“In Our Time” – Jeff Gundlach Webcast Live

It’s that time again when Jeffrey Gundlach, the billionaire chief investment officer and founder of DoubleLine Capital, holds his last webcast of 2021 for his DoubleLine Total Return Bond Fund where he touches on numerous market-linked topics. Readers can register for the webcast at the following link. The tile of the webcast is “in our time” referring to British Prime Minister Neville Chamberlain’s famous appeasement of Hitler before the start of WWII.

As Bloomberg reminds us, a lot of the issues Gundlach discussed in September’s webcast are likely to come up again today, especially inflation. Back then, he said he didn’t think history books would say inflation was transitory (he was right). He also said the Fed was distorting markets by keeping rates ultra-low with moves reminiscent of the 1970s. Gundlach also said TIPS looked “pretty expensive”, so it will be interesting what he says today. Inflation prints have been coming in hotter-than-expected since the last presentation.

Gundlach may wade deeper into DoubleLine’s concerns over the U.S. dollar’s role as a reserve currency. Last month, the firm warned the dollar was at risk of being “dethroned” by blockchain technology and stablecoins.

As most know, Gundlach has been a staunch critic of Fed policy, and it will be interesting to hear his interpretation of the recent flattening of the Treasuries yield curve, which as we have repeatedly said is a clear signal by the market that it is engaging in a “policy mistake” where it tightens too quickly or too strongly and ends up ruining the economic recovery.

Explaining why he titled the webcast “in our time”, Gundlach says that it’s because he’s been thinking about what’s been happening in society and we’re going to see some major changes “in our times”

Gundlach also likes the book by the same title by Hemingway, and also mentions Chamberlain’s “ridiculous piece of paper” which he waved when he said we have “achieved piece in our time” just months before the start of the great war.

The bond king starts with his favorite chart, showing that yields rise during episodes of QE and then collapse when QE ends – Covid QE “lo and behold, rates rose.” And now that the Fed is talking about a quicker taper, it would be more common for yields to be falling during that tapering.

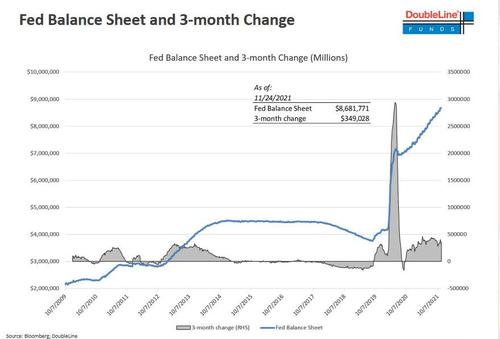

Gundlach reiterates his view that the Fed’s Quantitative Easing is what’s “driving U.S. markets, not fundamentals” and is “granddaddy” of all factors driving assets. Not surprisingly, he shows a chart of the Fed balance sheet.

Gundlach references Powell’s statement that taper could accelerate and since stock markets have been clearly supported by balance-sheet expansion, it’s turning into rougher water for markets as we move into taper. Most people now believe Powell has turned more hawkish. That’s why Gundlach says we’re likely to see much more uncertainty and stress as the Fed has decided to follow the bond market “and turn more hawkish.” He says Powell has admitted the word “transitory” is a meaningless phrase.

Looking ahead, he says that there will be much more uncertainty and stress as the Fed shifts tack. Gundlach says Powell tried to claim “transitory” meant no long-term structural problem. But inflation is likely to stay elevated until middle of next year — what he means by that is a 4-handle, he says.

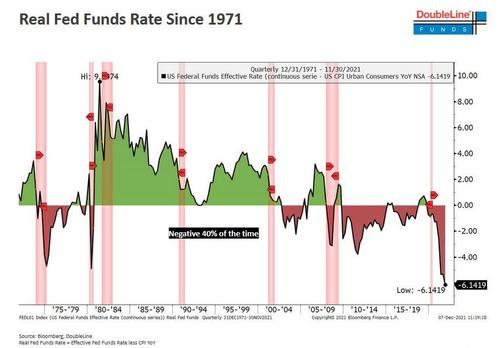

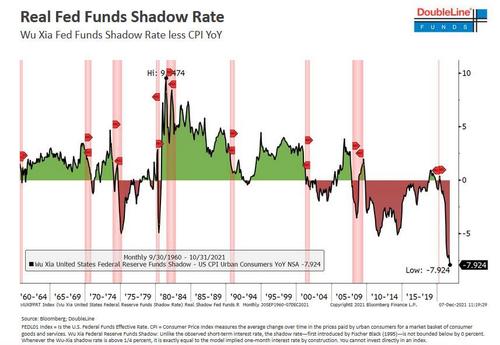

Gundlach then turns his attention to the record low real rate (which we have discussed here)…

… and the even more record shadow fed funds rate, both of which are extremely stimulative for risk assets it goes without saying. The implication here is that with the Shadow Rate being so negative, just ending QE is the equivalent of 7 rate hikes even before the Fed actually hikes ones. So yes, tapering is tightening.

Meanwhile, now that even the Fed has conceded that inflation isn’t transitory, Gundlach says CPI inflation could hit 7% or higher over the next couple of months, and while it will fade after, it is likely to stay elevated (defined as above 4%) until at least the middle of next year.

There is much more in his full presentation below

Gundlach December Presentation by Zerohedge on Scribd

Tyler Durden

Tue, 12/07/2021 – 16:20

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com