“REKT” – Stocks Storming Higher On Massive Hedge Fund Short Squeeze

When looking at the latest Goldman Prime Broker data, our collective jaws fell to the floor: while perhaps not a huge surprise, Goldman writes that the last two weeks saw that “largest 10-day net selling in US equities since Apr ’20 led by Macro Products as well as Info Tech/Consumer Disc stocks” with the bank elaborating that “North America and to a lesser extent EM regions were the most net sold, while DM Asia was net bought driven by short covers.”

But what was stunning was Goldman’s drilldown into the flow, where GS Prime found that the selling of US stocks – which made up more than 85% of the global $ net selling (-1.4 SDs) – was driven almost entirely by short sales and to a lesser extent long sales (9 to 1).

And the piece de resistance – “US equities have been net sold in 7 of the past 10 days. In cumulative $ terms, the net selling in US equities over the past 10 days is the largest since April ’20.”

Said otherwise, hedge funds were dumping stocks in the past 10 days – with most of the transactions outright shorting than long sales – with retail investors buying for the most part as we noted recently.

Some more remarkable details from the Goldman Prime report:

- Both Single Names and Macro Products (Index and ETF combined) were net sold and made up 54% and 46% of the $ net selling, respectively.

- 7 of 11 sectors were net sold led in $ terms by Info Tech, Consumer Disc, Industrials, and Utilities, while Staples, Materials, and Energy were the most net bought.

- Info Tech stocks were net sold for a fifth straight day (9 of the past 10), driven by short sales outpacing long buys 2 to 1.

- In cumulative $ terms, the selling in US Info Tech over the past 10 days is the largest in more than five years (-3.2 SDs).

- Info Tech’s weighting vs. SPX now stands at -4.1% U/W – the lowest level since Nov ’20 and near five-year lows (-4.5%).

- Reversing the recent trend, selling activity within the sector was driven by Tech Hardware and to a lesser extent Semis & Semi Equip, while Software saw modest net buying driven by long buys outpacing short sales 1.3 to 1.

- Most $ Net Sold Industries – Tech Hardware, Automobiles, Interactive Media & Svcs, Semis & Semi Equip, Hotels, Restaurants & Leisure, Multi-Utilities, Electrical Equip, Household Products

- Most $ Net Bought Industries – Food & Staples Retailing, Specialty Retail, Internet & Direct Marketing Retail, Software, Oil, Gas & Consumable Fuels, Chemicals, Metals & Mining, Real Estate Mgmt & Dev

The simple take home message from this data, which we posted on twitter late on Monday, is that with everyone shorting aggressively into the recent dump, it was only a matter of time before we had a face-ripping short squeeze higher…

Brace for faceripping short squeeze: pic.twitter.com/nq4656wRRW

— zerohedge (@zerohedge) December 7, 2021

… and sure enough, stocks are screaming higher, up 62 points overnight and a whopping 150 points higher from Friday’s closing low, amid what appears to be yet another face ripping short squeeze, with treasury curves flattening again, with the front-end offered into Friday’s expected “overheating” CPI print, while Omicron severity concerns re-rate lower (despite more Draconian “lockdown playbook” which will likely further fuel supply-chain kinks) while the long-end continues to “get the joke” on the implications of a hawkish Fed on “growth” forwards (and a $1.6B Fed purchase today in 22.5-30y sector at 1030am).

Picking up on this short squeeze theme this morning, Nomura’s x-asset strategist Charlie McElligott has just one word to describe what is going on: “REKT.” Pickingup where we left off, McElligott explains that “equities markets, as the saying goes, are “trading short,” as evidenced by this vapor-trail +3.6% move from late Friday lows in Spooz to this morning’s highs (FWIW, 4650 strike houses ~$2.1B of $Gamma)—which is an incredible understatement…while at the same time, totally rational, when considering the following:”

- The latest futures positioning data showed that the Asset Manager community was a incredible source of supply over the latest weekly reporting period, selling -$29.3B of US Equities via outlier 1w exposure reduction in S&P and Russell futures (-$25B of SPX / 1%ile 1w change; -$5B of Russell / 0.4%ile 1w change)

- Goldman PB data showing that the past two weeks have been the largest 10 days of HF selling in US Equities in 20 months, slashing nets via “long” selling and grossing-up of “shorts”

- US Eq Index / ETF Options $Delta has been absolutely gutted, with SPX / SPY (consolidated) alone from a 100%ile of ~+$660B on Nov 9th to yesterday’s -$55B, which is just 18.3%ile net $Delta since 2013

- CTA Trend model into yesterday estimates an astounding -$94.5B of net exposure reduction across Global Equities futures over the past 2 weeks, which coincided with signals flipping “long to short” of various strength across Russell, Eurostoxx, Nikkei, DAX, FTSE100, CAC40, Hang Seng, Hang Seng CH, ASX, KOSPI and Bovespa; the aggregate net $ exposure in Global Eq futs for CTA Trend is now just 18.4%ile since 2011

- Vol Control model estimates -$63.8B of selling in US Equities over the past 2w, with the current $ exposure just 40.9%ile (Equities allocation was over 75%ile 2w ago) following the “crash up” in realized volatility (SPX 1m rVol from 6.0 to 16.0), dictating mechanical de-allocation

In addition to the purely flow reversal of recent near-record shorting, there is also a psychological element to the current meltup, which is where the point McElligott always discuss on “vol spikes” clearly “kicks-in”, because the post-GFC conditioning kicks-in via:

- “short vol” behavior looking to harvest “extreme / rich” implieds; and

- these dynamics further incentivizes monetization of downside hedges at the same time, which are now bleeding and decaying.

