continue to claim that only a small portion of the infrastructure package ($110 billion) goes to traditional infrastructure, and that the package is not paid for (the CBO estimated that it would increase federal borrowing by $256 billion over 10 years).

In the second place, the bulk of the benefits will not arrive until 2024. Democrats will argue that the infrastructure package will alleviate supply chain bottlenecks, but voters are not likely to reap the benefits prior to the November 2022 midterm elections. Meanwhile, rampant inflation is eroding the purchasing power of middle and lower class voters, while the Fed continues to pump up the stock portfolios of wealthy voters until June next year. (Note that tapering is not tightening.) This means that the voters will mostly experience higher prices and constrained supply before the midterm elections in November next year.

But at least Biden can claim he has delivered a bipartisan bill, which swing voters may appreciate more than the progressive reconciliation bill. This could help rebuild his tarnished image. However, the passage of the infrastructure bill came too late to help Democratic candidates in last week’s elections, which did not go very well for them.

Reconciliation is next

Congress is on recess this week and returns on November 15. On top of the agenda will be the $1.75 trillion reconciliation bill. It is difficult to keep track of what’s in the reconciliation bill. Last Wednesday, Pelosi put the four weeks of paid family leave and negotiated changes on prescription drugs and immigration back in the reconciliation bill. These changes are likely to be rejected by the Senate, but Pelosi seems done waiting for what Manchin and Sinema exactly want before starting the process on the reconciliation bill. We are likely to see more changes, especially after the bill has been sent to the Senate. It is interesting to note that these days it seems easier to pass a bipartisan bill than a Democrats-only reconciliation bill. In fact, if moderate Republicans had not come to the rescue, the infrastructure bill would have failed in the House because of Democratic defections. While the bipartisan infrastructure bill had already passed the Senate prior to Friday’s passage in the House, the reconciliation bill still has to be approved by both the House and the Senate. It could take weeks before the CBO has finalized its full analysis of the reconciliation bill, but lawmakers may be satisfied with a few preliminary projection tables. So Congress will be focused on the reconciliation bill during the remainder of November.

Don’t forget the deadlines

However, there is a December 3 deadline for the debt ceiling and government funding. McConnell already said last month the Democrats were on their own next time. It remains to be seen if he will blink again in this game of chicken, but if he does not, the Democrats would have to include a raise in the debt ceiling in the reconciliation bill. However, the Democrats are again betting on a bipartisan increase in the debt limit. If the debt ceiling is not raised in time, the extraordinary measures taken by the Treasury Department are expected to run out after December 3 and a federal government default would become inevitable sometime between mid-December and mid-February according to estimates by the Bipartisan Policy Center. What’s more, if no government funding bill or continuing resolution is passed by December 3, the federal government will have to shut down partially in early December. Note that a continuing resolution would prevent a shutdown, but imply a substantial cut in defense spending. Unfortunately, the reconciliation bill may take up most of Congress’ time in coming weeks, leaving little time for the two fiscal deadlines.

Conclusion

While this bipartisan infrastructure law was long overdue given the state of US infrastructure, it will hit the economy at a time of full employment and after a couple of years of high inflation. This means that the bang for the buck will be substantially eroded. The attention of lawmakers now turns to the health care, education and child care bill that the Democrats want to pass through reconciliation, i.e. without Republican support. So far this has been more difficult than reaching bipartisan agreement on an infrastructure bill. As we noted earlier, President Biden is trying to hold together a broad and shaky coalition.

Tyler Durden

Tue, 11/09/2021 – 18:25![]()

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com