What Happens When Omicron Meets Powell

By Steve Englander, head of global FX research and North America macro strategy at Standard Chartered Bank, NY Branch

-

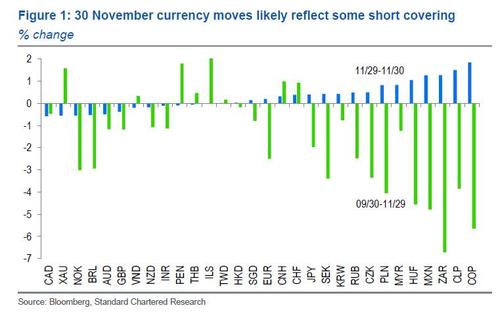

30 November FX moves most likely reflect position and G10 commodity currency unwinds

-

Weakest currencies of the past two months were best performers as Fed and Omicron fears ramped up

-

G10 currencies other than safe havens were weak, especially oil exporters

FX price action on 30 November reflected concerns related to Omicron, the new COVID variant, and a hawkish shift in Fed Chair Powell’s monetary policy stance in an appearance before the US Senate. Investors have treated Omicron largely as a downside risk for G10 commodity currencies, although it is uncertain how serious a health risk it is. Indications of a high degree of infectiousness and the likelihood that the variant is present in many countries outside of Africa are prompting concerns over intensified public health measures and slower-than-expected growth (yet again).

Some market participants likely were caught flatfooted by Powell’s Senate appearance. We and many others saw his prepared comments released 29 November as in line with expectations. The emergence of Omicron risk had led some to believe that renewed downside economic risk had fattened the monetary policy tail on the dovish side.

The combination of Omicron and Fed surprises may lead to widespread cutting of FX positions and paradoxical strength in currencies that are rarely strong in risk-off episodes (Figure 1). The rally of high-beta currencies on a day of sharply falling equity and commodity prices feels more like position unwinding than the establishment of new positions, particularly as the strongest currencies had been the weakest in the prior two months.

Economic and policy fears are likely to weigh on G10 commodity currencies until some daylight appears. However, the AUD and NZD are back to November 2020 levels and the CAD is flirting with its lows of the year, so it is hard to argue that investors are ignoring recent developments (Figure 2). Our index of COVID fears (driven by the ratio of COVID-sensitive stocks to techs, Figure 3) is similarly back to November 2020 levels. The CAD at 1.30 and AUD at 0.70 would undo almost all the progress made since the vaccine announcement in November 2020. If Omicron fears fade, there is room for a significant retracement upwards even if long positions look risky now. Except for the period of chaos in March 2020, risk reversals for commodity currencies are heavily bid for USD strength and commodity currency weakness relative to the past five years.

The Powell shift was the more surprising because it followed a relatively bland opening statement. It is possible that he saw himself increasingly in the minority with respect to FOMC voters and as chair did not want to be far out of the FOMC consensus. It seems unlikely that he would be so concrete had he not anticipated a strong FOMC consensus to accelerate tapering. He reiterated his concerns on the inflation trajectory and on the likely discussion of accelerated tapering a couple of times, an indication that he did not want his initial comments to be seen as a slip of the tongue. His references to bringing the tapering schedule forward a few months sounded as if he sees the FOMC thinking March or April rather than May or June.

The flattening of G10 curves suggests either that positions remain stretched on the fixed income side or that medium-term growth concerns are emerging even as (and possibly because) the Fed is shifting in a more hawkish direction (see MSV – Ride). In the aftermath of Powell’s comments, fed funds futures rates rose, but the maximum increase was in the February 2023 contracts, up 6bps. A similar pattern was seen in Eurodollar futures, where the expected yield increase peaked in late 2022 and early 2023 and then faded – this does not feel like a taper tantrum.

For the USD, the knee-jerk reaction to a more hawkish Fed is likely to be strength (USD – Q4 upside risk on wage/price fears), but we are sceptical that this will persist if growth fears emerge, and it would not take too much of a 2022 easing in inflation fears – not back to 2% but noticeably lower than at present – for investors to unwind USD optimism.

Tyler Durden

Wed, 12/01/2021 – 15:00

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com