Goldman Cuts GDP Forecast Due To Omicron, Setting The Stage For More Central Banks Stimulus

It was less than a month ago when bank after bank triumphantly revealed their extremely optimistic year-ahead growth forecasts, in which chief economists trumpeted 2022 GDP expectations in the mid- to high-single digits despite knowing well that these numbers are completely unattainable (as a reminder, the reason the forward swap yield curve just inverted is because even the market now understands that Powell is hiking into an imminent recession). An example of this is the following Nov 8 blurb from Goldman’s Jan Hatzius:

Although the fastest pace of recovery now lies behind us, we expect strong global growth in coming quarters, thanks to continued medical improvements, a consumption boost from pent-up saving, and inventory rebuilding. For 2022 as a whole, global GDP is likely to rise 4½%, more than 1pp above potential.

At the time we made the decision to simply ignore these forecasts which came just as speculation was emerging of a new covid variant, and which we – correctly – predicted would lead to imminent outlook cuts.

Just days after all the banks sent out their cheerful 2022 Economic outlook pieces, everything goes to hell.

— zerohedge (@zerohedge) November 19, 2021

Once again we were right, because one day after the IMF revealed the endgame with the latest “Omicron variant” farce, saying that it would downgrade global growth due to Omicron – despite nobody knowing what the full impact of omicron will be, and as a reminder some such as JPMorgan have even predicted it would be bullish – in the process greenlighting trillions more in fiscal and monetary stimulus just in time for the 2022 midterm elections (because with the world addicted to stimmies and Universal Basic Income there is no other way any more), overnight Goldman became the first Wall Street bank to admit that its full-year forecast published just a few weeks ago was garbage and the bank just cut its Q1 and Q2 GDP forecasts due to, wait for it, Omicron… even though, once again, nobody has any clue yet what the real impact of the newest covid variant will be.

Setting the stage for the next round of GDP cuts and hawkish forecast revisions, which eventually will culminate into a narrative that the US needs, nay demands trillions more in stimmies, Goldman’s Hatzius writes that “the emergence of the Omicron variant increases the risks and uncertainty around the US economic outlook” and while even the chief economist admits that “many questions remain unanswered, we now think a moderate downside scenario where the virus spreads more quickly but immunity against severe disease is only slightly weakened is most likely.”

In this scenario – the one scenario which magically translates into a modest slowdown which requires more stimmies but does not lead to a recession or outright depression that would crush markets, Goldman sees three main effects on the US economy.

- First, Omicron could slow economic reopening, but we expect only a modest drag on service spending because domestic virus-control policy and economic activity have become significantly less sensitive to virus spread.

- Second, Omicron could exacerbate goods supply shortages if virus spread in other countries necessitates tight restrictions. This was a major problem during the Delta wave, but increases in vaccination rates in foreign trade partners since then should limit the scope for severe supply disruptions.

- Third, Omicron could delay the timeline for some people feeling comfortable returning to work and cause worker shortages to linger somewhat longer.

Quantitatively this translates into Goldman’s admission that its cheerful 2022 GDP outlook was crap, and as Hatzius writes today, “we have updated our GDP forecasts to incorporate our updated virus outlook as well as the latest GDP tracking data. These changes result in a +0.5pp (qoq ar) boost to our Q4 growth forecast based mostly on stronger inventory data, and a -1.5pp cut to growth in Q1 and -0.5pp cut in Q2 due to virus-related drags on reopening and goods supply.“

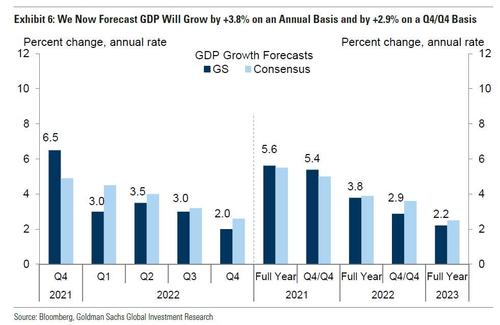

In other words, Goldman now expects GDP growth of +6.5%/+3.0%/+3.5%/+3.0%/+2.0% in 2021Q4-2022Q4, which implies 2022 GDP growth of +3.8% (vs. 4.2% previously) on a full-year basis and +2.9% (vs. +3.3% previously) on a Q4/Q4 basis.

This, as we have warned previously, is just the first of many GDP cuts coming, and the banks will use any and every possible excuse to “glideslope” their 2022 GDP forecast to drop to around 1% if not lower by year end. That’s the number that will be needed by the Fed to quietly forget all about its hiking plans.

But what about surging inflation? After all didn’t Powell himself say that “transitory” has to be retired.

Well, here Goldman finds a loophole too, because with oil tumbling (for now, before exploding higher in 2022) and gas prices set to slide creating the impression that inflation is now gone, Goldman says that it sees mixed implications for inflation, to wit:

reduced demand for virus-sensitive services such as travel could have a disinflationary impact in the near term, but prior virus waves suggest that such pressures would be temporary and reverse as demand recovers. In contrast, further supply chain disruptions due to Omicron or further delays in the recovery of labor supply could have a somewhat more lasting inflationary impact.

And lest someone accuses us of being hypocritical and reading too much into this initial narrative shift, which is completely innocent and has no bearing on central bank plans, on Friday Bloomberg reported that uncertainty surrounding the omicron variant is making some Bank of Japan officials see increased risk in ending or scaling back a Covid funding program set to expire in March.

While credit conditions for big firms have improved along with the market for corporate bonds and commercial paper, it may be risky to announce a reduction in support now, the people said. The new variant has fueled concern over the economic outlook and shaken financial markets, they said.

If financial market hadn’t been roiled by the new variant, the BOJ would have had an easier time deciding to lower their limit on corporate debt purchases, as long as the Tankan showed big firms were comfortable in their ability to raise funds, the people said.

Of course, there will always be something that “roils” markets, and if there is no external trigger then the very act of central banks unwinding their stimulus will be catalyst.

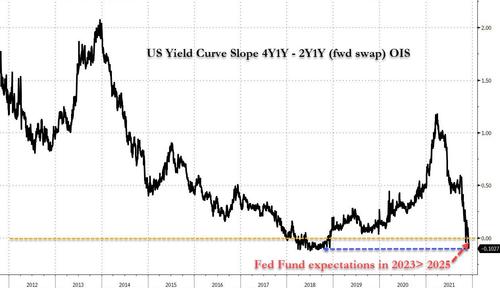

One final point: as we noted yesterday, the forward TSY curve slope as indicated by 4Y1Y less 2Y1Y fwd swap OIS, just inverted the most since late 2018. As a reminder, just a few weeks later, Powell was forced to abandon his tightening cycle as the Ghost of ’37 struck, sending stocks into a painful but brief bear market on Dec 24, 2018. Fast forward to today when the market is again saying that the Fed will also be forced to abandon its plans for rate hikes in coming months… or else the market gets it.

Which is why now that the IMF has revealed the Omicron endgame, and banks like Goldman have begun effectuating it, we see the near-term as follows:

- in a few weeks, banks will trim their hawkish forecasts.

- In 1-2 months they will predict tapering is postponed

- in 2-3 months rate hikes will be off the table.

in a few weeks, banks will trim their hawkish forecasts.

In 1-2 months they will predict tapering is postponed

in 2-3 months rate hikes will be off the table. https://t.co/uIkFQqwM7x— zerohedge (@zerohedge) December 4, 2021

And yes, all of that is just the pretext for central banks to take the needed measures to avoid another market crash.

Tyler Durden

Sat, 12/04/2021 – 13:00

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com