As Stocks Dump Post-Powell Gains, Nomura Explains Why Markets Have Become So Unstable

Well, as STIRs spiked and the yield curve and the dollar screamed policy mistake imminent, stocks soared yesterday. It appears the hangover has finally kicked in this morning as stocks dump the gains back in a hurry…

And it is worst at the single-name level – just look at AAPL…

Crucially, Nomura’s Charlie McElligott notes that yesterday’s euphoria was almost entirely due to the Vol space and flows driven by Dealer hedging of their exposures.

Taken as a whole (but particularly focusing on the “lower” neutral rate suggestion), Powell’s “bad-cop statement, good-cop press conference” predictably murdered “over-tightening” fears in our eyes, which alongside the simple “clearing” of the event-risk without any shockers or language fumbles- – especially threading the needle and messaging his confidence in the strength of the US economy – meant that US Equities implied Volatility got crushed…

From there, McElligott notes that the front-and-center catalyst for the substantial Equities upside move coming-out of The Fed was the rather prolific (over)hedging into the Fed event and ensuing NUKE job on iVol therafter (downside hedges / Puts in flames) then meant it was time for broad Equities to “get Greeked” by the Dealer hedging feedback loop.

All that “short Delta” from Dealers (as they were “short Puts” from recently v large buying of downside protection from clients) then got the double-whammy “virtuous” impact of Gamma- and Vanna- sensitivities in their hedges.

As iVol cratered, Dealer “short Delta” (-$22B at the 4700 strike alone) was now suddenly TOO short and set-off a reflexive spiral to cover said (short) hedges in futures on account of their Vanna…which then continued to eat its own tail in the usual feedback-loop – “Vol lower, Spot higher”.

And as “Spot” Equities then raged higher via this futures covering of hedges, you got the simultaneous Gamma impact kicking-in here too, compounding and escalating the covering of that Dealer “short futures” position as the Delta of those Puts collapses, moving further and further out of striking-distance as the market rallies—meaning more mechanical buying-back of Delta ensues.

The final complimentary element of this Delta hedging scramble is then the “reflexive” Vol seller component I always speak about—where as Vol is getting smoked, this further incentivizes net end-users to unwind their now-cratering downside hedges, and / or where actual “short Vol” expressions are then too added to the mix…both of which generates (you guessed it) Delta to BUY.

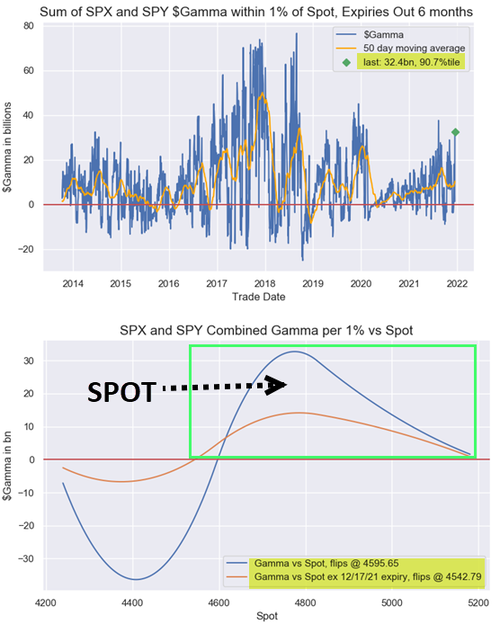

And as Vols got absolutely starched / spot ripped higher…Dealer Gamma got onside and “long” again, meaning additional “stabilization” as we move forward (most notably, SPX / SPY $Gamma now @ 90.7%ile and QQQ $Gamma @ 95.3%ile).

But, the Nomura strategist notes that all of this “mechanical catalyst” for higher stocks aside… does that mean we have cleared the all market risks from CB tightening tantrums, Omicron / COVID lockdowns, “no deals” on BBB and the like?

Absolutely not…

Tactically, we still have this Op-Ex to clear, and a MASSIVE amount of the $Gamma set to expire:

-

SPX options $Gamma will see 42% drop;

-

QQQ options will see an eye-watering 62% drop-off; and

-

IWM options will see 55% drop…

All of which means there still is potential for larger moves out there.

As long-time readers know, the “Short the Vol rip / Buy the Spot dip” trade will always lead to an overextension, as “stability breeds instability” – which will create coiled-springs of tension again in the Vol space as the pendulum swings in the opposite direction, creating negative Gamma / Convexity outburst impact on “leveraged-long risk” positioning built upon the edifice of “low Vol and low Rates”.

With G10 central banks now officially consensually embarking on this post COVID response / post FAIT inflation overshoot tightening cycle, it won’t require a major slip-up vs market expectations to see asymmetry yet-again “tip-over” into a Vol event, particularly as the economic cycle turn has now evolved from “Expansion into Slowdown”…and the now-imminent hiking cycle impact then accelerating us ever-closer to the pivot-point from “Slowdown to Contraction” as the next stage thereafter.

Tyler Durden

Thu, 12/16/2021 – 10:42

Zero Hedge’s mission is to widen the scope of financial, economic and political information available to the professional investing public, to skeptically examine and, where necessary, attack the flaccid institution that financial journalism has become, to liberate oppressed knowledge, to provide analysis uninhibited by political constraint and to facilitate information’s unending quest for freedom. Visit https://www.zerohedge.com