It’s The Taper, Stupid!

Submitted by QTR’s Fringe Finance

It is astounding to me how much market commentary I have seen over the last 48 hours placing blame for the market “volatility” (read: 2% off all time highs) on the Omicron variant.

While there are definitely still some uncertainties about the new variant, early indications make it look as though it is not going to be meaningfully deadlier than other variants and that, one way or the other, we will be able to deal with Omicron and see our way through it – just as we did with the Delta variant. That is, unless the government implements more of what one trader calls a “criminal” response to Covid and issues more lockdowns and mandates.

While Omicron uncertainty has likely contributed slightly to market volatility, I don’t think it is the driving force behind it. Rather, I believe that current volatility is a result of Jerome Powell’s surprising, and so far unrelenting, hawkish stance that a taper and rate hikes look to be necessary.

In fact, several Fed governors have commented over the last 48 hours about potentially accelerating both rate hikes and tapering. This language, as I noted days ago, is an admission that the Fed has lost control of inflation.

In fact, it looks as though inflation has gotten so bad that the Fed is going to have to try and attempt to “stick the landing” of presenting hurried tapering and rate hike plans to the market. Of course, the Fed won’t really be able to stick the landing on either because politicians on the left and castrated on-air finance personalities will cry foul as soon as the market has a 10% pullback as a result of higher rates (just as they did on the Covid crash).

But for now, the company line is that we are going ahead with rate hikes and looking to accelerate the taper. This – not the Omicron variant – is what is moving markets.

I said just days ago that Powell doesn’t even need to say anything for the market to continue to stay volatile at this point because his standing position on the matter is very hawkish. Yet, instead of saying nothing, he went as far as to reaffirm his hawkish stance on Wednesday of this week. From my piece earlier this week:

If the Fed does look to accelerate the taper and toss around the idea of rate hikes in order to try and rope inflation in, as indicated, I think we can expect further downside in equity markets in December, as I predicted about a week ago. In fact, Powell doesn’t even have to re-acknowledge what he said yesterday, he simply has to say nothing until the Fed’s next official nod to the markets.

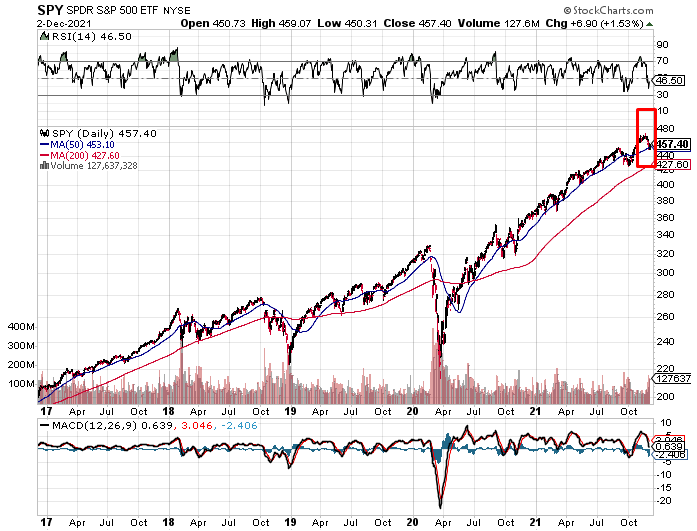

As I said during my interview yesterday with Jack Boroudjian, tapers cause markets to crash: it is that simple. Just take a look at what happened in December 2018. This time is not going to be different. If the Fed goes ahead and decides to taper, you can expect risk assets to get smacked.

Small caps and technology have gotten the “worst of it” during this volatility and I continue to believe that that will be the trend.

The Russell 2000 and NASDAQ are just so chock-full of overvalued, cash burning companies that the world would actually be better without – malinvestment that should’ve been corrected years ago – that I believe those indexes will move disproportionately lower.

I also continue to be profoundly negative on ARKK, an actively managed fund whose flagship component and largest weighting is up 90.6% in the last twelve months, yet has still somehow managed to plunge -11.9% over the same time period.

That takes some very special “active management”.

In fact, just yesterday after hours, another Cathie Wood holding, Docusign, took a 25% haircut.