What do these two vol dynamics above create? The well-known buying panic via a large delta to buy as Vol resets lower (which too in standard lagging-fashion will contribute to ‘target vol / risk control’ re-allocation in Equities in weeks / months ahead), and away we go….

But wait, there’s more: as Charlie also notes, the “pain” isn’t on the overall Equities exposure level now, as index explodes higher after so much de-risking / shorting because “the most acute source of performance beat-down within the Equities space over the past month has been via thematic / factor / sector long- and short- “reversal” behavior, where the ongoing dynamic of crowded expensive / unprofitable “Secular Growth Longs” (i.e. “Value Shorts”) getting absolutely vomited relative to huge outperformance in “Quality” and “Low Risk” now actually pivoted to a new & juxtaposed dynamic yesterday, where “Value Longs” (i.e. “Growth Shorts”) added to pain by EXPLOSIVELY rallying as well.”

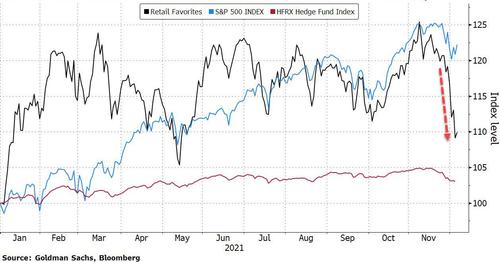

What does that mean in practical terms? Think the collapse in momentum stocks as observed by the plunge in the 50 most popular retail stocks (most of which are momentum names)…

… or, as CME puts it, a shock -3.3% / -3 z-score 1d move in long-term “Momentum Factor,” as not only did “Momentum Longs” continue to NOT perform (dead “flat” on the day), but most importantly and as per the prior observation, “Momentum Shorts” RIPPED higher (+3.4%)

Indeed, as shown in the chart below, the “Momentum Factor” is now -7.3% in the past 5d (-3.2 z-score move), the largest one week drawdown for the strategy since the week following the US Election, which then too saw chronically underowned “Cyclical Value” explode higher relative to legacy crowded-positioning in “Secular Growth”

To a lesser extent, he same effective phenomenon is displayed by the +18.3% return since late Oct / start Nov in “Cyclical Value” vs “HF Crowding,” the largest 1m+ move in the relationship since the performance disaster that was the Jan ‘21-Mar ’21 “meme stock” and “reflation” disaster for HFs, and which clearly evidences how much muscle-memory and survivorship bias PMs continue to hold in “Growth” after a multi-decade bond bull market, while at the same time, how much skepticism that investors continue to express with “Value.”

But perhaps the most important message here from the Nomura quant is that, again, at the core of this shocking blast of impulse “reversal” is the assumption that the Fed / the market / the economy cannot withstand an attempt at “policy tightening”, just like “Taper Tantrum” in Summer 2013; just like the “First Hike since the GFC Growth Scare” in late 2015; and just like the “QT Autopilot” / “Long way from Neutral” Tantrum in late 2018.

So once-again, the Fed policy-shift “trial balloons” – this time through pivoting to “inflation hawks”- has created the macro shock catalyst a tantrum although not in bonds but rather in stocks (as noted last week). As to whether markets can see it through to any real extent without significant collateral damage is another matter entirely…

With all that in mind, before everyone leans in to a resumption of the meltup trade, McElligott notes that there are still tangible risks ahead in coming weeks:

Tactically:

- Op-Ex and Fed next week is always a combustible match-up, while

- CTA deleveraging “sell triggers” will remain “proximate enough” to spot after this imminent covering squeeze tuckers-out and

- Despite implied Vols resetting lower here, Skew stays completely “jacked up” and stress-y, while as we see time-and-time again tends to self-fulfill exhibited in powerful blasts of “broken vol market” supply / demand dynamics

Strategically:

- As these US inflation prints are not expected to peak until 1Q21, it is highly probable that “Fed Put” strike is now much lower, because the bar the respond to market “financial conditions” mini-stresses is too high with inflation remaining at the forefront of political conversation—especially with the potentials that global authorities continue to respond to COVID seasonals with lockdown measures that will only exacerbate and extend said inflation pressures from the supply-side—this will mean that if the data further accelerates and crystalizes their “hawkishness” into MORE TIGHTENING REQUIRED, they will likely be powerless to intervene with the usual “market jawboning” to ease potential stress-points through the usual “dovish guidance”

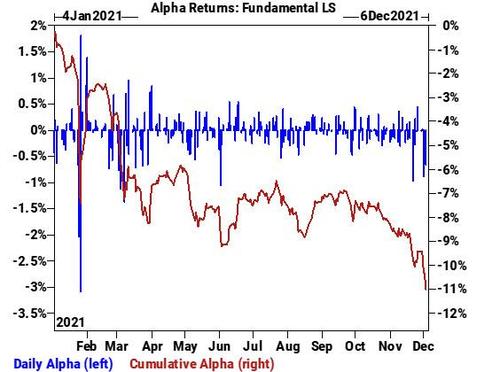

One final point: with hedge fund cumulative alpha in 2021 now absolutely catastrophic…

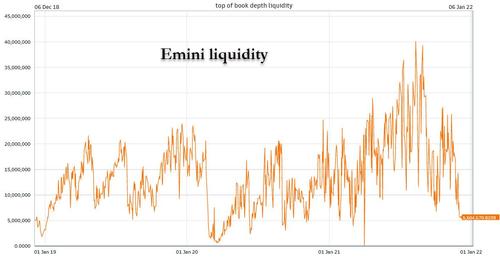

… and with just days left in 2021 as fund managers scramble to catch up to bogeys, while the market remains dreadfully illiquid…

… expect many more fast and furious moves, in both directions, over the year’s last trading days.

Tyler Durden

Tue, 12/07/2021 – 09:04

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com