Wood contends that the growth from her companies will eventually make up for this volatility in the very long term, but I think her portfolio of egregiously overvalued names represents the first head on the chopping block if market volatility continues. And, as I noted days ago, if Tesla ever starts to sell off, ARKK holders should look out below.

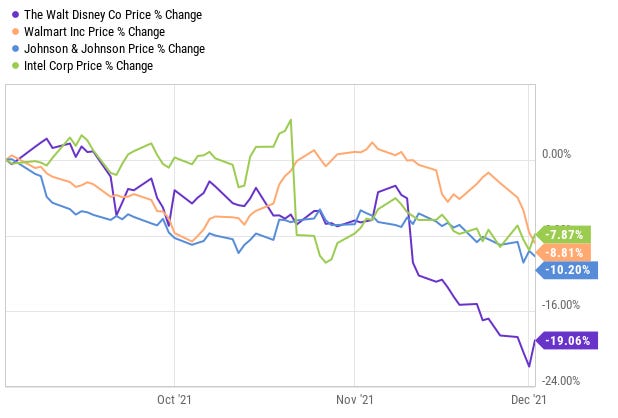

As I’ve said before, I also think there will be somewhat of a rotation trade back into cash generating blue chip names, consumer staples and the few companies that still pay a dividend and have modest price to earnings ratios – one of which I profiled as my favorite just weeks ago.

Some of my other favorite names that I am looking to buy if they continue to sell off are well-known blue chip staples that have seen their stocks trade sideways or disproportionately lower over the last couple of months, despite growth-style P/E’s for some. I’d argue names like Disney (DIS) and Walmart (WMT) offer GARP (“growth at a reasonable price”) should they keep selling off. I also love Johnson & Johnson (JNJ)(my largest holding in my all-dividend portfolio which I add to almost daily) and Intel (INTC), which I believe will undergo a renaissance and eventually retake its throne as king of chips – if it isn’t bought out first at these levels.

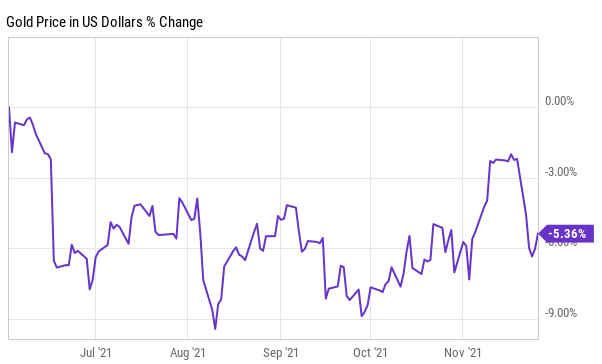

Gold has continued to selloff on the expectation that a taper is actually coming.

The selloff could easily continue for the short- to mid-term, at least until we get to the point that gold needs to be bought as a volatility hedge due to a taper, or the point where the Fed finally caves and stops its plans for tapering or raising rates. It will be interesting to see how inflation may drive the Fed’s decision making going forward.

Heading into the weekend and into the back end of this month, traders would do well to focus their energies more on Fed commentary than on developments with the Omicron variant, barring any massive change with what we know regarding the new strain. Obviously, if Omicron turns out to be a flesh eating variant of the virus that kills people instantly, that is going to have a profound effect on equity markets (Neel Kashkari heard shouting it the background: “Not if I can help it!”).

But for the time being, thank God that doesn’t seem to be the case. Heading into 2022, I still think the markets could be in for a collapse, as I wrote here, as it appears that this is the only man that can move markets in this day and age:

Readers of this free preview of paid content can subscribe to my blog and get 20% off normal pricing using this link: Get 20% off forever

DISCLAIMER:

I own JNJ, WMT, DIS and INTC. I own ARKK, IWM, SPY puts. I own puts and calls in GLD and own a host of gold-related and precious metals related names. None of this is a solicitation to buy or sell securities. Positions can always change immediately as soon as I publish this, with or without notice. You are on your own. Do not make decisions based on my blog. I exist on the fringe. The publisher does not guarantee the accuracy or completeness of the information provided in this page. These are not the opinions of any of my employers, partners, or associates. I get shit wrong a lot.

Tyler Durden

Fri, 12/03/2021 – 10:25

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com